- IRS forms

- Form 14157-A

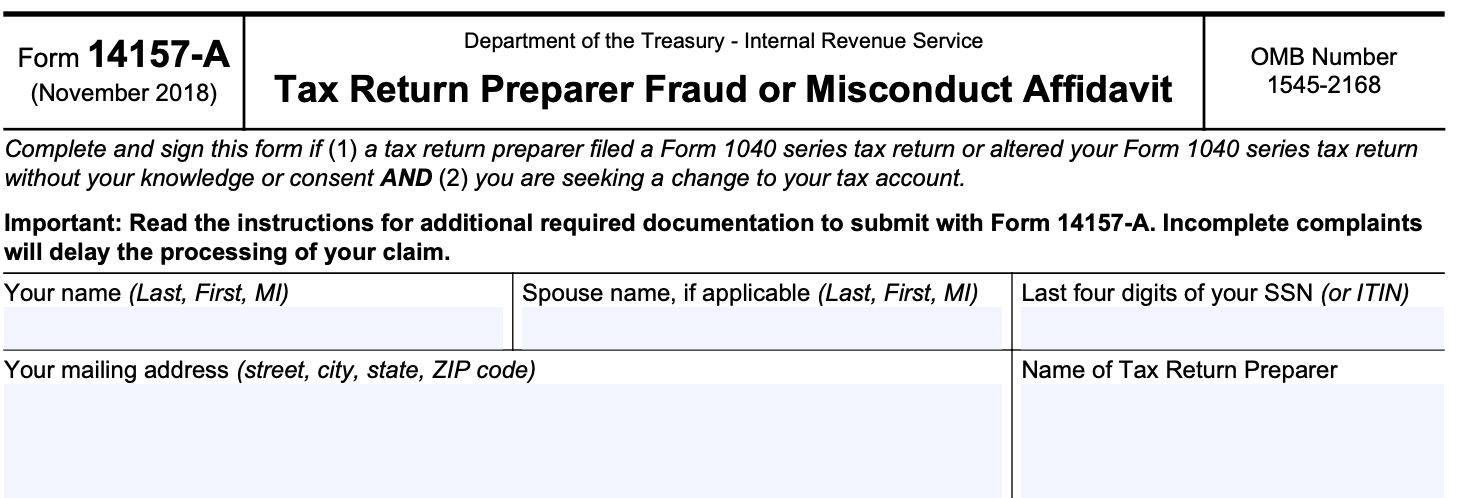

Form 14157-A: Tax Return Preparer Fraud or Misconduct Affidavit

Download Form 14157-ATax return preparers are individuals or businesses who assist taxpayers in preparing and filing their tax returns. While most tax preparers are honest and trustworthy, there are instances where some may engage in fraudulent activities or unethical behavior, leading to inaccurate or false tax filings on behalf of their clients.

