- IRS forms

- Form 1099-SA

Form 1099-SA Guide: Maximize HSA & MSA Contributions

Download Form 1099-SAIRS Form 1099-SA is an important document that you need to be aware of if you have a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage Medical Savings Account (MA MSA). This form is issued by the financial institution where you hold your account, and it reports the distributions you received from your account during the year.

In this guide page, we'll cover everything you need to know about IRS Form 1099-SA, including what it is, who needs to file it, how to fill it out, and more. By the end of this guide, you'll have a clear understanding of what you need to do with this form and how to avoid any penalties for non-compliance.

What is IRS Form 1099-SA?

Form 1099-SA is a tax document that is used to report the distributions you received from your HSA, MSA, or MA MSA during the tax year. The financial institution where you hold your account is responsible for issuing this form to you and the IRS.

Who Needs to File IRS Form 1099-SA?

If you received distributions from your HSA, MSA, or MA MSA during the tax year, you will receive IRS Form 1099-SA from your financial institution. This form is typically sent out by January 31st of the following year.

If you're the account holder, you'll need to include the information from the form on your tax return. However, if you're not the account holder but received distributions from the account, you'll still need to report the distributions on your tax return.

How to Fill Out IRS Form 1099-SA

Filling out IRS Form 1099-SA (Rev. 11-2019) is relatively straightforward. The financial institution where you hold your account will provide you with a copy of the form, and you'll need to fill out the following information:

Step 1: Gather the Information You Need

Before you begin filling out Form 1099-SA, you'll need to gather the following information:

- Your business name, address, and employer identification number (EIN)

- The recipient's name, address, and taxpayer identification number (TIN)

- The amount of distributions made to the recipient from an HSA or MSA during the tax year

