- IRS forms

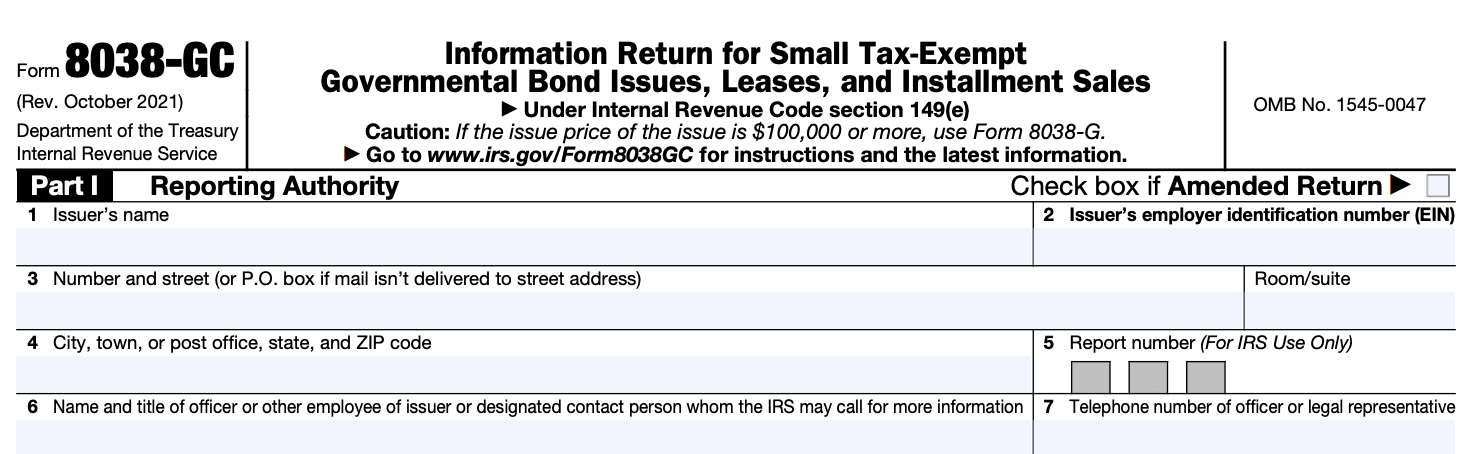

- Form 8038-GC

Form 8038-GC: Consolidated Information Return for Small Tax-Exempt Government Bond Issues

Download Form 8038-GCFor local governments seeking to fund infrastructure projects, educational initiatives, or community development, tax exempt government bonds provide a cost-effective means of raising capital. To maintain transparency and ensure proper tax compliance, the Internal Revenue Service (IRS) requires issuers of such bonds to file Form 8038-GC, the Consolidated Information Return for Small tax exempt Government Bond Issues.

Tax exempt government bonds, also known as municipal bonds, are issued by state and local governments to finance various public projects and services. The primary advantage of these bonds is that the interest income earned by investors is generally exempt from federal income tax, and in some cases, (link: https://fincent.com/glossary/state-and-local-tax-deduction text: state and local income tax) as well. This tax benefit allows governments to attract a broader pool of investors and access funds at lower interest rates, saving taxpayer money in the process.

This blog aims to shed light on this crucial form, its purpose, and its significance in simplifying compliance for small tax exempt government bond issues.

Purpose of Form 8038-GC

The purpose of Form 8038-GC is to provide the IRS with important details about these bonds and the projects they support.

The form includes information about the issuer, the type of tax credit bond issued, the amount of bonds issued, the project financed by the bond proceeds, and other relevant information. This allows the IRS to monitor compliance with tax laws related to tax credit bonds and ensures that the bonds are being used for their intended purposes, such as financing projects related to housing, education, or infrastructure.

It's essential for issuers of tax credit bonds to accurately fill out Form 8038-GC and submit it to the IRS to meet their reporting requirements and (link: https://fincent.com/blog/how-to-avoid-tax-penalties-a-simple-guide text: avoid potential penalties) for non-compliance.

Benefits of Form 8038-GC

The benefits of Form 8038-GC include:

- Federal subsidy payments: The primary benefit of Form 8038-GC is that it allows state and local governments to receive federal subsidy payments on their tax credit bonds. These payments help lower the borrowing costs for the issuer and make the bonds more attractive to investors.

- Lower interest rates: With federal subsidies, tax credit bonds can offer lower interest rates compared to conventional bonds. This can result in cost savings for the issuer and, in turn, benefit the community by funding critical projects more affordably.

