- IRS forms

- Form 1099-DIV

Form 1099-DIV: Dividends and Distributions

Download Form 1099-DIVInvesting in stocks and mutual funds is a popular way to grow wealth and generate income. If you have investments in these types of assets, you may receive dividends and distributions from them. To keep track of these earnings and report them to the Internal Revenue Service (IRS), you need to be familiar with Form 1099-DIV

Form 1099-DIV is a tax form issued by banks, brokers, and other financial institutions to investors who received dividends, capital gains, or other distributions during the tax year. The purpose of this form is to report income earned from investments and to help taxpayers accurately report that income on their tax returns.

In this blog post, we will provide a comprehensive guide to Form 1099-DIV, explaining what it is, who needs it, how to interpret it, and how to report it accurately on your tax return.

Purpose of Form 1099-DIV

The purpose of Form 1099-DIV is to provide the recipient with information about the income they have earned from these investments, which must be reported on their federal income tax return.

When you receive dividends or distributions, the payer or financial institution that made the payment is generally required to provide you with a Form 1099-DIV. This form includes details about the income you received, such as the total amount, the type of income (qualified dividends, ordinary dividends, etc.), and any taxes withheld.

As a taxpayer, you are required to report the information provided on Form 1099-DIV on your federal income tax return. You will need to accurately report the income in the appropriate sections of your tax return, such as Schedule B for dividends and Form 1040 or 1040A for ordinary dividends.

It's important to note that depending on the type and amount of dividends or distributions you receive, you may be subject to different tax rates or eligible for certain tax deductions or credits.

Benefits of Form 1099-DIV

Here are some of the benefits of Form 1099-DIV:

-

Accurate tax reporting: Form 1099-DIV helps ensure accurate reporting of dividend and distribution income to the Internal Revenue Service (IRS). It provides the necessary information to taxpayers and the IRS to correctly report and calculate their tax liability.

-

Simplified tax preparation: By receiving Form 1099-DIV from financial institutions or investment companies, taxpayers have the necessary information readily available to report their dividend and distribution income. This simplifies the tax preparation process and reduces the chances of errors or omissions.

-

Understanding investment income: Form 1099-DIV provides a breakdown of different types of dividend income, such as ordinary dividends, qualified dividends, and capital gain distributions. This information helps taxpayers understand the composition of their investment income and the tax implications associated with each type.

-

Identifying tax obligations: Form 1099-DIV helps taxpayers identify the taxable portion of their dividend and distribution income. It includes details such as the total amount of dividends received, any federal income tax withheld, and any foreign taxes paid, if applicable. This information is vital for accurately determining tax liabilities and any potential tax credits or deductions.

-

Compliance with tax regulations: By receiving Form 1099-DIV, taxpayers can ensure compliance with tax regulations and reporting requirements. Failing to report dividend and distribution income can lead to penalties, interest charges, or audits by the IRS. Form 1099-DIV helps taxpayers stay in line with tax laws and fulfill their reporting obligations.

Who Is Eligible To File Form 1099-DIV?

Here are some specific entities that may be eligible to file Form 1099-DIV:

Individuals: Any individual who receives dividends or distributions from stocks, mutual funds, or other investments may need to file Form 1099-DIV if the total amount received during the tax year exceeds $10.

Partnerships: Partnerships that receive dividends or distributions from investments may need to file Form 1099-DIV if the total amount received during the tax year exceeds $10.

Corporations: Corporations that receive dividends or distributions from investments may need to file Form 1099-DIV if the total amount received during the tax year exceeds $10.

**Trusts and estates: **Trusts and estates that receive dividends or distributions from investments may need to file Form 1099-DIV if the total amount received during the tax year exceeds $10.

How To Complete Form 1099-DIV: A Step-by-Step Guide

Completing Form 1099-DIV can be a straightforward process if you follow a step-by-step guide. Here's a general outline of the steps involved:

Step 1: Gather information

Collect all the necessary information and documents required to complete Form 1099-DIV. This includes your business's name, address, and taxpayer identification number (TIN), as well as the recipient's name, address, and TIN. Additionally, you'll need the details of the dividends or distributions paid during the tax year.