- The fair market value of the HSA or MSA on the date of the distribution

Step 2: Determine the Copies You Need to Fill Out

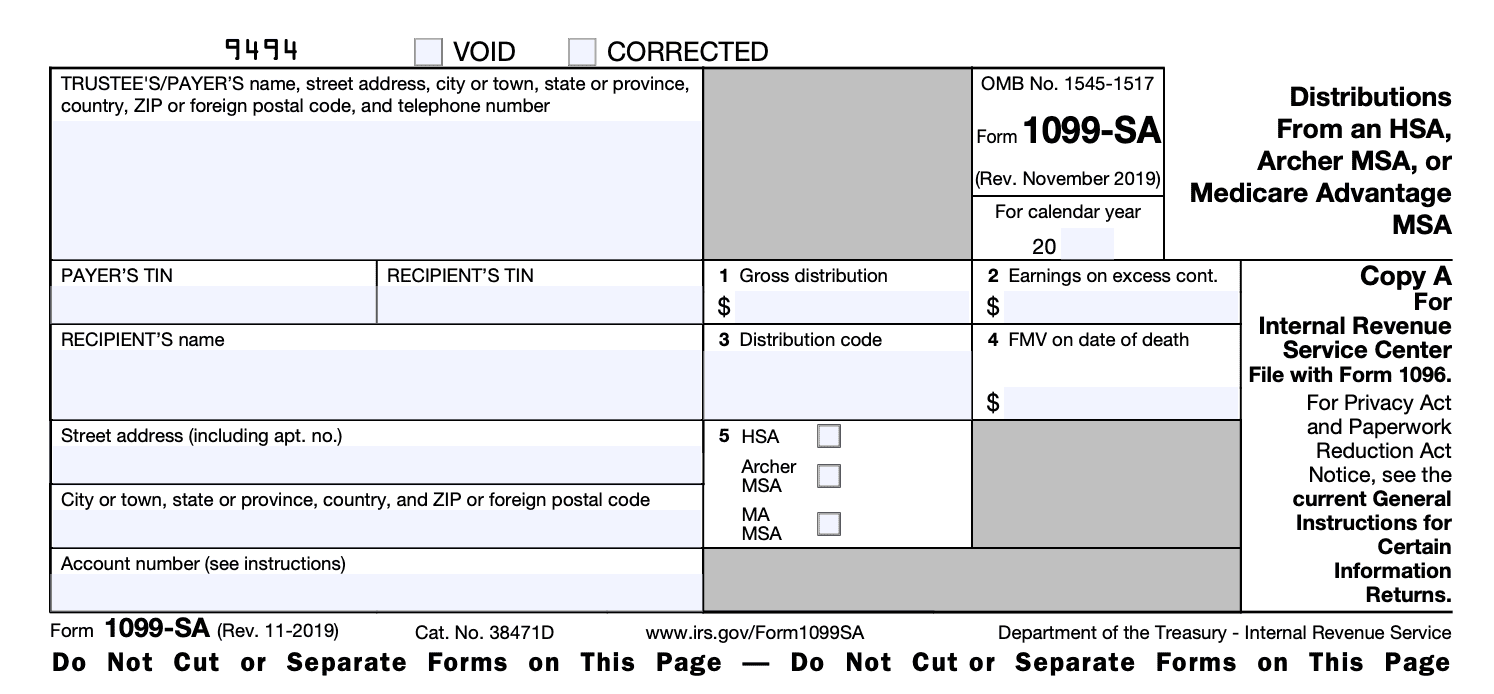

Form 1099-SA has three copies that you need to fill out:

- Copy A: This is the copy that you will send to the IRS. It must be printed on red scannable paper, which you can order from the IRS or purchase from an office supply store.

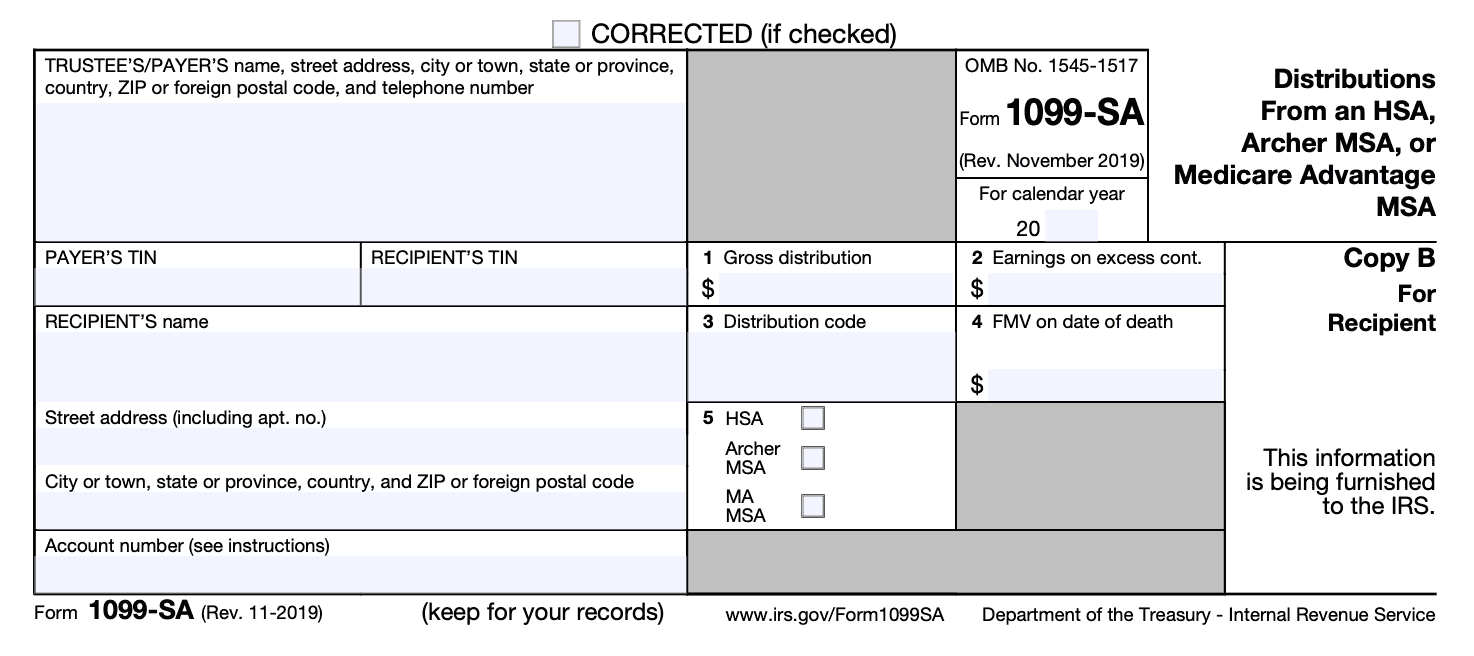

- Copy B: This is the copy that you will give to the recipient of the distribution.