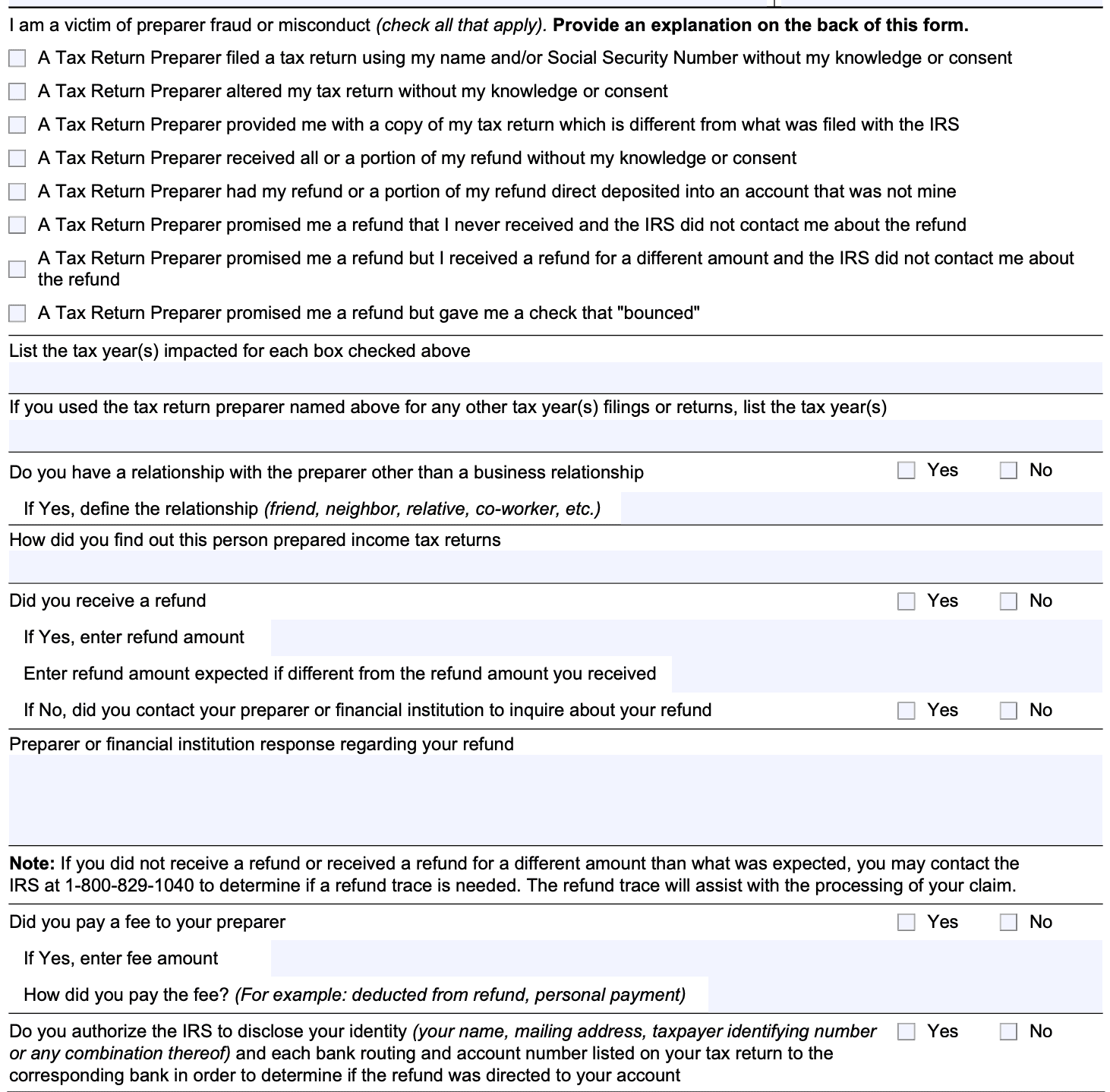

Form 14157-A allows taxpayers to report such misconduct by providing the IRS with detailed information about the preparer's actions. This information is crucial for the IRS to investigate potential fraud and take appropriate enforcement actions.The form typically requires the taxpayer to provide details about the tax preparer, such as their name, address, and Preparer Tax Identification Number (PTIN). Additionally, the taxpayer must describe the alleged fraudulent or unethical behavior, including any supporting documentation they may have.

In this blog, we will delve into the significance of Form 14157-A and how it helps curbing unethical practices.

Purpose of Form 14157-A

The primary purpose of Form 14157-A is to allow taxpayers to provide the IRS with information about tax return preparers they believe have engaged in fraudulent activities.

Here are some key points about the purpose of Form 14157-A:

Reporting preparer misconduct: The form is used by taxpayers to report tax return preparers they suspect of misconduct, which could include instances of filing false or misleading returns, charging excessive fees, or providing inaccurate advice.

Assisting IRS investigations: The information provided in Form 14157-A can help the IRS identify and investigate potential tax preparer fraud cases. This form serves as a formal complaint that can trigger further examination of the preparer's practices.

