- IRS forms

- Form 1099-R

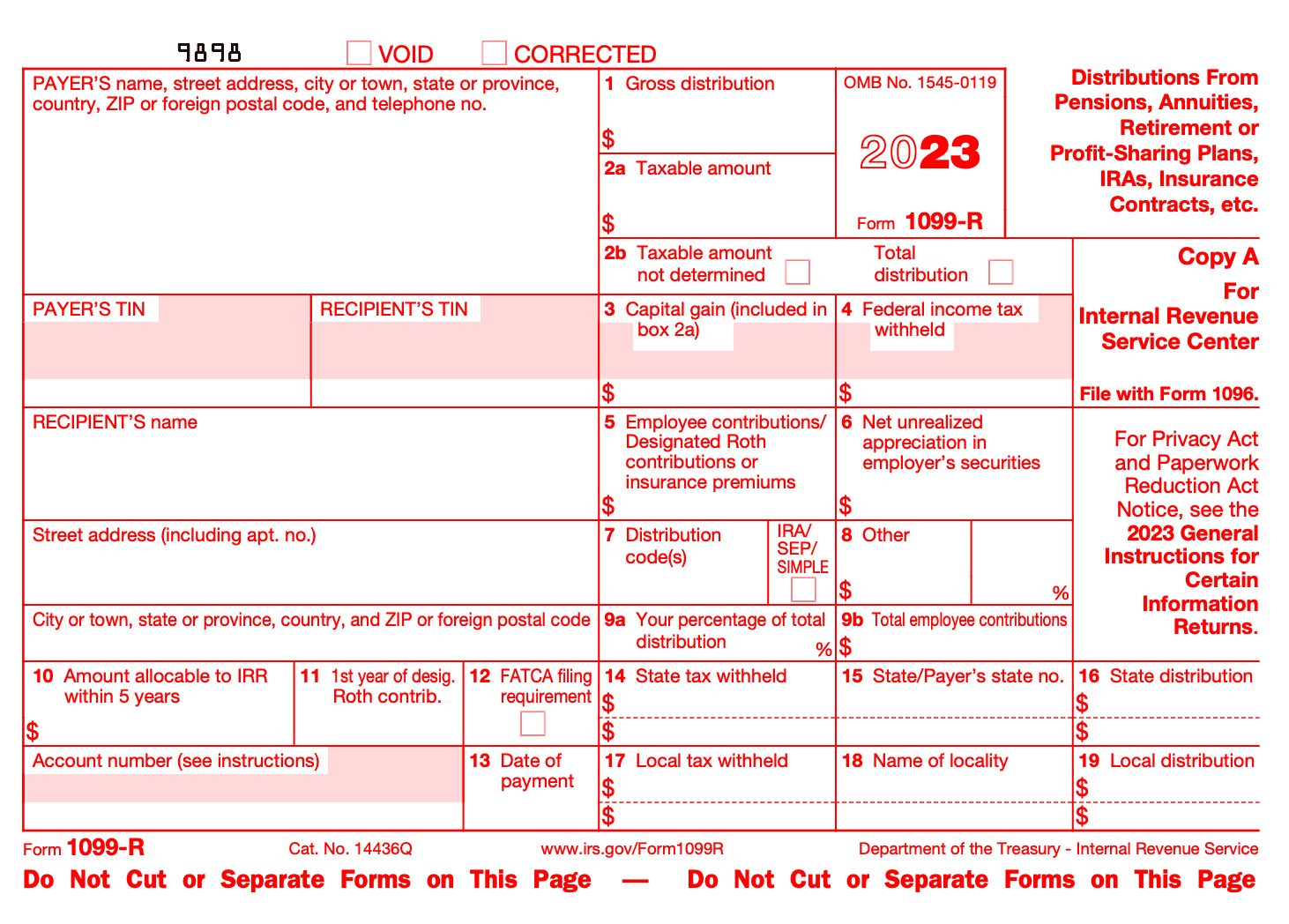

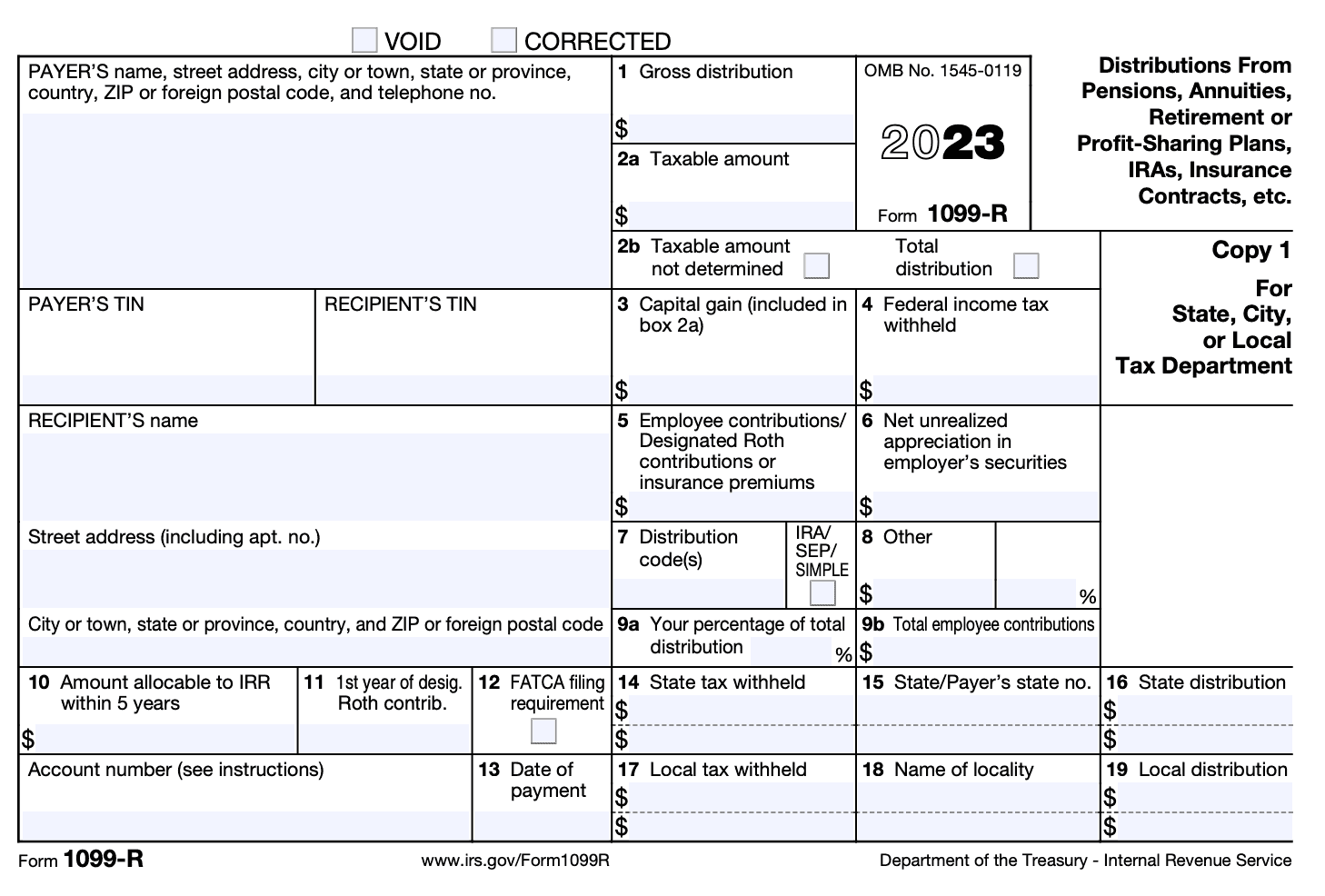

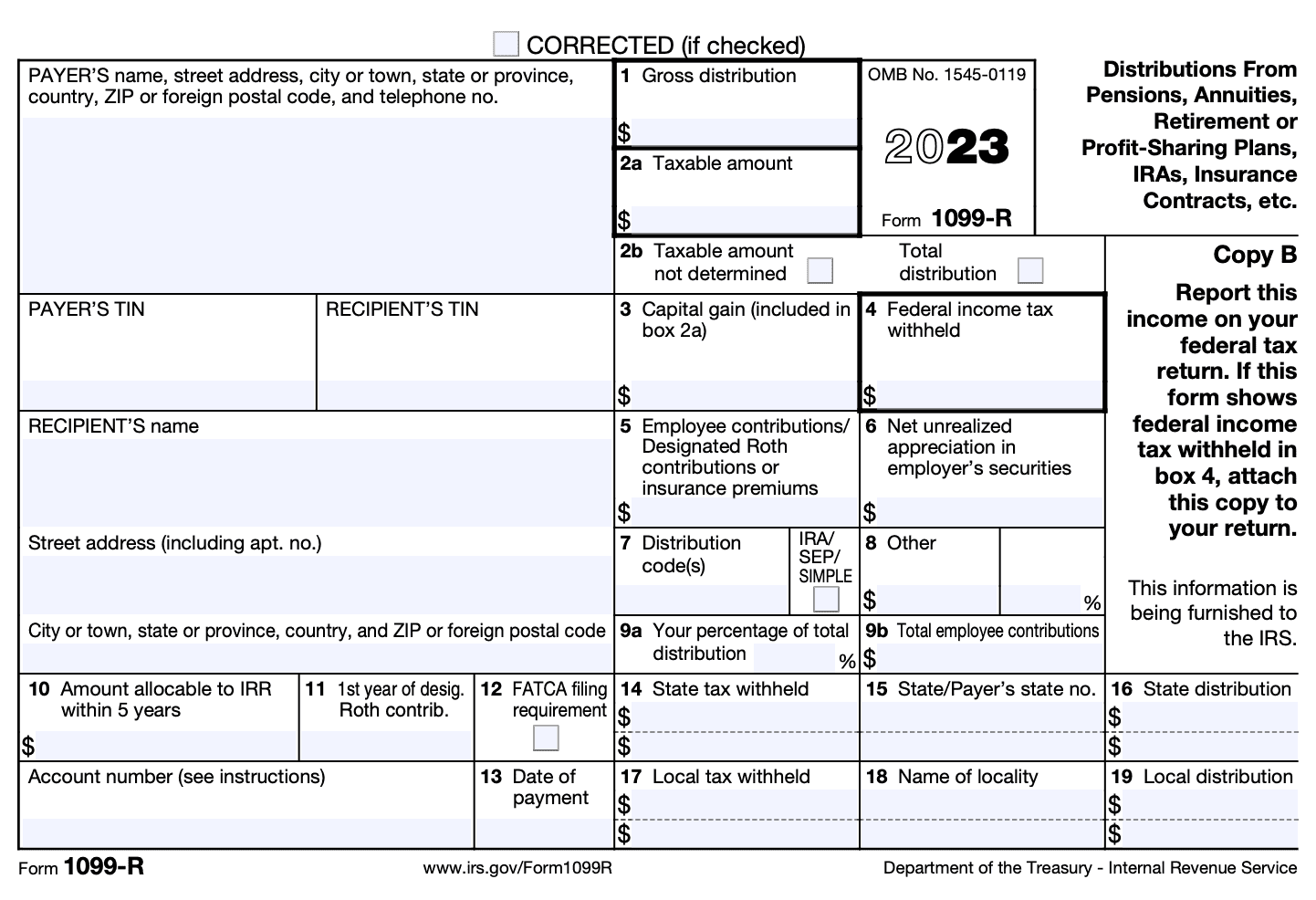

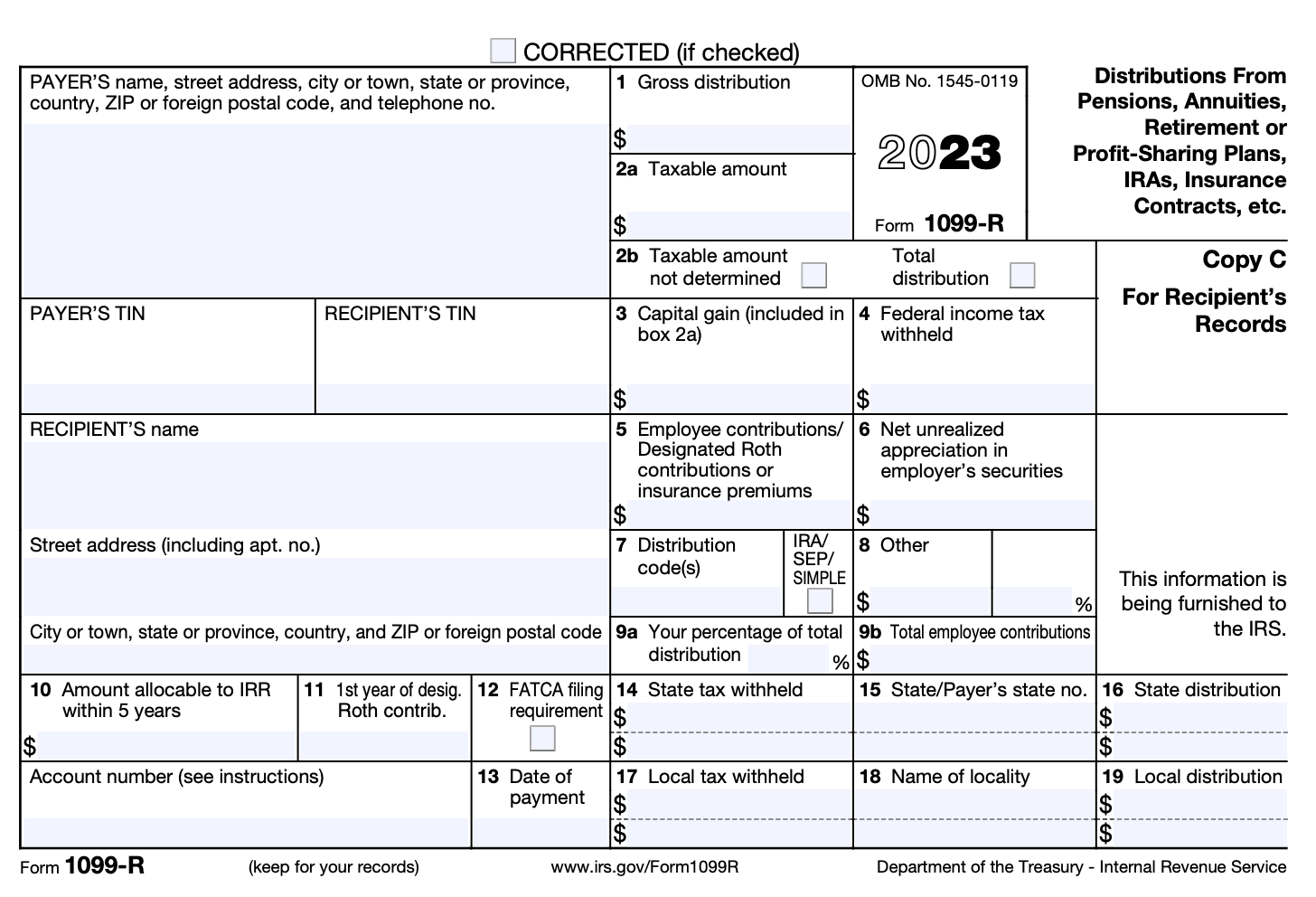

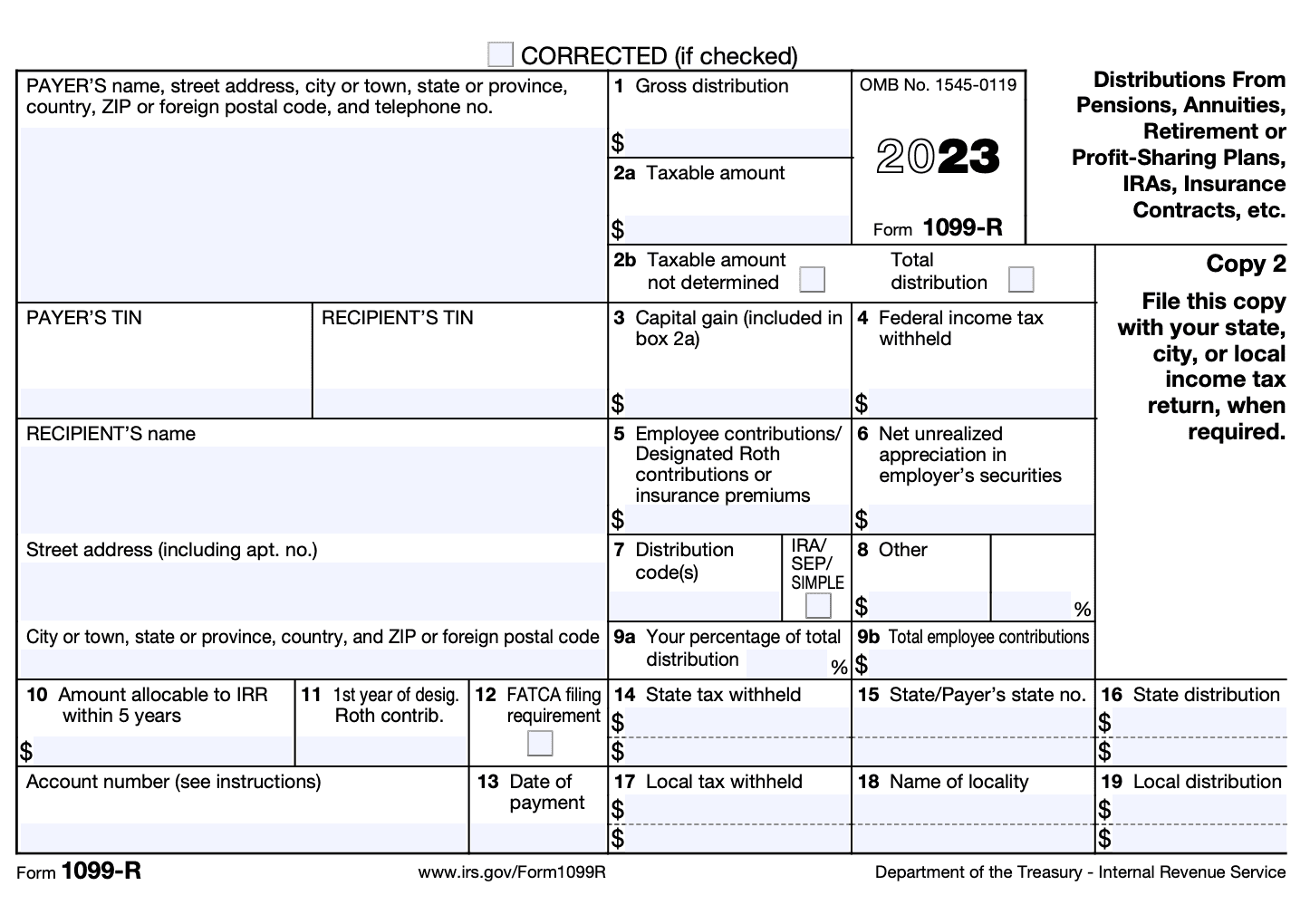

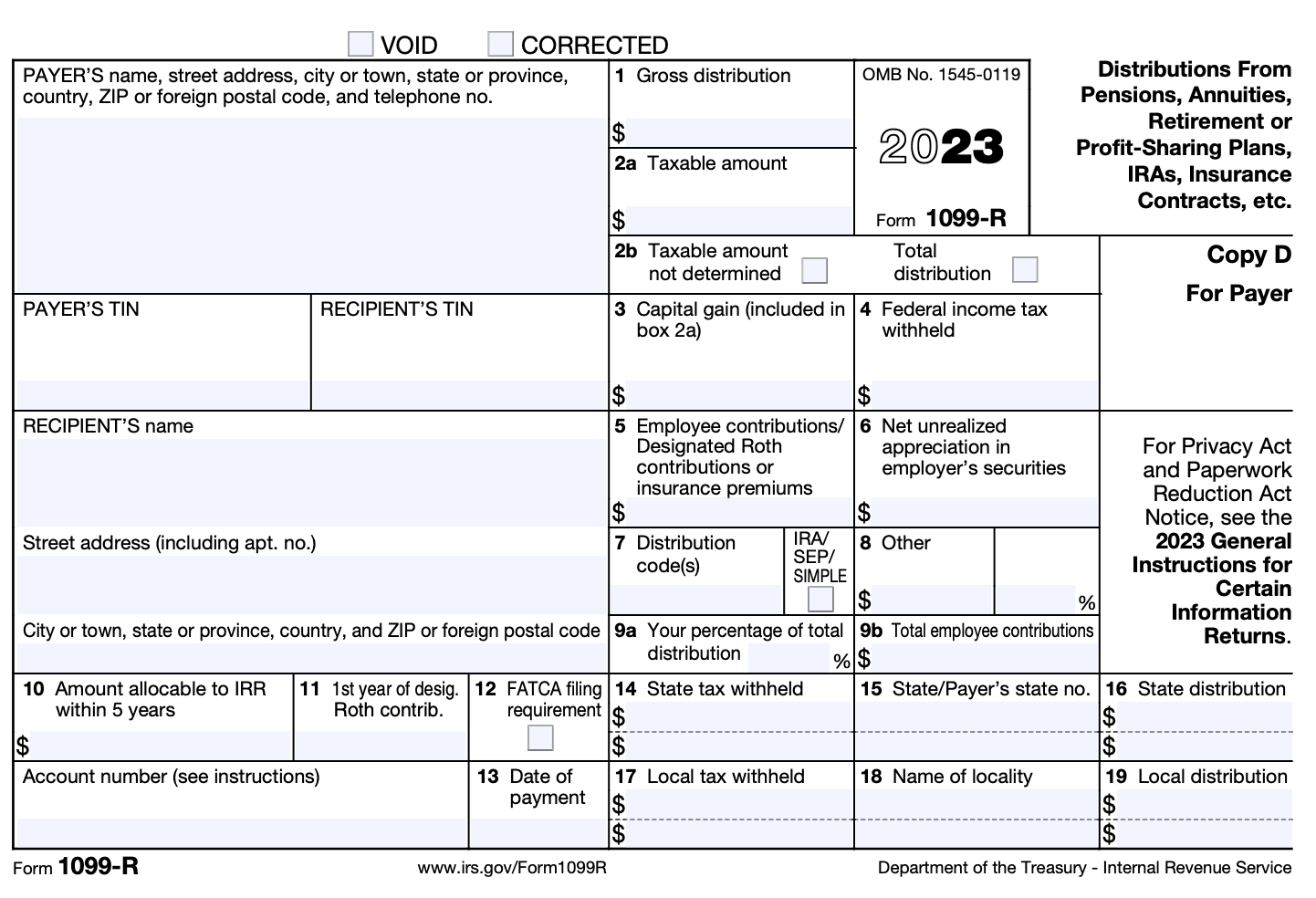

Form 1099-R: Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts

Download Form 1099-RAs individuals navigate their financial journey, various forms and documents come