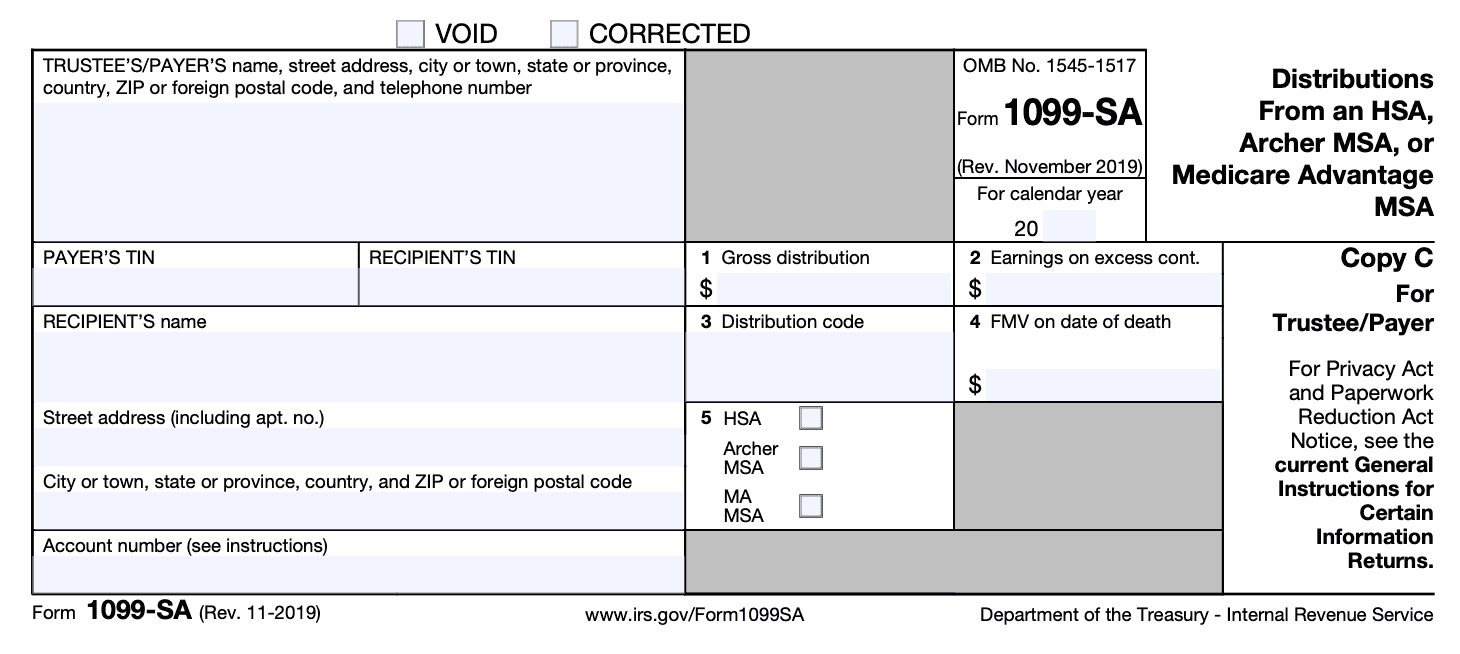

- Copy C: This is your copy, which you will keep for your records.

Step 3: Fill Out Copy A

Copy A is the copy that you will send to the IRS, so it's important to fill it out carefully and accurately. Here's how to do it:

- In the top left corner of the form, enter your business name, address, and EIN.

- In the top right corner, enter the tax year for which you are filing the form.

- In the box labeled "Payer's federal identification number," enter your EIN.

- In the box labeled "Recipient's identification number," enter the recipient's TIN.

- In the box labeled "Account number," enter any account number or other unique identifier you use to track the recipient's account.

- In the box labeled "Total distribution," enter the total amount of distributions made to the recipient from an HSA or MSA during the tax year.

- In the box labeled "FMV of HSA or MSA on the date of distribution," enter the fair market value of the HSA or MSA on the date of the distribution.

- Complete the remaining boxes on Copy A as necessary.

- Mail Copy A to the IRS by the last day of February, or by March 31st if you file electronically.

Step 4: Fill Out Copy B

Copy B is the copy that you will give to the recipient of the distribution. Here's how to fill it out:

- In the top left corner of the form, enter your business name, address, and EIN.