Protecting taxpayers: By reporting misconduct, taxpayers help protect others from falling victim to unscrupulous tax preparers and potentially facing legal and financial consequences due to fraudulent tax filings.

Documenting complaints: Form 14157-A serves as a formal record of the taxpayer's complaint against the preparer, ensuring that the concerns are documented for review and action by the appropriate authorities.

Gathering information: Form 14157-A collects detailed information about the tax return preparer and the nature of the alleged misconduct. This information is crucial for the IRS to assess the validity of the complaint and take appropriate actions.

Formal complaint process: Filing Form 14157-A initiates a formal complaint process with the IRS. This means that the complaint is officially recorded and reviewed by the appropriate authorities within the IRS.

Benefits of Form 14157-A

Key benefits of Form 14157-A are listed as follows:

-

Reporting tax return preparer issues: Form 14157-A allows taxpayers to report complaints about tax return preparers who engage in fraudulent activities, unethical behavior, or violate IRS regulations. This includes issues such as improper deductions, falsifying information, or engaging in fraudulent practices.

-

Protecting taxpayers: By submitting Form 14157-A, taxpayers can help protect themselves and others from unscrupulous tax return preparers who may be taking advantage of unsuspecting individuals for personal gain.

-

Assisting in investigations: The information provided on the form can help the IRS in conducting investigations and identifying tax return preparers who may be violating tax laws or regulations.

-

Improving tax compliance: By addressing complaints and taking appropriate actions against problematic tax return preparers, the IRS can promote better compliance with tax laws and regulations in the tax preparation industry.

-

Maintaining taxpayer trust: When taxpayers feel that their complaints are taken seriously and addressed by the IRS, it helps to maintain trust in the tax system and enhances confidence that tax matters are handled fairly.

-

Strengthening tax system integrity: Filing complaints using Form 14157-A contributes to the overall integrity of the tax system by weeding out dishonest tax return preparers and discouraging others from engaging in similar misconduct.

Who Is Eligible To File Form 14157-A?

To be eligible to use Form 14157-A, you must have information about a tax return preparer or tax preparation company that you suspect is engaged in fraudulent activities. This could include activities such as:

- Preparing false or misleading tax returns

- Falsifying information on a taxpayer's return without their knowledge

- Engaging in identity theft or misusing taxpayer information

- Promising or promoting unrealistic or illegal tax schemes

- Charging excessive fees or engaging in other unethical practices

How To Complete Form 14157-A: A Step-by-Step Guide

Here’s a general step-by-step guide to help you understand how to complete Form 14157-A

Step 1: Obtain the form

Visit the IRS website or your local IRS office to obtain a copy of Form 14157-A. Alternatively, you may call the IRS at their toll-free number to request the form by mail.

Step 2: Read the instructions

Before filling out the form, carefully read the instructions provided with it. Understanding the instructions will help you complete the form accurately and provide the necessary information.

Step 3: Gather information

You'll need specific details about the tax return preparer against whom you want to file a complaint. This includes the preparer's name, address, and PTIN (Preparer Tax Identification Number), if available. The PTIN is a unique identifier assigned to tax return preparers by the IRS.

Step 4: Complete the form

Provide your personal information, including your name, address, and contact details in the appropriate fields.

Step 6: Tax return preparer information

Enter the information about the tax return preparer you want to file a complaint against. Provide their name, business name (if applicable), address, and other relevant details.