- Financing public projects: Form 8038-GC facilitates the financing of various public projects, such as schools, hospitals, affordable housing, and infrastructure improvements. These projects contribute to the well-being of the community and can help stimulate local economies.

- Supporting infrastructure development: By providing financial assistance to state and local governments, tax credit bonds can support the development and maintenance of essential infrastructure, contributing to the improvement of public services and overall quality of life.

- Investor incentives: Tax credit bonds may attract investors who seek tax-advantaged investment opportunities. The direct-pay subsidy feature provides an added level of assurance for investors, making these bonds more appealing in the marketplace.

- Long-term planning: The availability of tax credit bonds can enable governments to plan and implement long-term projects that might have been otherwise financially challenging without the subsidy.

- Community growth: Financing public projects through tax credit bonds can foster community growth and development, creating jobs, improving services, and enhancing the overall appeal of the area for residents and businesses.

Who Is Eligible To File Form 8038-GC?

Form 8038-GC: "Consolidated Information Return for Small tax exempt Government Bond Issues" is used by small tax exempt governmental units to report information about their bond issues to the Internal Revenue Service (IRS). The term "small" refers to bond issues with an aggregate face amount not exceeding $10 million in a calendar year.

Eligible filers for Form 8038-GC include small governmental units such as cities, towns, counties, school districts, and other local governmental entities. These entities issue tax exempt bonds to finance various projects and activities, and reporting the relevant information to the IRS is a necessary part of complying with federal tax regulations.

How To Complete Form 8038-GC: A Step-by-Step Guide

As of September 2021, here is a general step-by-step guide to completing Form 8038-GC:

Step 1: Gather the necessary information

Before you begin filling out the form, gather all the relevant information and documents you'll need. This includes details about the issuer, the government obligations issued, and any refundings that occurred during the tax year.

Step 2: Download the form

You can find Form 8038-GC on the IRS website. Download the most recent version of the form and the accompanying instructions.

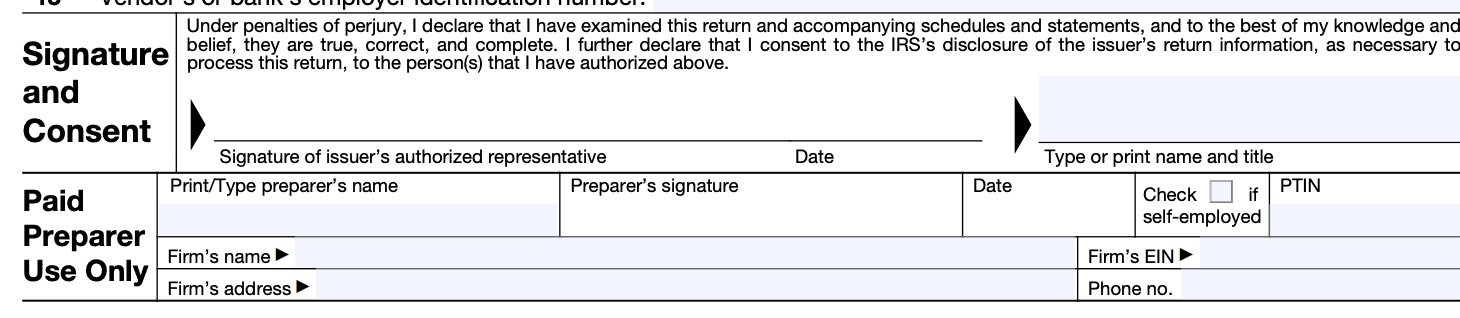

Step 3: Complete Part I - provide general information

Enter the basic information about the issuer in Part I of the form. This includes the issuer's name, address, taxpayer identification number (TIN), contact information, and the type of issuer (e.g., state, local government).

