- IRS forms

- Form 1099-A

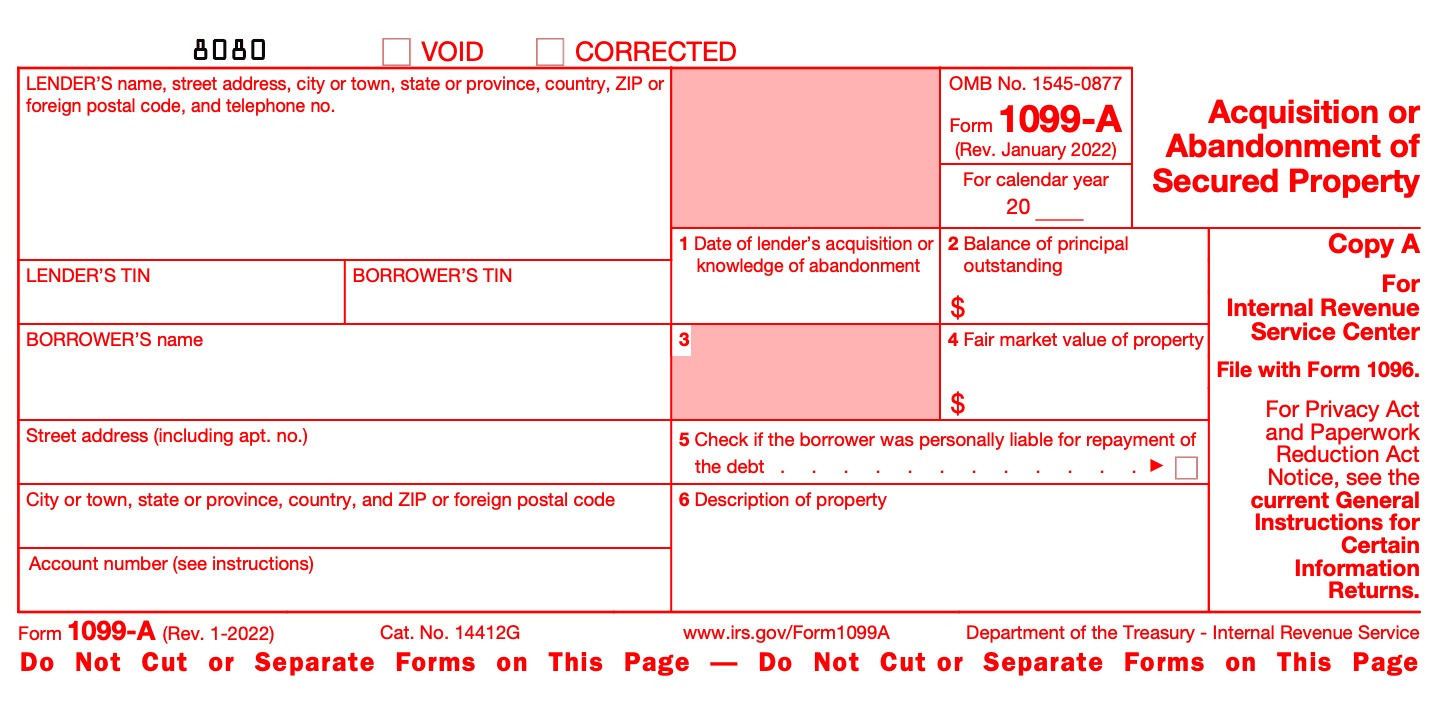

Form 1099-A: Acquisition or Abandonment of Secured Property

Download Form 1099-AWhen it comes to taxes, it's crucial to stay informed about the various forms and documents involved in the process. One such form is the IRS Form 1099-A, which is used to report the acquisition or abandonment of secured property.

Form 1099-A, also known as Acquisition or Abandonment of Secured Property, is an IRS tax form used to report the transfer or abandonment of secured property. It is typically filed by banks, lenders, financial institutions, or other entities that hold a security interest in a property.

If you've recently gone through a foreclosure, had your property repossessed, or abandoned secured property, understanding the basics of Form 1099-A can help you navigate the tax implications associated with such events. In this blog post, we'll delve into the details of Form 1099-A and shed light on its significance.

