- IRS forms

- Form 14157

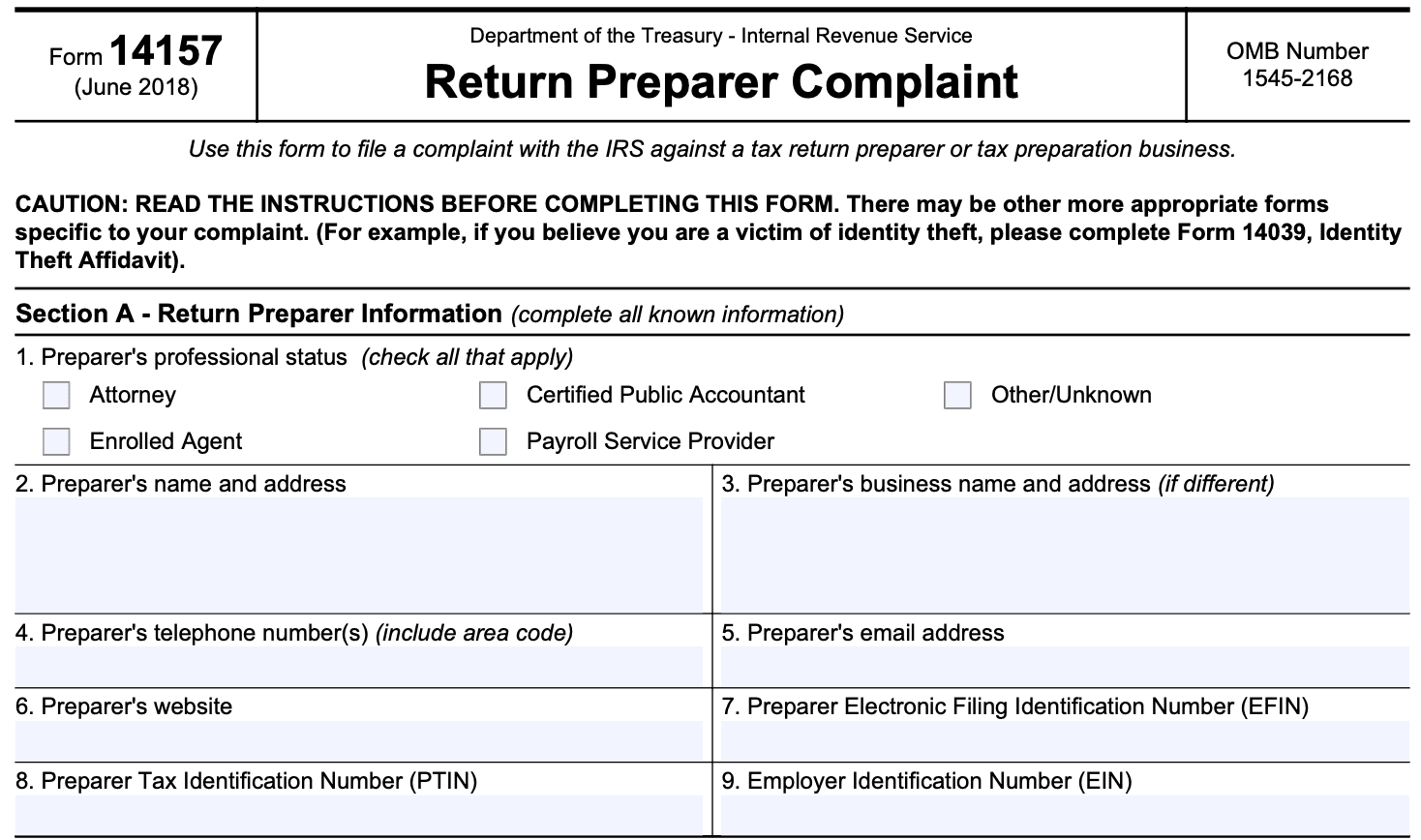

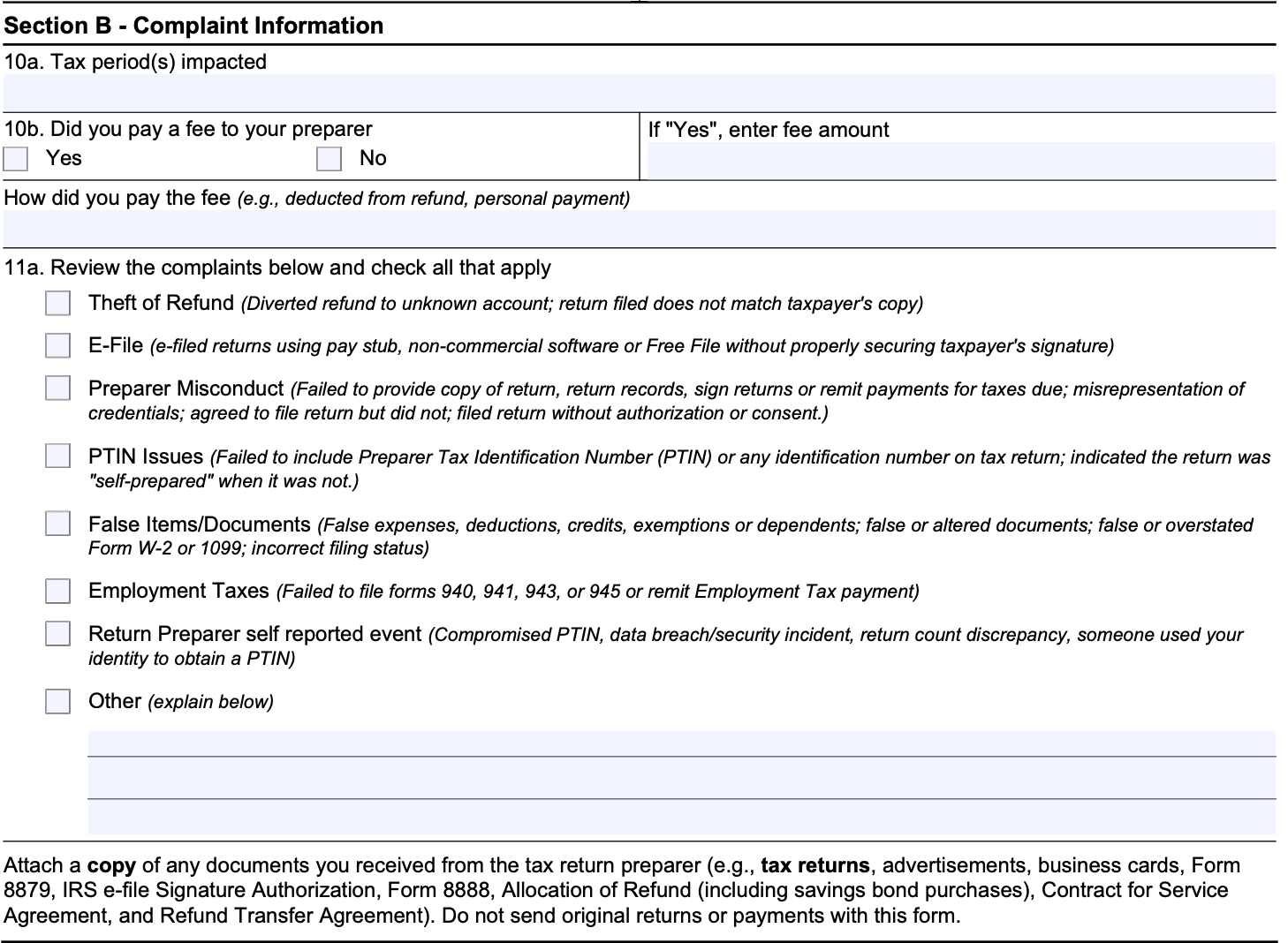

Form 14157: Return Preparer Complaint

Download Form 14157Before submitting Form 14157, it's essential for taxpayers to try to resolve their concerns directly with the tax preparer, and if that doesn't yield satisfactory results, then they can submit the complaint using this form. The IRS takes complaints seriously and investigates reported misconduct to maintain the integrity of the tax system and protect taxpayers' interests.

The form requires information about the tax preparer's identity, their business details, and the nature of the complaint. You can also use this form if you suspect that a tax return preparer is not complying with their ethical and legal responsibilities or is involved in promoting abusive tax schemes.

Purpose of Form 14157

Tax Return Preparer serves the specific purpose of reporting a tax return preparer who you believe has engaged in illegal, unethical, or inappropriate conduct related to tax preparation.The form is used to alert the Internal Revenue Service (IRS) about potential issues with tax return preparers to help maintain the integrity of the tax system and protect taxpayers from fraudulent or deceptive practices.