Step 2: Obtain Form 1099-DIV

Obtain a blank copy of Form 1099-DIV from the Internal Revenue Service (IRS) website or through authorized software. You can also purchase pre-printed forms from office supply stores.

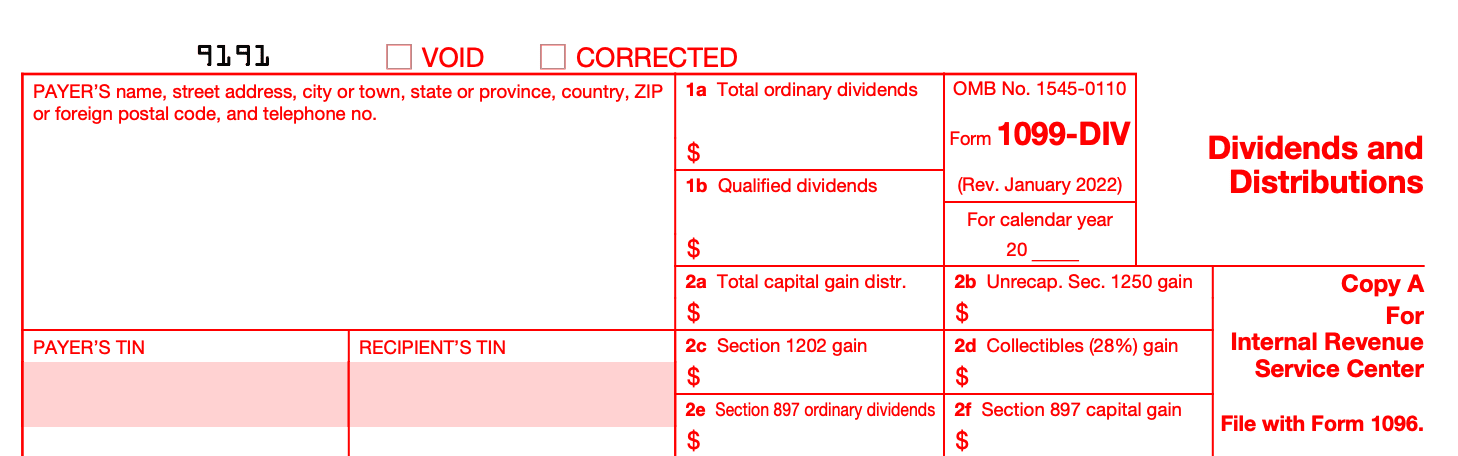

Step 3: Fill out payer information

In the top left corner of the form, enter your business's name, address, and TIN. Use the appropriate boxes for each piece of information.

Step 4: Fill out recipient information

In the middle of the form, enter the recipient's name, address, and TIN. Ensure the information is accurate and matches what you have on file.