Purpose of Form 1099-A

The form is typically used by lenders or financial institutions when they have taken over a property due to foreclosure, repossession, or similar circumstances. It is also used when a borrower abandons the property, indicating that they have voluntarily given up ownership and possession of the secured property.

The form reports important details about the property, such as its fair market value (FMV) at the time of acquisition or abandonment, the outstanding loan balance, and the borrower's information. This information is used by the IRS to determine any potential taxable gain or loss resulting from the transaction.

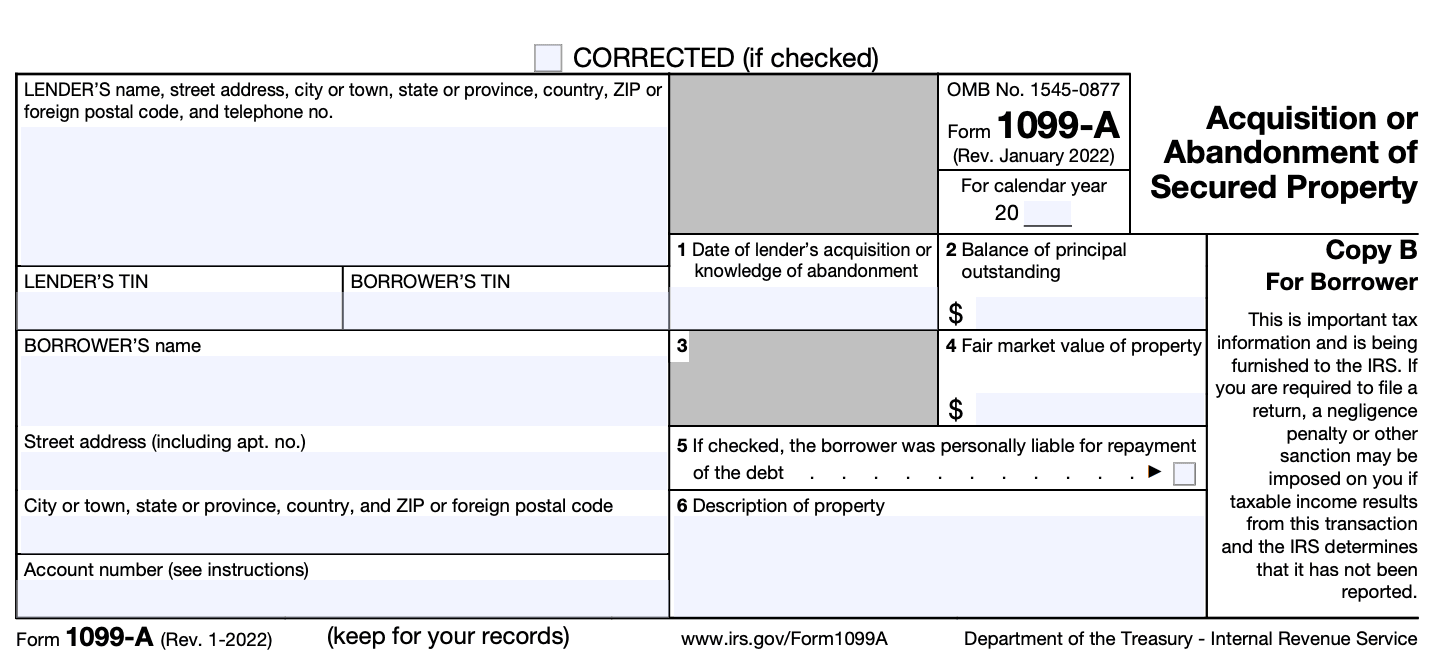

For the borrower, receiving Form 1099-A means that they may have certain tax implications. The borrower should consult with a tax professional to understand how the acquisition or abandonment of the secured property may affect their tax situation. They may need to report the transaction on their tax return and potentially include any applicable gain or loss.