- In the box labeled "Recipient's name," enter the recipient's name.

- In the box labeled "Recipient's address," enter the recipient's address.

- In the box labeled "Recipient's identification number," enter the recipient's TIN.

- In the box labeled "Account number," enter any account number or other unique identifier you use to track the recipient's account.

- In the box labeled "Total distribution," enter the total amount of distributions made to the recipient from an HSA or MSA during the tax year.

- In the box labeled "FMV of HSA or MSA on the date of distribution", enter the fair market value of the HSA or MSA on the date of the distribution.

- Complete the remaining boxes on Copy B as necessary.

- Give Copy B to the recipient by January 31st of the year following the tax year.

Step 5: Fill Out Copy C

Copy C is your copy of Form 1099-SA, which you should keep for your records. Here's how to fill it out:

- Fill out Copy C with the same information as you did for Copy A and Copy B.

- Keep Copy C for your records.

Step 6: Review and Submit Your Form

Before you submit your Form 1099-SA, it's important to review it carefully to ensure that all the information is correct. Double-check the spelling of the recipient's name, address, and TIN, as well as the amounts you entered in the boxes.

Once you have reviewed your form, you can submit it to the IRS. If you are filing on paper, mail Copy A to the IRS along with a Form 1096, which is a summary of all the Forms 1099 you are filing. If you are filing electronically, you can submit your form through the IRS's Filing Information Returns Electronically (FIRE) system.

Form 1099-SA versus Form 1098-SA: What is the difference

| Form Number | Purpose | Information Reported |

| 1099-SA | Reports distributions made from an HSA, Archer MSA, or MA MSA during the tax year | Total amount of distributions made from the account; Distributions made for non-qualified medical expenses |

| 1098-SA | Reports contributions made to an HSA, Archer MSA, or MA MSA during the tax year | Total amount of contributions made to the account; Excess contributions withdrawn from the account; Contributions made for the prior tax year; Contributions made for the current tax year after the tax filing deadline |

Where Do I Mail Form 1099-SA?

If you're responsible for filing Form 1099-SA, you'll need to mail a copy of the form to both the recipient and the IRS. Here are the addresses where you should send the forms:

Recipient:

The copy of Form 1099-SA that you send to the recipient must be mailed or electronically delivered by January 31st of the year following the tax year. You should send the form to the recipient's last known address or email address, depending on the method of delivery you agreed upon with the recipient.

IRS:

The copy of Form 1099-SA that you send to the IRS should be mailed by the last day of February, or by March 31st if you file electronically. The mailing address to use depends on the state in which the recipient is located:

| Location | Mailing Address |

| Alabama, Arizona, Arkansas, Connecticut, Delaware, Florida, Georgia, Kentucky, Louisiana, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Texas, Vermont, Virginia, or West Virginia | Department of the Treasury

Internal Revenue Service Center Austin, TX 73301 |

| Alaska, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Maryland, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, or Wyoming | Department of the Treasury

Internal Revenue Service Center Kansas City, MO 64999 |

What Are the Penalties for Not Filing Form 1099-SA?

If you don't file IRS Form 1099-SA, you could face penalties from the IRS. The penalties for not filing can be quite steep, so it's important to make sure you file the form on time.

The penalties for not filing IRS Form 1099-SA are as follows:

- $50 per form if you file within 30 days of the due date (maximum penalty of $565,000 per year)

- $110 per form if you file more than 30 days after the due date but before August 1st (maximum penalty of $1,696,000 per year)

- $280 per form if you file after August 1st or do not file at all (maximum penalty of $3,392,000 per year)

These penalties can add up quickly, so it's important to make sure you file the form on time.

What should I do if I don't receive Form 1099-SA?

Step 1: Contact the Issuer

The first step is to contact the issuer of the Form 1099-SA. This is typically the financial institution that manages your HSA or MSA account. You can contact them and ask if they have sent out the form yet and if there are any issues with the mailing address they have on file for you. It's possible that the form was sent to an outdated address or there was some other error in the mailing process.

Step 2: Request a Copy

If you are unable to obtain the form from the issuer or if they do not have a record of sending it to you, you can request a copy of the form. You can do this by contacting the IRS at 1-800-829-1040 and requesting a transcript of your tax return. The transcript should include all the information reported on Form 1099-SA.

