- IRS forms

- Form 7207

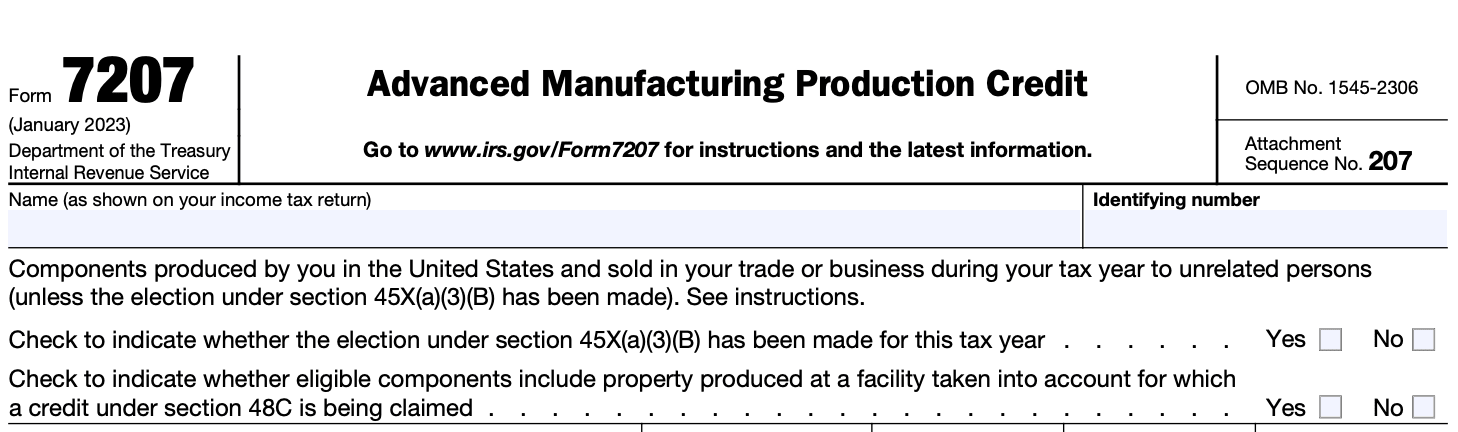

Form 7207: Advanced Manufacturing Production Credit

Download Form 7207The landscape of manufacturing has witnessed a remarkable evolution over the years, driven by technological advancements and innovative practices. As nations strive to remain at the forefront of this transformative industry, governments are recognizing the crucial role played by the manufacturing sector in economic growth and job creation.

In pursuit of fostering innovation and sustainable development, many countries have introduced various incentives to support manufacturers. One such initiative that has garnered significant attention is Form 7207 and the Advanced Manufacturing Production Credit.