It's important to note that Form 1099-A is separate from Form 1099-C, which is used to report canceled debts. Form 1099-C is issued when a lender forgives or cancels a debt, potentially resulting in taxable income for the borrower. If both forms are received by a taxpayer for the same property, they may need to reconcile the information and properly report it on their tax return.

Benefits of Form 1099-A

While it may not offer direct benefits to the recipient, Form 1099-A serves several purposes and has implications for both the lender and the borrower. Here are some key benefits and considerations related to Form 1099-A:

-

Tax reporting: Form 1099-A provides the necessary information to report the acquisition or abandonment of secured property for tax purposes. It helps lenders, borrowers, and the IRS accurately report the transaction and comply with tax regulations.

-

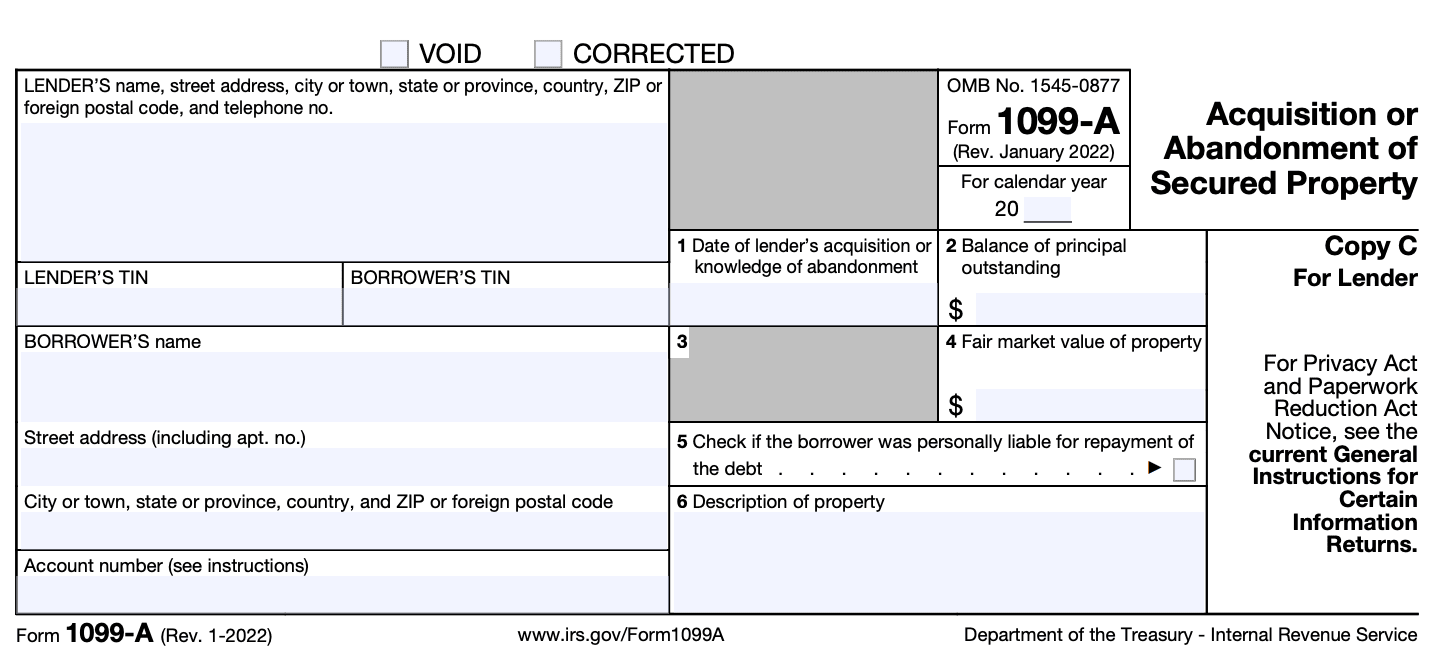

Acquisition of property: If you are the lender, Form 1099-A helps you document the acquisition of the property securing a loan when a borrower defaults. It provides you with relevant details such as the borrower's name, address, and taxpayer identification number (TIN), which can be useful for tracking the transaction and for subsequent tax reporting.