The main purposes of Form 14157 are as follows:

Fraudulent tax return preparation: If you suspect that a tax preparer has submitted false or misleading information on your tax return, you can use Form 14157 to report this misconduct.

Mishandling of funds: If you believe a tax preparer has mishandled your funds or engaged in financial misconduct related to your tax preparation, you can use this form to notify the IRS.

Identity theft concerns: If you suspect that your personal information has been misused by a tax return preparer for fraudulent purposes, you can file a complaint using this form.

Violation of tax laws or regulations: Any actions or behaviors by a tax preparer that go against tax laws or IRS regulations can be reported through Form 14157.

Reporting preparer misconduct: The primary purpose of Form 14157 is to provide a formal channel for taxpayers to report tax return preparers who they suspect of engaging in fraudulent activities, unethical behavior, or any other misconduct related to tax preparation.

Assisting IRS investigations: By submitting Form 14157, taxpayers can provide the IRS with crucial information and documentation that can help them investigate and take appropriate actions against the accused preparer.

Protecting taxpayers: The form is designed to protect taxpayers from unscrupulous tax return preparers and to ensure that tax preparers adhere to the appropriate legal and ethical standards.

Anonymous reporting: The form allows individuals to submit their complaints anonymously if they wish. However, providing your contact information may help the IRS to follow up if they need additional details or clarifications.

Types of preparer misconduct: The form covers various types of misconduct, such as improper or false deductions, credits, or exemptions claimed on a return, false income reporting, aiding and abetting false returns, and more.

Benefits of Form 14157

Form 14157 is used to report allegations of misconduct or fraudulent activities by tax return preparers. Filing this form can lead to several benefits and actions, some of which include:

- Reporting misconduct: Form 14157 allows individuals to report tax preparers who engage in unethical practices, provide false information, or commit fraudulent activities while preparing tax returns.

- Protecting taxpayers: By reporting misconduct, taxpayers can help protect themselves and others from falling victim to unscrupulous tax return preparers who may manipulate information to the taxpayers' detriment.

- Investigation: The IRS takes complaints filed on Form 14157 seriously and may conduct an investigation into the allegations against the tax return preparer. If found guilty, the preparer may face penalties, sanctions, or even criminal charges.

- Corrective measures: Filing the form may prompt the IRS to take corrective actions, which can include revoking the preparer's right to practice, imposing fines, or requiring additional training and education.

- Improved tax compliance: By weeding out fraudulent tax return preparers, the IRS can contribute to improved overall tax compliance, ensuring that taxpayers' returns are accurate and in line with tax laws.

- Public awareness: Filing a complaint can help raise awareness about specific tax return preparers who may be engaging in unethical practices, potentially alerting others to avoid using their services.

- Encouraging compliance: By reporting tax return preparer misconduct, taxpayers play an essential role in promoting compliance with tax laws. When fraudulent preparers face consequences for their actions, it serves as a deterrent for others who may be considering engaging in similar practices.

- Assisting IRS investigations: Filing Form 14157 provides the IRS with valuable information to investigate and take appropriate actions against tax return preparers who are breaking the law. This helps the IRS allocate resources effectively to tackle tax-related fraud and misconduct.

Who Is Eligible To File Form 14157?

If you suspect that a tax return preparer has engaged in fraudulent or improper activities, you can use Form 14157 to submit a complaint to the IRS. This form is specifically for reporting tax return preparers, not for reporting individual taxpayers.

To be eligible to use Form 14157, you should have a genuine reason to believe that the tax return preparer has committed violations such as:

- Failing to sign a return

- Not providing their preparer tax identification number (PTIN)

- Engaging in fraudulent or misleading practices

- Misusing taxpayer information for personal gain

- Filing a return without the taxpayer's consent or knowledge

- Any other misconduct related to tax return preparation

How To Complete Form 14157 : A Step-by-Step Guide

Step 1: Obtain Form 14157

Visit the IRS website or contact your local IRS office to get a copy of Form 14157. You can also call the IRS at their toll-free number to request the form be mailed to you.

Step 2: Read the instructions

Before you start filling out the form, carefully read the instructions provided with it. Understanding the purpose and requirements of the form will help you complete it correctly.