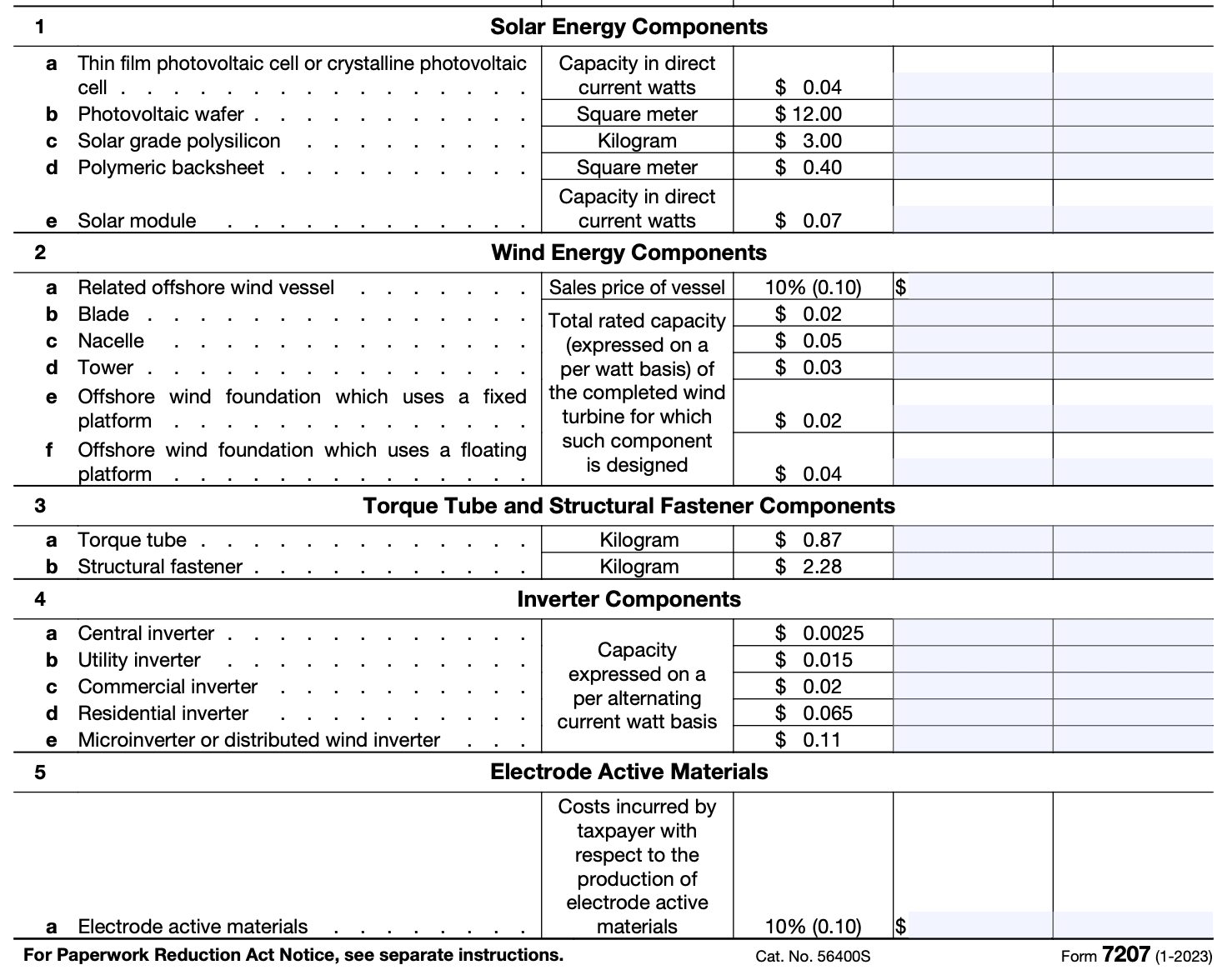

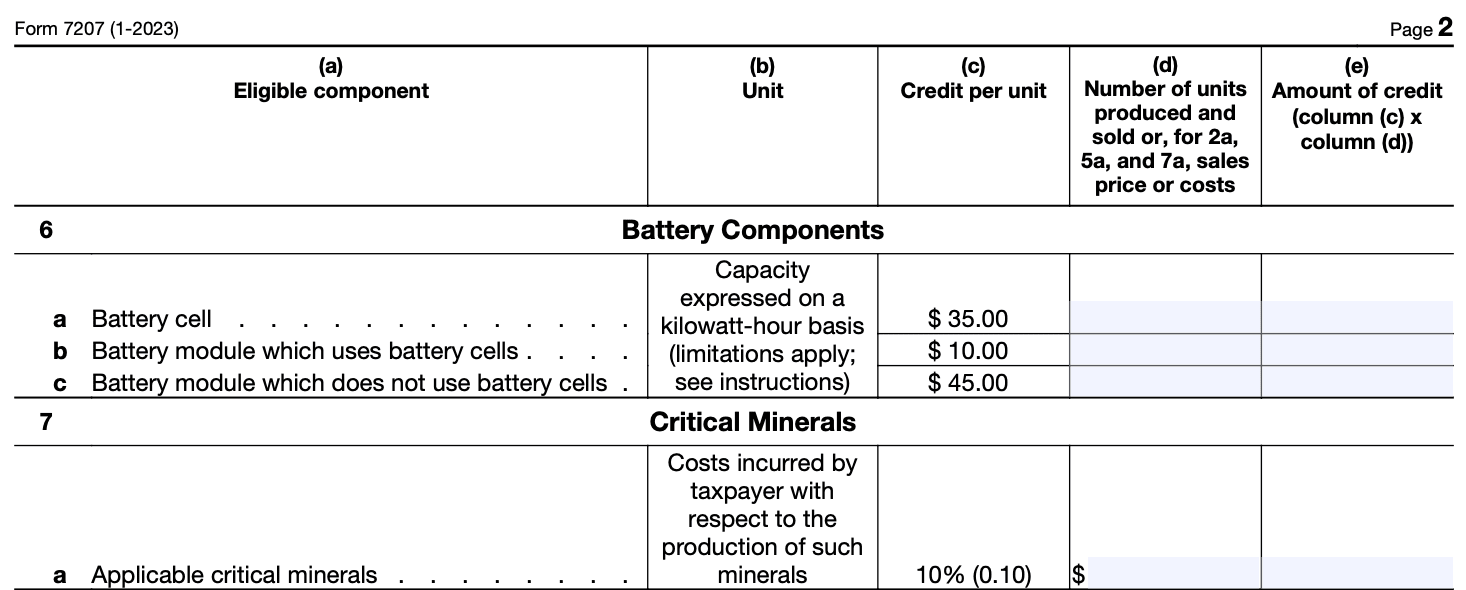

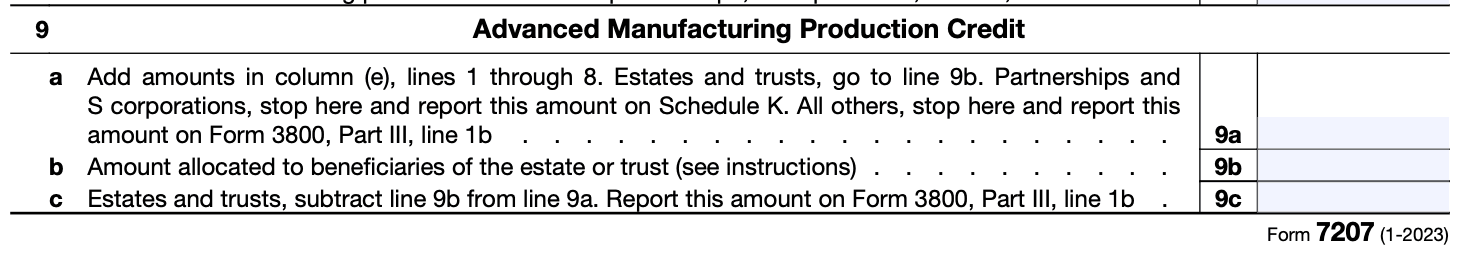

The Advanced Manufacturing Production Credit (AMPC) is a tax credit designed to encourage investments and advancements in the manufacturing sector. This credit aims to stimulate research, development, and production activities that drive technological innovation, promote sustainable practices, and improve overall productivity within the manufacturing industry.

Purpose of Form 7207

The AMPC is designed to incentivize manufacturers to invest in modernizing their production processes, adopting innovative technologies, and engaging in research and development activities within the manufacturing sector. By offering a tax credit, governments aim to promote technological advancement, improve productivity, and foster sustainable practices within the manufacturing industry.

Here are the primary purposes of Form 7207:

Application for tax credit: Form 7207 serves as the official application for the Advanced Manufacturing Production Credit. Manufacturers must complete and submit this form to the relevant tax authorities to request the tax credit based on their eligible investments and activities.

**Verification of eligibility: **The information provided on Form 7207 helps tax authorities verify whether the manufacturer meets the eligibility criteria for the AMPC. This includes ensuring that the business is engaged in manufacturing activities and has made the required investments in advanced manufacturing equipment or technology.

Documentation of investments: Through Form 7207, manufacturers must provide detailed information about their investments in advanced manufacturing equipment, machinery, research activities, or other qualifying expenditures. This documentation is essential to substantiate the claimed credits and demonstrate compliance with the program's requirements.

**Calculation of credit amount: **Form 7207 assists tax authorities in calculating the amount of credit that a manufacturer is entitled to receive. The credit amount is typically based on a percentage of eligible investments and may vary depending on the specific tax credit program and its associated regulations.

Compliance with regulations: By requiring manufacturers to complete Form 7207 and provide supporting documentation, the government ensures that participants in the AMPC program comply with all relevant laws and regulations governing the tax credit initiative.