Step 3: Report the Income

Even if you do not receive Form 1099-SA, you are still responsible for reporting the income from your HSA or MSA distributions on your tax return. You can use the information you have available, such as your account statements, to determine the amount of distributions you received during the year.

Step 4: Correct any Mistakes

If you receive Form 1099-SA after you have already filed your tax return and there are mistakes or omissions on the form, you will need to file an amended return. This can be done using Form 1040X, Amended U.S. Individual Income Tax Return.

Common mistakes to avoid when filling out Form 1099-SA

Filling out tax forms can be a daunting task, and it's easy to make mistakes. Here are some common mistakes to avoid when filling out IRS Form 1099-SA:

- Incorrect account holder information: Make sure to include the correct name, address, and TIN for the account holder. This information is used by the IRS to match the form to the correct taxpayer.

- Incorrect recipient information: Make sure to include the correct name, address, and TIN for the recipient. If the information is incorrect, the form may not be credited to the correct taxpayer, which could result in penalties or an audit.

- Incorrect distribution amount: Make sure to report the correct distribution amount on the form. If the amount is incorrect, it could result in penalties or an audit.

- Not reporting all distributions: Make sure to report all distributions made from the account during the tax year. If you miss reporting a distribution, it could result in penalties or an audit.

- Not including fair market value: Make sure to include the fair market value of the account on the last day of the tax year. This information is used by the IRS to determine if any gains or losses have occurred.

- Not filing the form on time: Make sure to file the form on time to avoid penalties. The form is due by January 31st of the following year.

- Not providing a copy to the recipient: Make sure to provide a copy of the form to the recipient. The recipient will need this information to file their taxes accurately.

Final Thoughts

IRS Form 1099-SA is an important tax document that you need to be aware of if you have a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage Medical Savings Account (MA MSA). It's used to report the distributions you received from your account during the year, and the financial institution where you hold your account is responsible for issuing the form to you and the IRS.

If you received distributions from your HSA, MSA, or MA MSA during the tax year, you'll need to report them on your tax return using the information from IRS Form 1099-SA. If you don't file the form on time, you could face penalties from the IRS.

In conclusion, IRS Form 1099-SA is an important document that you need to be aware of if you have an HSA, MSA, or MA MSA. By understanding what the form is, who needs to file it, how to fill it out, and what the penalties are for non-compliance, you can avoid any issues with the IRS and ensure that your taxes are filed accurately and on time.

Frequently Asked Questions about Form 1099-SA:

Q: Can I deduct HSA, Archer MSA, or MA MSA distributions on my tax return?

A: If the distributions were used to pay for qualified medical expenses, they may be deductible on your tax return. However, if the distributions were not used for qualified medical expenses, they may be subject to income tax and an additional 20% penalty.

Q: How do I report HSA, Archer MSA, or MA MSA distributions on my tax return?

A: HSA, Archer MSA, or MA MSA distributions should be reported on Form 8889, Health Savings Accounts (HSAs), which is attached to your Form 1040. The total amount of distributions should be reported on Line 14a of Form 8889, and the amount of any qualified medical expenses used to offset the distributions should be reported on Line 14b.

Q: What are qualified medical expenses?

A: Qualified medical expenses are generally expenses that are paid for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any part or function of the body. This includes expenses for medical, dental, vision, and mental health care services, as well as prescription medications and certain medical equipment and supplies.

Q: Are there any limits on HSA, Archer MSA, or MA MSA distributions?

A: Yes, there are limits on the amount of HSA, Archer MSA, or MA MSA distributions that can be made each year. For 2022, the maximum contribution to an HSA is $3,650 for individuals and $7,300 for families, and the maximum contribution to an Archer MSA is $6,050 for individuals and $12,100 for families. There are also limits on the amount of annual distributions that can be made from an HSA or Archer MSA.

Q: What happens if I overcontribute to my HSA or Archer MSA?

A: If you contribute more than the maximum amount allowed to your HSA or Archer MSA, you may be subject to a 6% excise tax on the excess contribution. You can avoid the excise tax by withdrawing the excess contribution and any earnings on the contribution before the tax filing deadline (including extensions) for the year in which the contribution was made.

Q: Can I transfer funds from my HSA or Archer MSA to another account?

A: Yes, you can transfer funds from your HSA or Archer MSA to another HSA or Archer MSA without incurring any tax or penalty. However, you cannot transfer funds from an HSA or Archer MSA to an MA MSA.