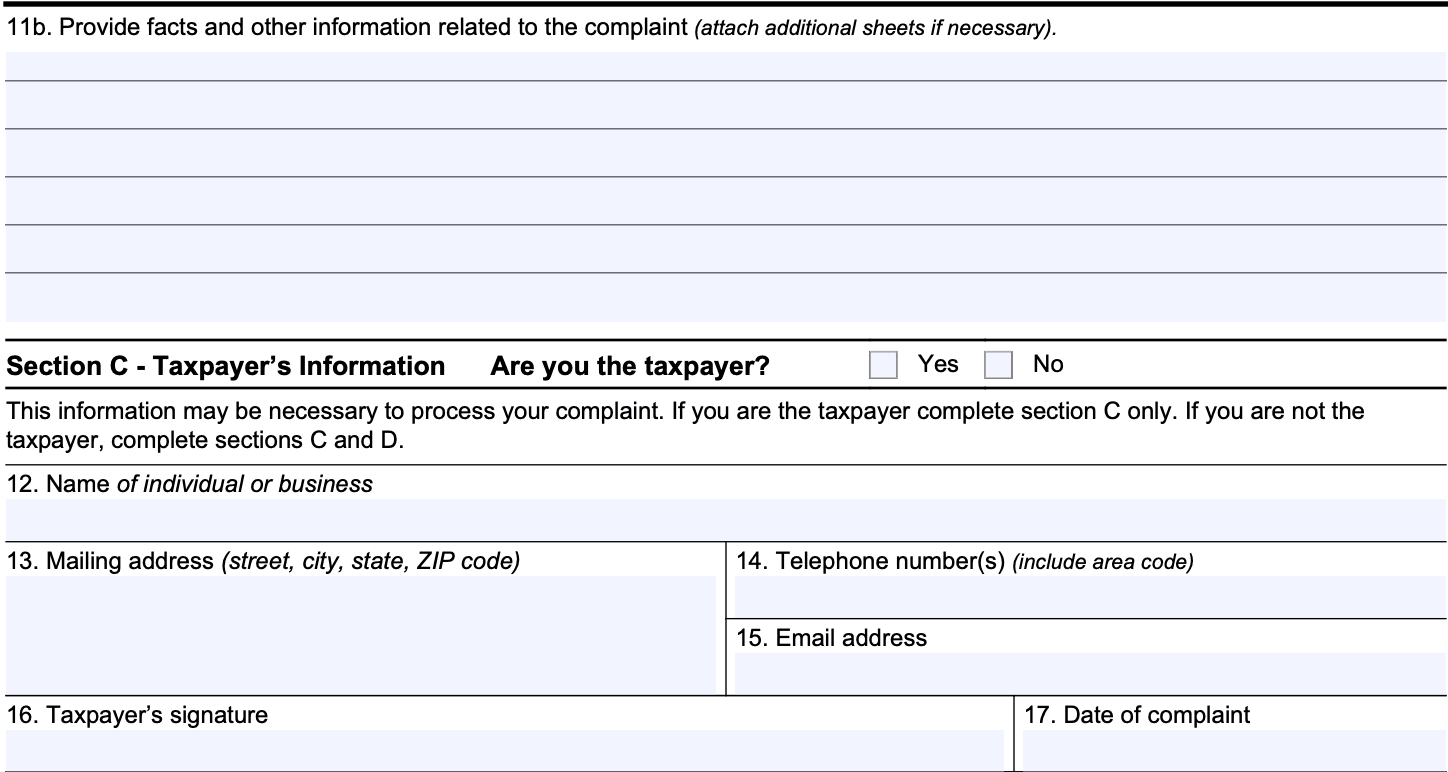

Step 3: Provide your information

In the top section of the form, you will need to provide your personal information, such as your name, address, phone number, and Social Security number.

Step 4: Describe the complaint

Use the space provided on the form to describe in detail the nature of your complaint against the tax return preparer. Include any relevant information, such as specific actions, dates, and any evidence you have to support your claim.

Step 5: Identify the tax return preparer

In the next section, you will need to provide information about the tax return preparer you want to report. This includes the preparer's name, address, and any contact details you have.

Step 6: Identify problem preparers

The information provided on the form can help the IRS identify and take action against tax return preparers who consistently engage in illegal or unethical behavior.

Step 7: Sign and date the form

Sign and date the form in the designated area to certify that the information provided is true and accurate to the best of your knowledge.