-

Abandonment of property: If a borrower abandons the secured property, Form 1099-A allows you, as the lender, to report the abandonment and potentially claim a tax deduction or loss on the disposition of the property. This can have tax benefits for the lender by offsetting income or reducing taxable gains.

-

Basis and fair market value: Form 1099-A reports the fair market value (FMV) of the property at the time of acquisition or abandonment, as well as the outstanding principal balance of the loan. This information is important for determining the lender's basis in the property and for calculating potential gains or losses on subsequent sales or dispositions.

-

Potential tax consequences: For the borrower, receiving Form 1099-A can have tax implications. The acquisition or abandonment of secured property may result in taxable income or a loss that needs to be reported on the borrower's tax return. It is crucial for borrowers to consult with a tax professional to understand the potential tax consequences of the transaction.

-

Documentation and record-keeping: Form 1099-A provides an official record of the acquisition or abandonment of secured property. It helps both lenders and borrowers maintain accurate records for future reference, potential legal disputes, or audits.

Who Is Eligible To File Form 1099-A?

The following individuals or entities may be eligible to file Form 1099-A:

Lenders: Financial institutions, such as banks, credit unions, or other organizations that lend money and hold a security interest in the property, are typically responsible for filing Form 1099-A.

**Mortgage lenders: **If a mortgage lender forecloses on a property or accepts a deed-in-lieu of foreclosure, they may need to file Form 1099-A to report the acquisition or abandonment of the property.

Government entities: Government agencies that acquire or abandon secured property may also be required to file Form 1099-A.

It's important to note that as an individual taxpayer, you may not typically file Form 1099-A unless you are engaged in the business of lending or are a government entity responsible for the acquisition or abandonment of secured property.

How To Complete Form 1099-A: A Step-by-Step Guide

Completing Form 1099-A, also known as the Acquisition or Abandonment of Secured Property, requires careful attention to detail.Here is a step-by-step guide to completing Form 1099-A:

Step 1: Gather necessary information

Before starting to fill out the form, make sure you have all the relevant information handy. This includes:

- Name, address, and taxpayer identification number (TIN) of the lender or financial institution.

- Name, address, and TIN of the borrower or debtor.

- Description of the property that was acquired or abandoned.

- Dates of the acquisition or abandonment.

- Fair market value (FMV) of the property at the time of acquisition or abandonment.

- Outstanding principal balance of the loan or debt.

Step 2: Obtain the official form

Visit the IRS website (www.irs.gov) and download Form 1099-A. You can search for the form using the website's search feature or look for it in the "Forms and Publications" section.

Step 3: Provide payer and recipient information

In the top left section of Form 1099-A, enter the payer's name, address, and TIN. The payer is typically the lender or financial institution. On the right side, enter the recipient's name, address, and TIN. The recipient is usually the borrower or debtor.

Step 4: Complete the property information

In Part I of the form, provide details about the property that was acquired or abandoned. This includes the property's complete address and a description. Indicate whether the property was acquired or abandoned by checking the appropriate box.

Step 5: Enter the dates

In Part I, indicate the date of the acquisition or abandonment. Use the MM/DD/YYYY format.

Step 6: Report the fair market value

In Part II, report the fair market value (FMV) of the property at the time of the acquisition or abandonment. This should reflect the property's value in its current condition.

Step 7: Provide the loan information

In Part III, report the outstanding principal balance of the loan or debt at the time of the acquisition or abandonment. This amount should include the unpaid principal and any accrued interest or other charges.

Step 8: Review and certify

Double-check all the information you've entered to ensure accuracy. Then, sign and date the form in the appropriate spaces. If you're preparing the form on behalf of a business, include the business name and your title.

Step 9: Distribute copies

Make copies of Form 1099-A for your records, as well as for the recipient and the IRS. Provide the recipient with Copy B, and file Copy A with Form 1096, which is a transmittal form for all 1099 forms being submitted. Send Copy A to the IRS by the due date.

Step 10: Submit to the IRS

Mail Copy A of Form 1099-A, along with Form 1096, to the appropriate IRS address. The address can be found in the instructions for Form 1096. Ensure that you meet the deadline for filing, which is typically by the end of February if filing on paper or by the end of March if filing electronically.