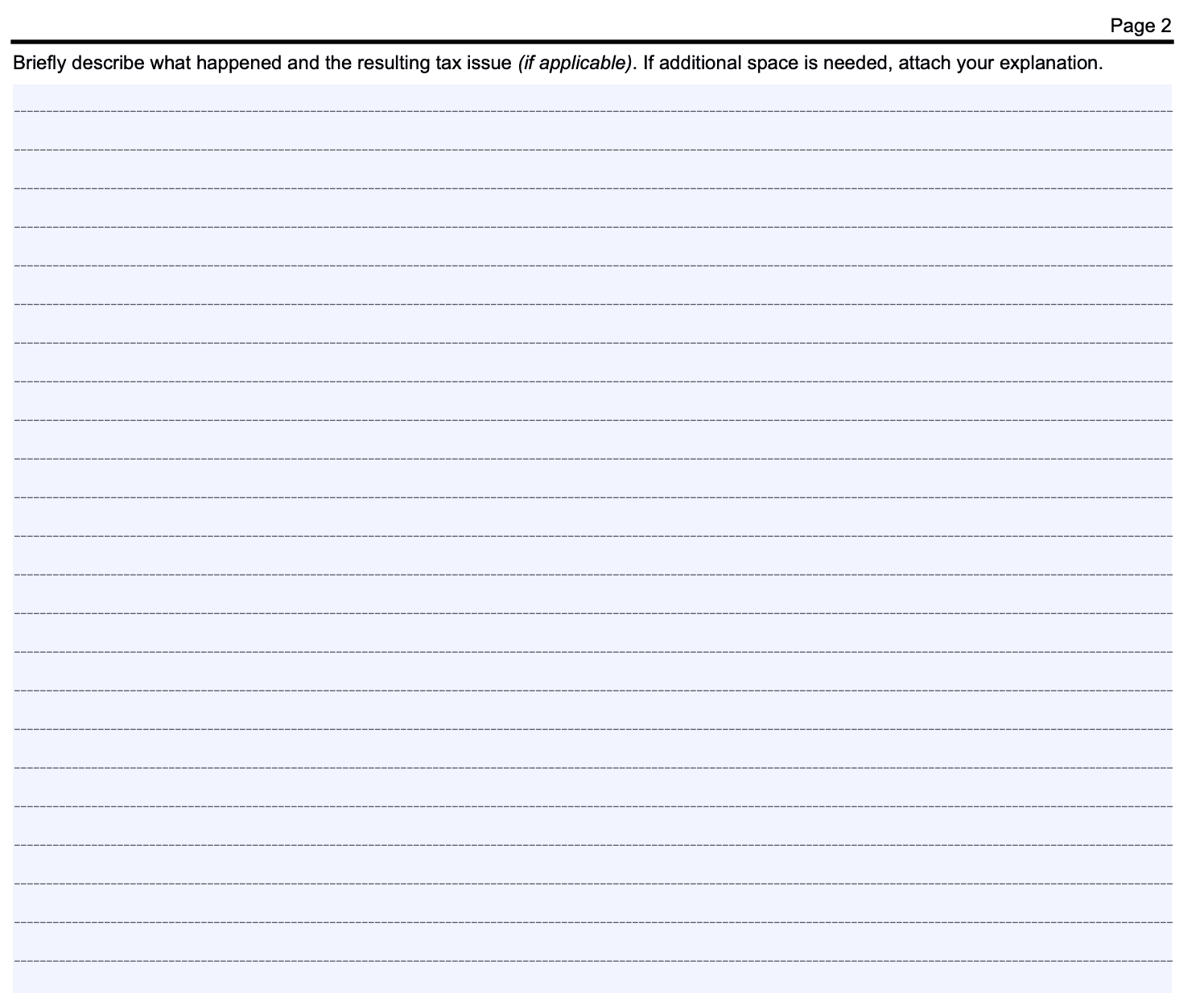

Step 7: Describe the complaint

In the complaint section, clearly describe the issues you have with the tax return preparer's services. Provide specific details, dates, and any relevant documents that support your complaint.