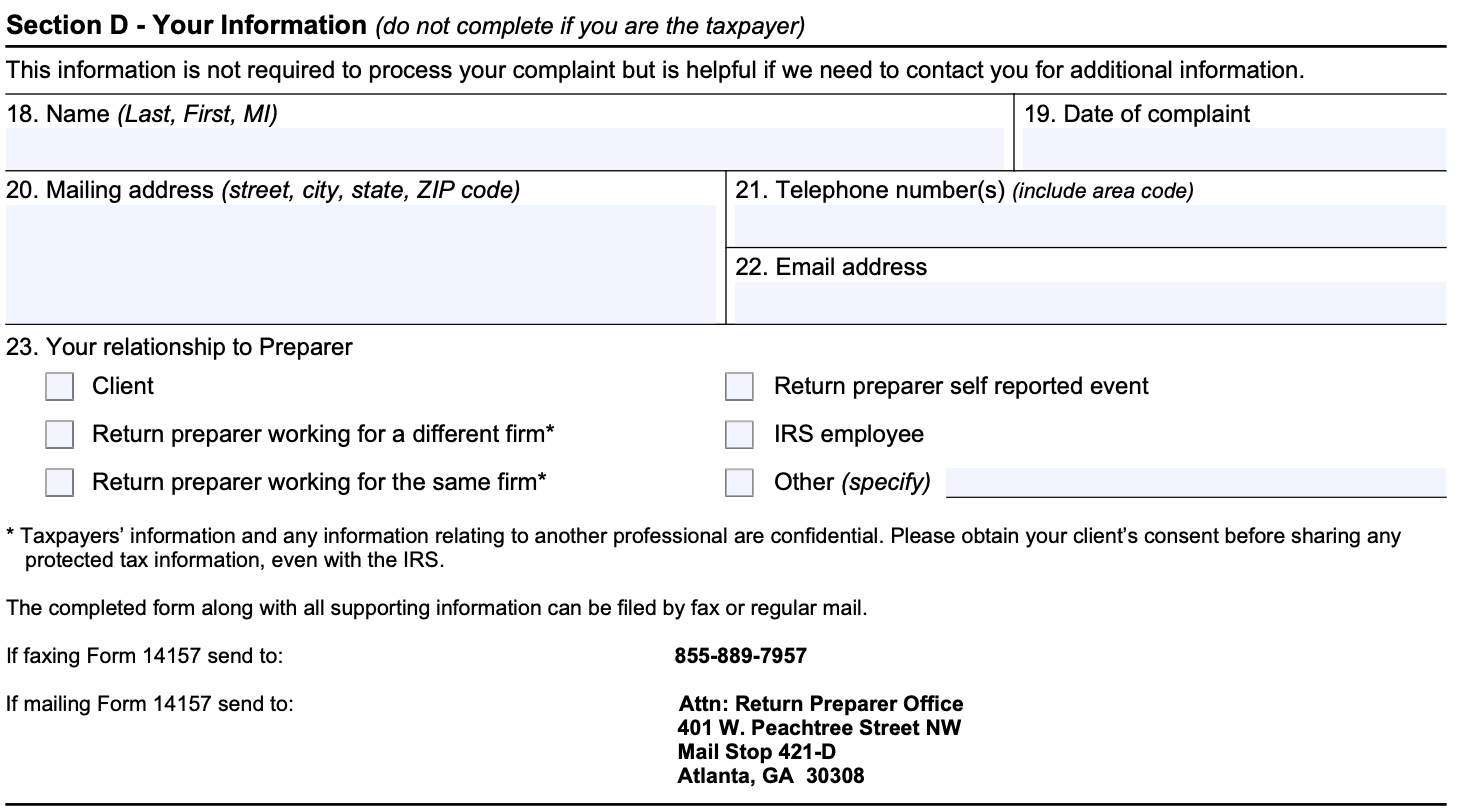

Step 8: Submit the form

Once the form is completed, mail it to the appropriate IRS office. The address should be provided in the instructions or on the IRS website. It's essential to send the form to the correct location to ensure it reaches the appropriate department for review.

Step 9: Follow up

After submitting the form, you may want to follow up with the IRS to check on the status of your complaint. Keep any reference numbers or correspondence related to the complaint for future reference.

Special Considerations When Filing Form 14157

When filing Form 14157 , there are some special considerations that issuers should be aware of:

Accurate and detailed information: Provide as much specific and accurate information as possible about the tax return preparer in question. This includes the preparer's name, business name, address, phone number, and any other relevant details that can help the IRS investigate the matter effectively.