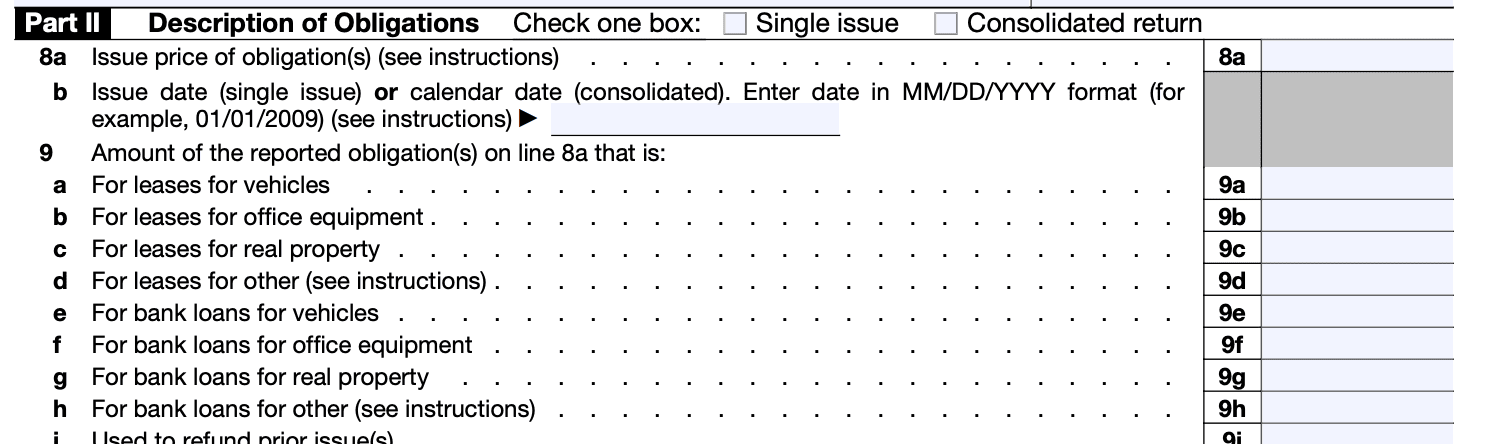

Step 4: Complete Part II - Obligations obligations issued

In Part II, you'll need to provide details about the government obligations issued during the tax year. This includes the date of issue, purpose of the issue, description of the issue, issue price, and the CUSIP number (a unique identifier for the bond).

Step 5: Complete Part III - Refunding issues

If there were any refunding issues during the tax year, you need to provide the relevant details in Part III. This includes information about the refunded issue, the issue being refunded, and the amount of the refunding issue.

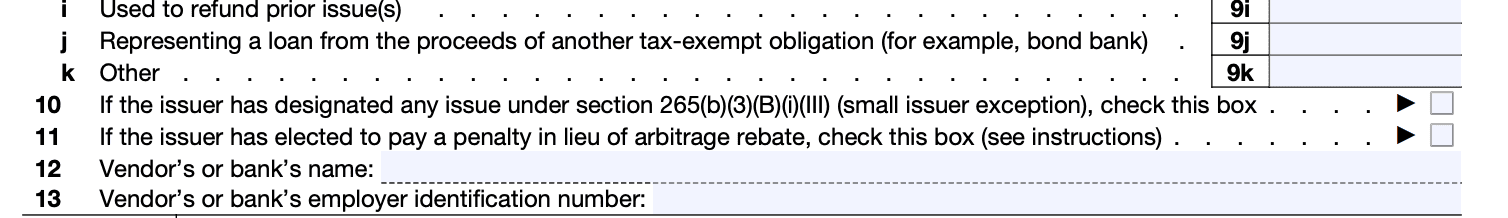

Step 6: Complete Part IV - Certification

In Part IV, the issuer or an authorized official must certify that the information provided on the form is true, correct, and complete.

Step 7: Attach any necessary schedules

Depending on the complexity of the issuer's financial situation and the nature of the obligations issued, you may need to attach additional schedules providing more detailed information.

Step 8: File the form

After completing the form and double-checking all the information for accuracy, you must file it with the IRS by the (link: https://fincent.com/blog/tax-filing-extention-deadlines-everything-you-should-know text: appropriate deadline). The filing deadline for Form 8038-GC is typically six months after the end of the issuer's tax year.

Step 9: Retain a copy

Make sure to keep a copy of the completed and filed Form 8038-GC, along with any supporting documents, for your records.

Special Considerations When Filing Form 8038-GC

Here are some general considerations you should be aware of when filing Form 8038-G:

**Accurate and timely filing: **Ensure that the form is filled out accurately and submitted on time. Missing the deadline can result in (link: https://fincent.com/irs-tax-forms/form-1098-f text: penalties) and interest charges.

Correct project and issuer information: Provide accurate details about the issuer of the bonds and the specific project(s) financed by the tax credit bonds. This includes the name, address, and other identifying information.

**Bond information: **Report the necessary information about the tax credit bonds issued, such as the bond issue date, maturity date, CUSIP number, and face amount.

Qualified purposes: Tax credit bonds are issued to fund qualified purposes, such as certain types of infrastructure projects or affordable housing. Ensure that the financed projects meet the requirements for tax credit bonds.