Encouraging technological innovation: The AMPC is designed to promote technological innovation and adoption within the manufacturing sector. By providing a tax credit for investments in advanced manufacturing technologies, the government encourages manufacturers to stay at the forefront of industry trends and enhance their competitiveness on a global scale.

Benefits of Form 7207

The Advanced Manufacturing Production Credit offers several benefits to both manufacturers and the broader economy:

-

Financial incentives: The AMPC provides a financial incentive for manufacturers to invest in modernizing their production processes. This infusion of capital can lead to increased productivity and efficiency, potentially leading to higher profit margins.

-

Technological advancement: By encouraging manufacturers to adopt advanced technologies and innovative practices, the AMPC helps to drive technological advancement within the manufacturing sector, positioning it at the cutting edge of global competitiveness.

-

Job creation: As manufacturers expand and invest in their operations, they are likely to create new job opportunities, supporting local economies and contributing to overall employment growth.

-

Sustainable manufacturing: The AMPC can also promote sustainable manufacturing practices by incentivizing investments in eco-friendly technologies and energy-efficient processes, reducing the environmental impact of production activities.

-

Economic growth: A thriving manufacturing sector can have a ripple effect on the broader economy, contributing to economic growth and stability.

Who Is Eligible To File Form 7207?

To take advantage of the Advanced Manufacturing Production Credit, manufacturers must meet specific eligibility criteria and fulfill certain qualifications, which may vary depending on the country or jurisdiction in which the credit is offered.

Common eligibility requirements include:

Manufacturing activities: The credit is typically reserved for businesses engaged in manufacturing or producing tangible goods. Service-based industries may not be eligible for this particular credit.

Investment threshold: Manufacturers must meet a minimum investment threshold in eligible advanced manufacturing equipment, machinery, or technology. This investment demonstrates a commitment to upgrading production capabilities.

**Technological innovation: **Manufacturers must demonstrate how their investments contribute to technological advancement and innovation within the industry. This could include adopting automation, artificial intelligence, sustainable practices, or other transformative technologies.

Compliance with regulations: Manufacturers must comply with all relevant laws and regulations governing the industry and the AMPC program.

**Application process: **To claim the credit, manufacturers are required to submit the necessary documentation and forms, including Form 7207, which outlines the details of their eligible investments and activities.

Special Eligibility Criteria and Schedules on Form 7207

For purposes of the advanced manufacturing production credit, section 45X(d)(1) provides that persons are treated as related to each other if such persons would be treated as a single employer under the regulations prescribed under the common control rules of section 52(b).

Sales of eligible components are considered under section 45X only with respect to eligible components, the production of which is within the United States or U.S. possessions, including continental shelf areas described in sections 638(1) and 638(2).

A person is treated as having sold an eligible component to an unrelated person if such component is integrated, incorporated, or assembled into another eligible component which is sold to an unrelated person.

How To Complete Form 7207: A Step-by-Step Guide

Here's a general guide on how to complete Form 7207:

Step 1: Obtain the form

Visit the IRS website (irs.gov) or your tax professional to obtain the most recent version of Form 7207. Ensure that you have the correct form for the year you are filing.

Step 2: Gather necessary information

Before filling out the form, gather all the required information. This may include details about your business, manufacturing activities, and any eligible expenses related to advanced manufacturing production.

Step 3: Fill out Part I - General Information

Provide your business's name, address, employer identification number (EIN), and other general information as requested in Part I of the form.

Step 4: Fill out Part II - Certification

In this section, you will need to certify that your business meets the qualifications for the Advanced Manufacturing Production Credit. Read the instructions carefully and provide the necessary information and signatures.

Step 5: Fill out Part III - Credit determination

This is where you will calculate the credit amount you are eligible to claim. You'll need to provide details about your qualified advanced manufacturing production activities and related expenses.

Step 6: Fill out Part IV - Credit carryforward (if applicable)

If you have any unused credit from previous years, you may be able to carry it forward. Complete this section if applicable.

Step 7: Complete any other required sections

Depending on your specific circumstances, there may be additional sections or schedules that you need to complete. Review the instructions to ensure you haven't missed any relevant sections.