into play, and one such important document is Form 1099-R. If you've received distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, or insurance contracts, it's crucial to understand what Form 1099-R entails.

Form 1099-R is an Internal Revenue Service (IRS) document used to report distributions from qualified retirement plans, annuities, pensions, insurance contracts, and other similar accounts. The form is typically generated and issued by the financial institution responsible for administering the account from which the distribution is made. It is then sent to the account holder and the IRS.

In this blog post, we'll delve into the details of Form 1099-R, explaining its purpose, key sections, and the implications it holds for taxpayers.

Purpose of Form 1099-R

The purpose of Form 1099-R is to provide information to the Internal Revenue Service (IRS) about the taxable and non-taxable portions of the distribution.

The form is typically issued by the financial institution or the payer responsible for making the distribution, such as a retirement plan administrator or an insurance company. The recipient of the distribution, the taxpayer, receives a copy of Form 1099-R to report the income on their federal income tax return.

Form 1099-R includes various details about the distribution, including the total amount disbursed, any federal income tax withheld, the type of distribution (such as a regular distribution, early distribution, or rollover), and whether any exceptions or special tax treatment applies.

Benefits of Form 1099-R

Form 1099-R serves several important purposes and provides several benefits to both recipients and the Internal Revenue Service (IRS). Here are some of the key benefits of Form 1099-R:

Tax reporting: Form 1099-R provides recipients with essential information to accurately report their retirement plan distributions on their federal income tax returns. It includes details such as the total distribution amount, taxable amount, and any applicable tax withholding.

Record-keeping: By receiving Form 1099-R, recipients have a clear record of their retirement plan distributions, making it easier to track their income for financial planning, tax purposes, and future reference.