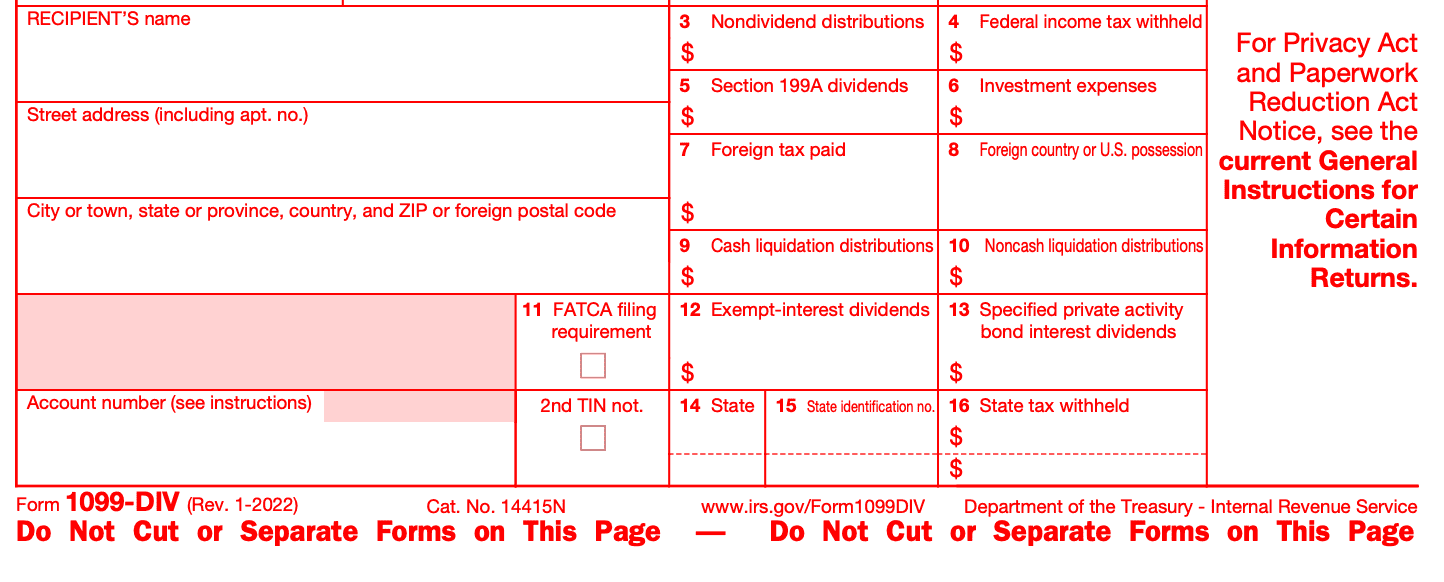

Step 5: Enter dividend and distribution information

Moving down the form, report each dividend or distribution paid to the recipient in the appropriate boxes. The information to be included is as follows:

Box 1a: Total ordinary dividends

Box 1b: Qualified dividends

Box 2a: Total capital gain distributions

Box 2b: Unrecaptured Section 1250 gain

Box 2c: Section 1202 gain

Box 2d: Collectibles (28%) gain

Box 3: Non-dividend distributions

Step 6: Complete Additional Sections (if applicable)

Depending on the specific situation, you may need to complete other sections of Form 1099-DIV, such as reporting exempt-interest dividends or specifying the type of security for certain dividends. Refer to the instructions provided with the form to determine if any additional sections apply to your situation.

Step 7: Review and verify information

Before finalizing the form, carefully review all the information you've entered. Ensure accuracy, completeness, and legibility. Mistakes or omissions could lead to delays or penalties.