Step 8: Double-check and review

Once you have completed the form, review all the information for accuracy and completeness. Ensure that you have attached any required documentation or schedules.

Step 9: File the form

Submit the completed Form 7207 to the IRS according to their instructions. It's crucial to file the form by the specified deadline to claim the Advanced Manufacturing Production Credit.

Step 10: Keep copies for your records

Make copies of the completed form and all supporting documents for your records. It's essential to retain these records for at least the period specified by the IRS.

Considerations When Filing Form 7207

When filing Form 7207, there are a few factors to consider. Here are a few:

Research the credit: Since the AMPC is specific to advanced manufacturing production, make sure you thoroughly understand the requirements and eligibility criteria. It's essential to gather all the necessary information and documentation to support your claim.

**Obtain the correct form: **Ensure that you have the correct version of Form 7207 for the tax year you are filing. IRS forms can be updated regularly, so using the most recent version is crucial.

**Review instructions: **Carefully read the instructions provided by the IRS for Form 7207. The instructions will outline the eligibility criteria, documentation required, and how to calculate the credit.

Attach supporting documents: As with any tax credit, you'll likely need to provide supporting documentation to substantiate your claim. This might include records of qualified manufacturing production, expenses, or other relevant data.

**Consult a tax professional: **Tax laws can be complex, especially when dealing with less common credits like AMPC. Seeking advice from a tax professional or accountant who is familiar with manufacturing-related tax credits can ensure you complete the form correctly and maximize your benefits.

**File by the deadline: **Make sure to submit Form 7207 and any associated tax returns by the IRS deadline. Failure to file on time may result in penalties and could lead to a loss of the credit.

Common Mistakes To Avoid When Filing Form 7207

Here are some common mistakes to avoid when filing Form 7207 for the AMPC:

Inaccurate or incomplete information: Make sure to provide all required information accurately. Double-check names, addresses, employer identification numbers (EIN), and other essential details before submitting the form.

**Incorrect calculation of credit: **Ensure that you calculate the credit amount correctly. Review the instructions and any applicable tax codes to properly determine the credit you are eligible for.

Missing deadlines: Pay attention to the filing deadlines for Form 7207. Filing late can result in penalties and the loss of the credit, so submit the form on time.

Failing to attach required documentation: The IRS may require additional documentation to support your claim for the AMPC. Make sure to include all necessary attachments, such as evidence of qualified production activities and other relevant documentation.

Not meeting eligibility criteria: Understand the eligibility requirements for claiming the AMPC. If you do not meet the criteria, do not file the form as doing so could lead to penalties or other consequences.

**Ignoring changes in tax laws: **Tax laws and regulations can change over time. Stay updated with the latest IRS guidance and instructions to ensure compliance with the most recent requirements.

**Using outdated forms or instructions: **Always use the most recent version of Form 7207 and the corresponding instructions provided by the IRS. Using outdated forms or instructions can lead to errors and delays in processing your claim.

**Incorrectly claiming multiple credits: **If you are eligible for multiple tax credits, be careful not to double-count expenses or claim the same expense for different credits. Each credit has specific rules, and expenses should only be claimed once for the appropriate credit.

Failing to retain records: Keep a copy of your filed Form 7207 and all supporting documentation for at least the IRS-recommended retention period. Having proper records can help in case of an audit or if any questions arise.

Not seeking professional advice when needed: If you're unsure about how to complete Form 7207 or have complex tax situations, consider seeking assistance from a tax professional to ensure accurate filing and maximize your tax benefits.

Conclusion

The Advanced Manufacturing Production Credit (AMPC) is a powerful tool that governments can utilize to foster innovation, growth, and competitiveness within the manufacturing sector. By incentivizing manufacturers to invest in cutting-edge technologies and sustainable practices, the AMPC unlocks the potential for a brighter future in manufacturing.

As the global manufacturing landscape continues to evolve, initiatives like the AMPC will play an increasingly crucial role in shaping the industry's trajectory. Manufacturers that take advantage of this credit can position themselves as leaders in innovation, while governments can nurture a resilient and robust manufacturing sector that drives economic prosperity for years to come.