**Compliance with federal tax requirements: **Verify that the bonds comply with all relevant federal tax requirements. This may include compliance with the arbitrage rules, private activity bond rules, and other applicable regulations.

Tax credit amounts: Report the amount of the tax credit provided by the bonds accurately. This could be the specified percentage of the bond interest paid to the bondholders or other types of tax credits.

Final allocation of bonds: If the bonds are issued in multiple series or tranches, ensure that the final allocation of bonds is reported correctly.

Record-keeping: Maintain proper records and documentation related to the issuance of tax credit bonds, as the IRS may request additional information in the future.

Form 8038-GC supplemental forms: Depending on the specific circumstances of the bond issuance, certain supplemental forms or schedules may need to be included with Form 8038-GC. Be sure to check the latest IRS instructions for any additional reporting requirements.

**Professional advice: **Consider seeking advice from tax professionals or legal experts with experience in tax exempt bonds if you have any doubts or questions during the filing process.

How To file Form 8038-GC: Offline/Online/E-filing

Here are the general steps for filing Form 8038-GC:

Obtain the form: You can download Form 8038-GC from the official IRS website. The form and its instructions are typically available in the "Forms and Publications" section.

**Complete the form: **Provide all the required information accurately. Review the instructions carefully to ensure you've included all necessary details and attachments.

**Offline filing: **If you choose to file offline, you need to print the completed Form 8038-GC and mail it to the IRS. The mailing address can be found in the form's instructions. Make sure to use the correct address based on your location and any accompanying documentation needed.

Online filing: As of my last update, the IRS doesn't support direct online filing for Form 8038-GC through their website. However, they offer the option to file electronically using the Filing Information Returns Electronically (FIRE) system. To file electronically, you need to use compatible software or third-party service providers approved by the IRS. Check the IRS website for the most current list of approved providers and procedures for electronic filing.

E-filing: E-filing generally refers to the electronic submission of tax forms, but as mentioned earlier, Form 8038-GC is not directly filed on the IRS website. Instead, it's filed through the FIRE system or approved third-party providers.

Common Mistakes To Avoid When Filing Form 8038-GC

Filing Form 8038-GC correctly is essential to comply with tax regulations and avoid potential penalties or delays. Here are some common mistakes to avoid while filing Form 8038-GC:

Late filing: Make sure to submit the form on time. The deadline for filing Form 8038-GC is generally the 15th day of the 2nd month following the close of the calendar quarter in which the bonds were issued.

Incomplete or inaccurate information: Double-check all the information provided on the form to ensure accuracy and completeness. Incorrect or missing data can lead to issues with the IRS.

**Incorrect bond issue date: **The bond issue date is crucial for determining the reporting period and compliance with deadlines. Ensure you have the correct date for each bond issued.

**Omitting required attachments: **Form 8038-GC may require attachments, such as bond documents and legal opinions. Ensure you include all necessary supporting documentation as per the instructions.

Incorrect calculation of credit amounts: If you are claiming tax credits, ensure that you calculate the amounts accurately based on the correct provisions and regulations.

**Failure to report material events: **Certain events related to the bonds may need to be reported to the IRS. For example, if there are significant changes to the terms of the bonds or if there is a default, these events should be reported on Form 8038-GC.

Incorrect taxpayer identification number (TIN): Providing the wrong TIN for either the issuer or the bondholder can cause processing delays or complications. Verify TINs before submitting the form.

**Using outdated forms or instructions: **Always use the most recent version of the form and follow the updated instructions provided by the IRS.

**Ignoring record-keeping requirements: **Maintain proper records and documentation related to the tax credit bonds issued. These records may be needed for future audits or inquiries from the IRS.

**Not seeking professional assistance when necessary: **Tax regulations can be complex, especially when dealing with tax credit bonds. If you're unsure about any aspect of Form 8038-GC or the related tax implications, it's advisable to consult a tax professional for guidance.

Conclusion

Form 8038-GC plays a vital role in ensuring transparency and adherence to tax regulations for small tax exempt government bond issues.

By gathering essential information about the bond issuance, the IRS can monitor compliance and maintain the integrity of the tax exempt bond market.

Local governments should prioritize understanding their obligations and promptly filing Form 8038-GC to foster a smooth and compliant bond issuance process.

As tax regulations may evolve, it is essential for issuers to stay up-to-date with the latest guidance from the IRS to ensure continued compliance with tax exempt bond rules.