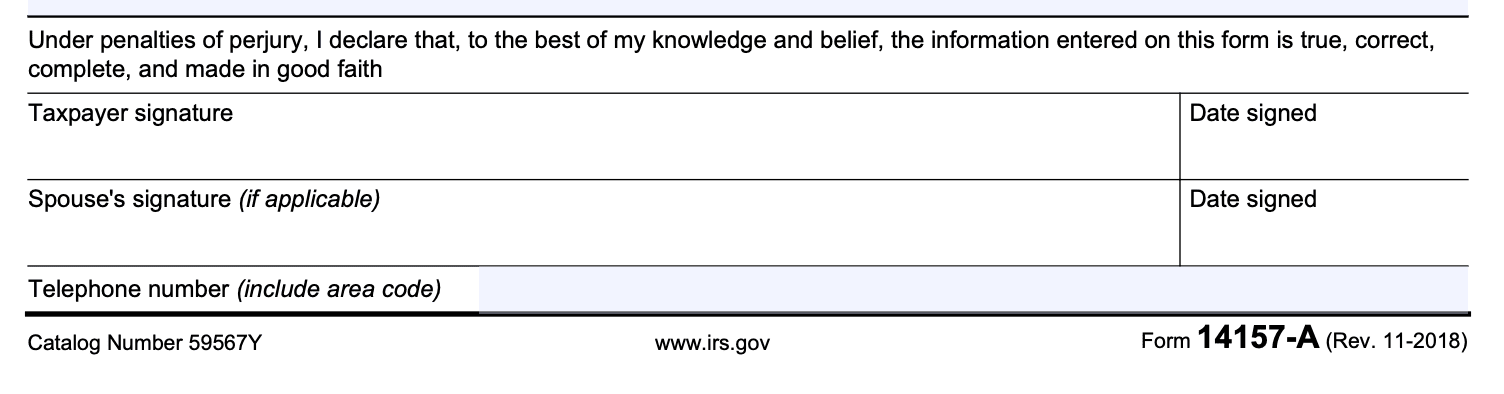

Step 9: Consent and sign

Read the consent statement provided on the form. If you agree with the terms, sign and date the form. If you are filing the complaint on behalf of someone else, make sure you have the appropriate authorization to do so.

Step 10: Submit the form

Once you have completed the form, make a copy for your records and send the original to the IRS at the address provided in the instructions. It's recommended to use certified mail or a trackable delivery service to ensure it reaches the IRS securely.

Step 11: Await response

After submitting the complaint, the IRS will review the information provided and take appropriate actions if necessary. They may contact you for further details if needed.

Special Considerations When Filing Form 14157-A

When filing Form 14157-A, there are some special considerations that issuers should be aware of:

Purpose: The primary purpose of Form 14157-A is to provide taxpayers with a means to report tax return preparers who are suspected of engaging in fraudulent or abusive practices while preparing their tax returns.

Reporting misconduct: If you believe that a tax return preparer has acted dishonestly or unethically in preparing your tax return or someone else's tax return, you can use this form to report the preparer's actions to the Internal Revenue Service (IRS).

Providing information: When filling out the form, it's crucial to provide as much detailed and accurate information as possible. This includes the preparer's name, contact information, and any relevant identifying numbers. You should also describe the specific fraudulent activities or misconduct you witnessed or experienced.

Confidentiality: The information you provide on Form 14157-A is treated as confidential by the IRS. However, in some instances, the IRS may need to share the information with other government agencies, law enforcement, or parties involved in an investigation related to the reported misconduct.

Filing process: You can obtain Form 14157-A from the official IRS website or by contacting the IRS directly. Once you have completed the form, you can submit it to the IRS for review. The IRS may use the information provided on the form to initiate an investigation into the alleged misconduct.

Protection against retaliation: The IRS has provisions in place to protect taxpayers from retaliation by tax return preparers against whom they have filed complaints. If you experience any form of retaliation or harassment as a result of filing Form 14157-A, you should report it to the IRS.

Specifics of misconduct: When completing the form, it is crucial to be as specific as possible about the alleged misconduct. Include any relevant dates, amounts, or other pertinent information that can help the IRS investigate the matter thoroughly.

Supporting evidence: If you have any supporting evidence, such as documents, receipts, or other materials that substantiate the claims of misconduct, it is advisable to submit them along with the completed form. However, if you don't have concrete evidence, you can still provide details about the suspicious behavior to the best of your ability.