Allegations and supporting evidence: Clearly state the allegations of misconduct against the tax return preparer. Provide any supporting documentation or evidence that you may have, such as copies of your tax returns, communication with the preparer, or any other relevant information that can substantiate your claims.

Protecting your identity: If you wish to remain anonymous when filing the complaint, you can do so. The IRS does not require you to provide your name, but it may be helpful to the investigation if they have the option to contact you for additional information.

Filing deadlines: Be mindful of any deadlines for reporting the alleged misconduct. The IRS may have specific time frames within which complaints should be filed, so make sure to submit the form within the required timeframe.

Retain copies: Keep copies of the completed Form 14157 and any supporting documentation for your records. This will be helpful in case there are follow-up inquiries from the IRS or other authorities.

Confidentiality: The IRS takes complaints seriously and treats the information provided with confidentiality. However, be aware that certain circumstances might require the IRS to disclose your identity during their investigation.

Other avenues for resolution: Filing Form 14157 is a way to report misconduct, but if you have concerns about the accuracy of your tax return or other tax-related matters, you may want to consider discussing the issue with the tax return preparer directly or seeking assistance from a tax professional.

How To File: Offline/Online/E-filing

Offline filing

To file Form 14157 offline, follow these steps:

- Obtain the form: You can download Form 14157 from the IRS website or request a physical copy by calling the IRS toll-free number.

- Complete the form: Fill out the required information on Form 14157, providing details about the tax return preparer and the nature of your complaint.

- **Attach supporting documentation: **If you have any evidence or supporting documents related to your complaint, make copies and attach them to the form.

- **Mail the form: **Once the form is completed and supporting documents are attached, mail it to the appropriate address provided in the form's instructions.

Online filing

The IRS does not currently offer a direct online filing option for Form 14157. However, they may provide an electronic submission option through their Secure Access IRS e-file (SAF) system or other online platforms. Check the IRS website or contact the IRS for any updated methods of electronic filing for Form 14157.

E-filing through tax professional software

Some tax professional software may offer the option to submit Form 14157 electronically. If you are working with a tax professional, they might be able to assist you in filing the form electronically through their software systems.

Common Mistakes To Avoid When Filing Form 14157

Assuming the Form's purpose remains the same, here are some common mistakes to avoid while filing Form 14157 or any similar form for reporting (link: https://fincent.com/glossary/irs-scams text: tax fraud):

Incomplete or inaccurate information: Ensure that you provide all required details accurately. Mistakes in names, addresses, and Social Security Numbers can delay the investigation process or lead to incorrect identification of the individuals involved.

Missing documentation: Include any supporting documentation or evidence related to the suspected tax fraud activity. Providing as much relevant information as possible can help the IRS investigate the matter more effectively.

Failing to sign and date the form: Remember to sign and date the form properly. Unsigned or undated forms may be considered invalid, and the IRS might not process them.

Late submission: File the form as soon as you become aware of the suspected tax fraud. Delaying the submission could hamper the IRS's ability to take timely action.

Not keeping a copy for your records: Always retain a copy of the completed Form 14157 and any accompanying documentation. This will be useful in case you need to refer back to the information or if the IRS requests additional details.

Submitting multiple reports for the same issue: Avoid submitting duplicate reports for the same suspected tax fraud activity. One well-documented report is sufficient for the IRS to initiate an investigation.

Speculating or making baseless claims: Stick to the facts and provide concrete evidence to support your suspicions. Speculative or unsubstantiated claims may not carry much weight in the investigation process.

Providing false information: It is essential to be truthful while reporting tax fraud. Deliberately providing false information on Form 14157 could lead to legal consequences.

Ignoring follow-up communication: If the IRS reaches out to you for additional information or clarification, respond promptly. Cooperating with the IRS during the investigation is crucial.

Conclusion

Form 14157 is a powerful tool that empowers taxpayers to stand up against unscrupulous tax return preparers. By reporting fraudulent activities, you play a significant role in upholding the integrity of the tax system and safeguarding the interests of honest taxpayers.

Remember, the IRS relies on the collective effort of all taxpayers to identify and root out dishonest practices. So, if you come across any suspicious or fraudulent behavior during tax preparation, don't hesitate to use Form 14157 and be a part of the solution.