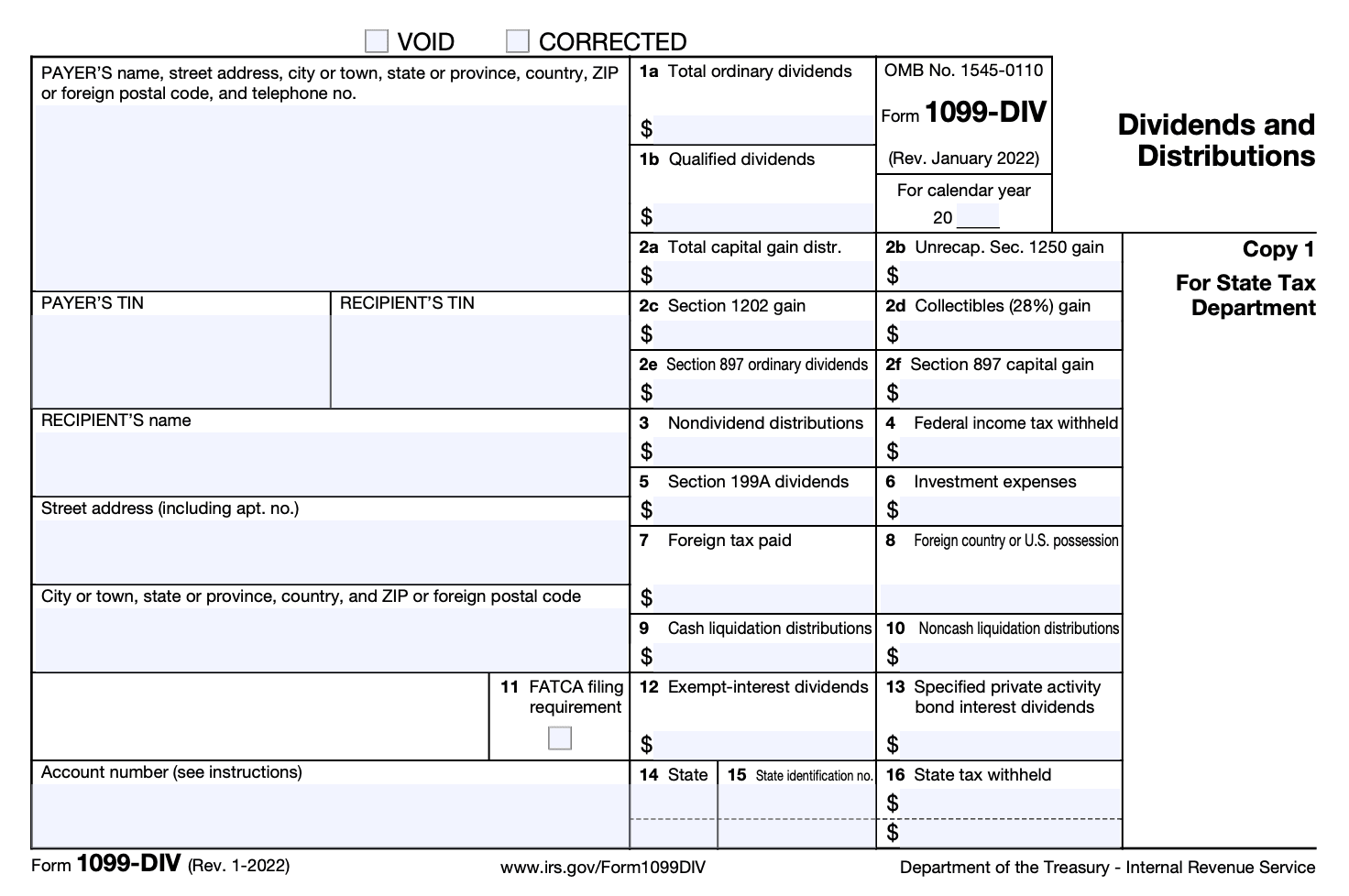

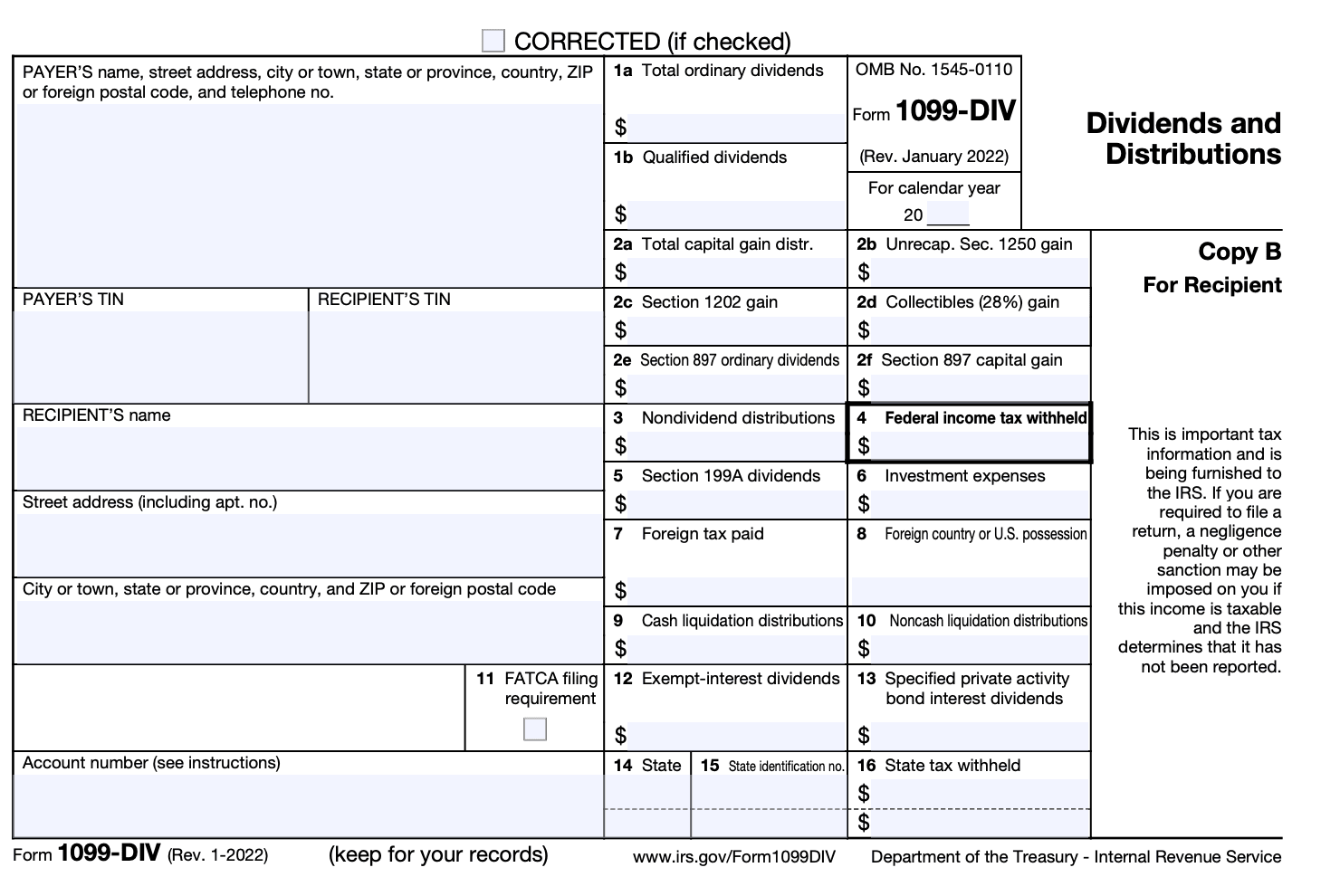

Step 8: Distribute copies

Make copies of Form 1099-DIV for your records, as well as for the recipient and other applicable parties. Furnish Copy B to the recipient by January 31st of the year following the tax year, and submit Copy A to the IRS by the appropriate deadline. Be sure to follow the IRS guidelines for distributing the form and retaining copies.

Step 9: File with the IRS

Submit Form 1099-DIV to the IRS along with Form 1096, which serves as a transmittal form. The filing deadline for paper filing is typically at the end of February, while electronic filing has a deadline at the end of March. Note that these deadlines may change, so refer to the most recent instructions or consult a tax professional to confirm the dates.

Special Considerations When Filing Form 1099-DIV

When filing Form 1099-DIV, which is used to report dividends and distributions, there are several special considerations to keep in mind. Here are some important points to consider:

**Correct identification: **Ensure that you have the correct taxpayer identification number (TIN) for the recipient of the dividend or distribution. This could be an individual's social security number (SSN) or an employer identification number (EIN) for a business.

Reportable dividends: Reportable dividends include ordinary dividends, qualified dividends, and capital gain dividends. Ordinary dividends are typically taxable at the ordinary income tax rates, while qualified dividends may qualify for lower tax rates. Capital gain dividends represent the distribution of long-term capital gains and may also be eligible for preferential tax treatment.

**Foreign accounts and investments: **If you have paid dividends to foreign account holders or if you have investments in foreign corporations, there may be additional reporting requirements. Review the IRS instructions for Form 1099-DIV to determine if you need to report any foreign transactions.

Tax-exempt dividends: Some dividends may be tax-exempt, such as those from municipal bonds or certain mutual funds. These tax-exempt dividends should be reported separately from taxable dividends.

Backup withholding: If backup withholding was applied to any dividends, make sure to report the withheld amount on Form 1099-DIV. Backup withholding is typically required when the recipient's TIN is missing or incorrect, or if the recipient has been notified by the IRS that they are subject to backup withholding.