**Compliance: **The form helps ensure compliance with tax laws by providing the IRS with information about retirement plan distributions. It helps the IRS match the reported income on recipients' tax returns with the information provided by payers, reducing the likelihood of errors or underreporting.

Withholding information: Form 1099-R includes details on any federal income tax withheld from the distribution. This information is crucial for recipients to determine their tax liability and can help them avoid potential underpayment penalties.

Retirement account monitoring: The form provides a summary of distributions from retirement accounts, allowing recipients to monitor their account activity, understand the tax implications, and potentially plan for future contributions or withdrawals.

Tax deductions and credits: Form 1099-R can be used to claim certain deductions or credits related to retirement plan distributions. For example, if the distribution is used for qualified education expenses or to purchase a first home, recipients may be eligible for specific tax benefits.

Third-party verification: Form 1099-R acts as a third-party verification for retirement plan distributions. This can be useful in situations where individuals need to provide evidence of their retirement income, such as when applying for loans or other financial transactions.

Who Is Eligible To File Form 1099-R?

The following individuals or entities may be eligible to file Form 1099-R:

Payers of distributions: If you are a financial institution, insurance company, government agency, or any other entity responsible for making distributions from retirement accounts or annuities, you are required to file Form 1099-R to report those distributions.

Recipients of distributions: If you received a distribution from a retirement account, annuity, pension, or other similar plan, you may receive Form 1099-R from the payer. The form will report the amount of the distribution you received during the tax year.

Examples of retirement accounts that may require Form 1099-R include Individual Retirement Accounts (IRAs), 401(k) plans, 403(b) plans, and government pension plans.

How To Complete Form 1099-R: A Step-by-Step Guide

Here's a step-by-step guide on how to complete Form 1099-R:

Step 1: Obtain the form

You can find Form 1099-R on the official website of the Internal Revenue Service (IRS) or obtain a physical copy from an authorized source. The form is available in PDF format.

Step 2: Fill out payer and recipient information

In Box 1, enter the total amount of the distribution you made to the recipient during the tax year. In Box 2a, report the taxable amount of the distribution. If the taxable amount is unknown, leave it blank, and Box 2b will be checked.

Provide the recipient's identification number (usually their Social Security Number) in Box 2. Include the recipient's name, address, and other relevant information in Boxes 3 through 13.

Step 3: Indicate the distribution type

In Box 7, select the appropriate distribution code to describe the type of distribution made. The codes range from 1 to 7, and each code represents a specific type of distribution. Consult the instructions provided with the form or IRS Publication 575 for assistance in selecting the correct code.

Step 4: Report additional information

Depending on the circumstances, you may need to provide additional information in certain boxes. For example, if the distribution is due to the recipient being disabled, you may need to check Box 4. Similarly, if the recipient is a deceased individual, Box 9a must be checked.

Step 5: Complete state and local information

If required, enter the state and local information in Boxes 13 through 17. Some states have their own tax reporting requirements, so consult the applicable state instructions for specific guidelines.

Step 6: Copy and submit the form

Once you have completed the form, make a copy for your records. If you are filing electronically, submit the form to the IRS following the appropriate e-filing procedures. If you are filing a paper return, mail the completed form to the IRS using the address provided in the form's instructions.

Step 7: Furnish a copy to the recipient

Furnish a copy of the completed Form 1099-R to the recipient by the due date, which is generally January 31 of the year following the tax year in which the distribution was made. The recipient will use this information to report the distribution on their own tax return.

Special Considerations When Filing Form 1099-R

When filing Form 1099-R, there are several special considerations to keep in mind. Here are some important points to consider:

Correct information: Ensure that the information reported on Form 1099-R is accurate, including the recipient's name, address, and Social Security number (or taxpayer identification number).

**Distribution codes: **Use the appropriate distribution code to indicate the reason for the distribution. The distribution code determines how the distribution is taxed, so it's crucial to select the correct code from the list provided by the IRS.

Taxable amount: Report the taxable amount of the distribution in Box 2a. This is the amount that is subject to income tax and should be included on the recipient's tax return.

Withholding: If any federal income tax was withheld from the distribution, report it in Box 4. It's important to accurately report any withholding to avoid discrepancies in the recipient's tax liability.