How To File Form 14157-A: Offline/Online/E-Filing

The form can be filed either offline or online. Here's how you can do it:

Offline filing

To file Form 14157-A offline, you can print the form from the IRS website or request a copy from the IRS directly. Once you have the form:

a. Complete the form: Fill out all the required information on the form. Provide details about the tax return preparer you are reporting and describe the misconduct or violation that you believe has occurred.

b. Gather supporting documents: Collect any supporting documentation or evidence related to the complaint. This may include receipts, correspondence, or any other relevant materials.

c. Mail the form: Once the form is completed and signed, mail it along with any supporting documents to the following address:

Internal Revenue Service

P.O. Box 312690

Cincinnati, OH 45231

Ensure you send the form via certified mail with a return receipt requested so that you have proof of delivery.

Online filing

To file Form 14157-A online, you can use the IRS's Online Tax Return Preparer Complaint Referral Form.

Follow these steps:

a. Access the online form: Go to the IRS website and find the Online Tax Return Preparer Complaint Referral Form. You may need to search for it on the IRS website or use the IRS website's search function.

b. Complete the form: Fill out all the necessary information in the online form. Provide the details of the tax return preparer you are reporting and describe the alleged misconduct or violation.

c. Upload supporting documents: If you have any supporting documents or evidence related to the complaint, you can upload them through the online form.

d. Submit the form: Once you have filled in all the required information and attached any relevant documents, submit the online form.

Common Mistakes To Avoid While Filing Form 14157-A

Here are some common mistakes to avoid when filling out Form 14157-A:

Incomplete information: Make sure to provide all the required information accurately. Incomplete forms may delay the processing of your complaint or result in the IRS being unable to investigate the issue thoroughly.

Missing preparer information: Clearly identify the tax return preparer involved in the complaint. Provide their name, address, and Preparer Tax Identification Number (PTIN), if available.

Unclear complaint details: Be specific and provide as much detail as possible regarding the issue or incident you are reporting. Vague or insufficient information may hinder the IRS's ability to take appropriate action.

**Including original documents: **Do not include original documents or evidence with the Form 14157-A. Instead, follow the instructions provided on the form to submit copies of any supporting documentation.

Submitting multiple complaints for the same incident: If you have already submitted a complaint for the same incident, submitting another may not be necessary and can create confusion. Check with the IRS or the appropriate contact to ensure the status of your previous complaint.

**Missing contact information: **Ensure you provide accurate contact information, such as your name, address, phone number, and email, so the IRS can reach out to you if needed.

Filing the form after statute of limitations: Be mindful of the statute of limitations for filing complaints. If too much time has passed since the incident, the IRS may not be able to take action.

**Unclear description of the issue: **Be specific and clear when describing the issues or problems you experienced with the tax return preparer. Avoid vague language or general complaints, as this could lead to misunderstandings or insufficient grounds for investigation.

**Lack of supporting documentation: **Include any relevant documentation or evidence to support your complaint. This might include copies of tax returns, communication with the preparer, receipts, or any other relevant information that helps the IRS understand the nature of the complaint.

**Failure to sign the form: **Remember to sign the Form 14157-A before submitting it. Unsigned forms will not be considered valid, and your complaint will not be processed.

Missing the deadline: Make sure you file the complaint within the appropriate time frame. Check the IRS website or the instructions on Form 14157-A for the current deadline information.

Conclusion

Form 14157-A is a vital tool in the fight against tax return preparer fraud. By using this form to report suspected fraudulent activities, taxpayers can play a crucial role in ensuring the integrity of the tax system and protecting themselves and others from unscrupulous individuals.

If you suspect that your tax return preparer has engaged in fraud or misconduct, don't hesitate to take action and submit Form 14157-A to the IRS. Your efforts may help create a more transparent and honest tax environment for everyone. Always remember to keep a copy of the form and any supporting documentation for your records.

Please note that the information provided in this blog is for general informational purposes only and should not be considered as legal or tax advice. If you encounter tax-related issues, it's advisable to consult with a qualified tax professional or legal expert.