Timely filing: Form 1099-DIV must be filed with the IRS by the due date, which is typically January 31st of the year following the tax year. It is also important to provide a copy of the form to the recipient by the same due date.

Corrections: If you discover an error on a previously filed Form 1099-DIV, you may need to file a corrected form. Use Form 1099-DIV, Box 6 on the corrected form to indicate the correct amount or classification of the dividend.

Electronic filing: If you are required to file more than 250 Forms 1099-DIV, you must file electronically. Electronic filing is also encouraged for all filers due to its efficiency and accuracy.

Filing Deadlines & Extensions on Form 1099-DIV

The filing deadline for Form 1099-DIV depends on whether you are filing electronically or by mail and whether or not you are filing Copy A with the IRS.

Here are the general deadlines:

Filing deadline for Copy A with the IRS

If you are filing Copy A with the IRS, the deadline is typically February 28th of the year following the tax year. However, if February 28th falls on a weekend or a holiday, the deadline is extended to the next business day.

Filing Deadline for Copy B and Copy 2 to Recipients:

Copy B (for the recipient) and Copy 2 (for the recipient's state tax department, if applicable) should be furnished to the recipients by January 31st of the year following the tax year. Again, if January 31st falls on a weekend or a holiday, the deadline is extended to the next business day.

Electronic Filing Deadline:

If you are filing electronically, you generally have until March 31st of the year following the tax year. This deadline applies to both the filing with the IRS (Copy A) and furnishing copies to the recipients (Copy B and Copy 2).

Extensions

If you need more time to file Form 1099-DIV, you can request an extension. However, it's important to note that an extension of time to file Form 1099-DIV does not extend the deadline for furnishing copies to recipients.

To request an extension for filing Form 1099-DIV, you can file Form 8809, "Application for Extension of Time To File Information Returns," with the IRS. The extension will generally be granted for a maximum of 30 days, and it must be filed by the original due date of the form.

Common Mistakes To Avoid While Filing Form 1099-DIV

Here are some mistakes to watch out for:

Incorrect taxpayer identification number (TIN): Ensure that you have obtained the correct TIN for the recipient of the dividend or distribution. If the TIN is missing or incorrect, it can lead to penalties or processing issues.

**Misclassification of dividends: **Dividends can be classified as qualified or non-qualified, and the tax treatment differs for each. Make sure you correctly classify dividends based on the appropriate criteria to avoid errors in reporting.

Failure to report all dividends and distributions: Ensure that you report all dividends and distributions made during the tax year accurately. Review your records and include all relevant information to avoid underreporting or omitting any transactions.

Incorrect calculation of tax withheld: If tax was withheld on dividends or distributions, ensure that you calculate and report the correct amount. Review your records and cross-check the information provided by the payer to ensure accuracy.

**Late or incomplete filing: **Form 1099-DIV has a specific deadline for filing with the IRS, which is usually at the end of February. Failing to file on time or submitting an incomplete form can result in penalties. Be mindful of the deadline and ensure that all required fields are filled out accurately.

Not providing copies to recipients: Apart from filing with the IRS, you are also required to provide a copy of Form 1099-DIV to the recipient. Failure to provide the recipient with a copy can result in penalties. Make sure to distribute the necessary copies by the deadline.

Incorrect recipient information: Double-check the recipient's name, address, and other identifying information to ensure accuracy. Mistakes in recipient information can cause confusion and delays in processing.

Neglecting to report backup withholding: If backup withholding was applied to the dividends or distributions, it should be reported on Form 1099-DIV. Make sure to include this information to avoid discrepancies with the recipient's tax records.

Conclusion

Form 1099-DIV is a vital document for investors who receive dividends and distributions from their investments. By understanding this form and its contents, you can accurately report your investment income on your tax return, avoiding potential penalties or issues with the IRS.

Always review your Form 1099-DIV carefully and consult with a tax professional if you have any questions or concerns. Being diligent with your reporting will ensure compliance with tax regulations and help you make the most of your investment income.