Early distributions: If the distribution is an early distribution (i.e., made before the recipient reaches the age of 59½), additional tax penalties may apply. Report any applicable penalty taxes in Box 7.

Rollovers: If the distribution is rolled over into another retirement account or eligible plan, report it as a rollover in Box 7. This indicates that the distribution is not taxable in the current year.

Multiple recipients: If the distribution is split between multiple recipients, each recipient should receive a separate Form 1099-R reporting their respective portion of the distribution.

Correct deadlines: Ensure that you file Form 1099-R with the IRS by the appropriate deadline. The deadline for filing paper copies is typically February 28th, while electronic filings must be submitted by March 31st. However, it's important to double-check the current year's filing deadlines, as they can change.

Furnishing recipient copies: Provide the recipients of the distributions with their copy of Form 1099-R by the applicable deadline. The deadline for furnishing recipient copies is usually January 31st, but it's essential to verify the current year's deadline.

Corrections: If you discover an error on a previously filed Form 1099-R, you may need to file a corrected form. Use Form 1099-Rc to make corrections and ensure that both the IRS and the recipient receive accurate information.

Filing Deadlines & Extensions for Form 1099-R

The filing deadlines and extensions for Form 1099-R, are as follows:

Deadline for furnishing recipient copies: January 31

By this date, the payer (employer or financial institution) must provide a copy of Form 1099-R to the recipient (the individual who received the distribution).

Deadline for paper filing with the IRS: February 28

If you are filing a paper return, you must submit Copy A of Form 1099-R, along with the corresponding Form 1096 (Annual Summary and Transmittal of U.S. Information Returns), to the IRS by February 28th.

Deadline for electronic filing with the IRS: March 31

If you choose to file electronically, you have until March 31st to submit the electronic version of Form 1099-R to the IRS.

Extensions

If you are unable to meet the above deadlines, you may request an extension of time to file Form 1099-R. However, the extension only applies to the filing with the IRS, not the furnishing of recipient copies. To request an extension, you must file Form 8809 (Application for Extension of Time to File Information Returns) before the original due date of the return. The extension, if granted, will typically provide an additional 30 days to file the form.

Common Mistakes To Avoid While Filing Form 1099-R

When filing Form 1099-R, it's important to avoid certain common mistakes to ensure accurate reporting. Here are some mistakes to avoid while filing Form 1099-R:

Incorrect recipient information: Ensure that the recipient's name, address, and Social Security number (or taxpayer identification number) are accurate. Mistakes in recipient information can lead to complications and may require correction later.

**Incorrect distribution codes: **Form 1099-R requires the use of specific distribution codes to indicate the type of distribution made. Ensure that the correct distribution code is selected for each transaction, as different codes have different tax implications.

Omitting or duplicating entries: Double-check that you have included all the relevant distributions on the form. Omitting a distribution or duplicating an entry can lead to discrepancies and possible IRS inquiries.

Incorrect reporting of taxable amounts: Ensure that the taxable amount reported on Form 1099-R is accurate. It should reflect the taxable portion of the distribution, excluding any non-taxable amounts such as a return of contributions.

Failure to report rollovers correctly: If there were any rollovers or transfers of funds between retirement accounts, make sure to report them accurately. Rollovers are generally not taxable if properly executed, but they need to be properly reported on Form 1099-R.

**Missing or incorrect withholding information: **If federal income tax was withheld from the distribution, report the amount correctly in Box 4 of Form 1099-R. Failure to include accurate withholding information can lead to discrepancies in the recipient's tax return.

**Late or incomplete filing: **Ensure that you file Form 1099-R by the deadline, which is typically January 31st following the tax year in which the distribution was made. Late or incomplete filing may result in penalties or interest charges.

Conclusion

Form 1099-R plays a vital role in reporting distributions from retirement accounts, pensions, annuities, and insurance contracts. Understanding its purpose, key sections, and the implications it holds for taxpayers is crucial for accurate income reporting and tax compliance.

If you receive Form 1099-R, take the time to review it carefully, and consult with a tax professional if you have any questions or concerns. Being well-informed about your financial documents will help you navigate the tax season with confidence.