Special Considerations While Filing 1099-A

When filing a 1099-A form, there are several special considerations you should keep in mind. Here are some important points to consider:

**Reporting requirements: **You need to file a 1099-A if you are a financial institution or a lender who has acquired an interest in secured property, such as a foreclosure or repossession.

**Identifying information: **The form requires you to provide the name, address, and taxpayer identification number (TIN) of both the lender and the borrower. Ensure that this information is accurate and up to date.

Property information: You must provide a detailed description of the property that was acquired or abandoned. This includes the address, type of property, and any relevant identifiers (e.g., vehicle identification number for a repossessed car).

**Acquisition date: **Report the date on which the lender acquired the property. This is usually the date of foreclosure or repossession.

Fair market value (FMV): You need to report the fair market value of the property on the date of acquisition. This value represents the amount that could be reasonably expected to be received for the property if sold in an open market.

**Outstanding loan balance: **If there was an outstanding loan on the property at the time of acquisition, report the balance of that loan.

**Discharge of indebtedness: **If there was a discharge of indebtedness as part of the acquisition, you may also need to file a separate 1099-C form to report the cancellation of debt income.

Timely filing: Ensure that you file the 1099-A form by the due date, which is generally January 31 of the year following the acquisition. Provide a copy of the form to the borrower as well.

IRS reporting: The information provided on the 1099-A form will be used by the IRS to track and verify the taxpayer's financial transactions. Ensure accuracy and retain a copy for your records.

Filing Deadlines and Extensions on Form 1099-A

The general deadline for filing Form 1099-A is January 31st of the year following the calendar year in which the acquisition or abandonment occurred. For example, if the acquisition or abandonment took place in 2022, the deadline to file the form would be January 31, 2023.

If you are unable to meet the deadline, you may request an extension by filing Form 8809, Application for Extension of Time to File Information Returns. This form should be filed before the original due date of Form 1099-A. If approved, the extension will give you additional time to submit the required forms.

Keep in mind that an extension of time to file Form 1099-A does not grant an extension for paying any taxes owed. Any tax liability associated with the transaction should be reported and paid according to the appropriate tax rules and deadlines.

Common Mistakes To Avoid When Filing Form 1099-A

Here are some common mistakes to avoid when filing Form 1099-A:

Incorrect or missing taxpayer identification numbers (TIN): Ensure that you accurately report the TINs of the transferor and transferee. The TINs must be verified to prevent any discrepancies.

Failure to report all relevant information: Provide complete and accurate information about the acquisition or abandonment of secured property. Include details such as the date of acquisition or abandonment, the fair market value, and the loan balance outstanding.

Missing or incorrect property description: Include a detailed description of the property acquired or abandoned, including its address, type, and any other relevant information. The description should be clear and specific.

Late or missing filing: Ensure that you file the Form 1099-A by the designated deadline. Missing the deadline or failing to file the form can result in penalties or other consequences.

Failure to furnish a copy to the recipient: After filing Form 1099-A with the IRS, you must also provide a copy to the recipient (the transferor). Failing to furnish a copy to the recipient can lead to penalties.

Incorrect calculations: Double-check all calculations related to fair market value, outstanding loan balances, and other relevant figures. Incorrect calculations can lead to discrepancies and potential issues.

Using an incorrect form: Ensure that you are using the correct form for reporting the acquisition or abandonment of secured property. In this case, Form 1099-A is the appropriate form.

**Not keeping records: **Maintain accurate records of the information reported on Form 1099-A and any supporting documents. This will help you in case of any future inquiries or audits.

Key Takeaways

Form 1099-A plays a significant role in reporting the acquisition or abandonment of secured property. Whether you're a borrower or a lender, understanding the purpose and requirements of this form is crucial to ensuring compliance with tax regulations.

If you find yourself in a situation where Form 1099-A is applicable, consider consulting a tax professional to help you navigate the complex tax implications associated with the form.

Staying informed and properly addressing tax obligations can help you manage the financial consequences of property acquisition or abandonment effectively.