How to Demystify Sole Proprietorship Taxes: Your Guide

These 28M sole proprietorship businesses are taxed differently- no separate filing for business income. This article covers sole proprietorship taxes in detail. Therefore, if you, a sole proprietor, want to know what to file, when, and which benefits you can get, this article is for you.

IRS found that 28 M US-based businesses were registered as sole proprietorships in 2020. To put that figure’s magnitude into perspective, the population of Venezuela was the same in 2013.

These 28M sole proprietorship businesses are taxed differently- no separate filing for business income. Instead, business income is added to owners’ personal income, and owners pay taxes on the total sum. Also, depending on your operation, industry, and other factors, you need to file different forms.

Since sole proprietorship taxes can vary across different businesses, there is no “one-size-fits-all” tax guide available. Because of this perceived lack of “guidance,” new sole proprietors often get confused. Hear this Reddit user for example:

“Hi. Two months ago, I started a sole proprietorship in California and have received wildly different responses (in real life) on how I'm supposed to file taxes now. I'm confused and don't want to mess up. Can anyone link me to a reliable resource or let me know where to look? Or better yet, explain it like I'm five, because I feel like I'm five right now.”

This article covers sole proprietorship taxes in detail. Therefore, if you, a sole proprietor, want to know what to file, when, and which benefits you can get, this article is for you.

Sole proprietorship tax: things to remember

The defining characteristic of sole proprietorship tax is that your business profits ( net income) are reported on your income tax return. IRS calls it “pass-through taxation.” Your business’s tax liability “passes through” your personal income tax return; hence this is the name IRS has picked.

Because of this distinct tax structure, you can expect the following:

- When your business generates profit, IRS views it as the overall growth of your personal income and wealth ( not just higher business income). Thus you can find yourself in a higher income tax slab after a profitable year or two.

- As a sole proprietor, you can claim some deductions based on your business expenses. However, your income tax isn’t a business expense. Yes, one can argue that since higher income tax is the direct result of higher business income, one should be able to report the income tax as a business expense. However, the IRS doesn’t view it that way. Therefore you can’t report income taxes as expenses.

- You can take out a percentage of your business profit to pay off these taxes, but it won’t be considered as a business expense either. In the IRS's book, that’s an owner’s draw, not an expense.

Sole proprietorship tax deductions:

To calculate your payable taxes as a sole proprietor, you need to know two things:

- Your taxable income ( personal income+business net profit) and

- Expenses that you can deduct from your taxable income (“tax write off”s).

Before we move on to tax filing, let’s cover the most common tax write-offs you can get:

Self-employment tax deduction:

Self-employment tax includes two different taxes: Medicare and Social Security taxes. If you are a freelancer, small business owner, or independent contractor, you need to pay this tax.

In case you are wondering, you pay 15.3% of your net earnings: 12.4% for social security and 2.9% for medicare. Employed taxpayers split their social security and medicare taxes in half with their employers as per IRS rules.

However, when you are a self-employed sole proprietor ( you are both employer and employee at the same time), IRS views the employer part of your self-employment taxes as a business expense. Therefore, you can deduct half of your self-employment tax. Use Form 1040 Schedule C to calculate and report this.

Retirement plan contribution deduction:

Your contributions to SEP-IRA, SIMPLE-IRA, and solo 401(k) are deductible. In other words, IRS minus the amount that goes to retirement plans from your total taxable income. It can be a great way to slash some tax amounts.

Interestingly, self-employed individuals also can benefit from investment gains. IRS doesn’t slap a tax on any gains on your retirement plan investments until you withdraw the retirement money years later.

As you have probably expected, IRS has set some limits on how much you can contribute:

- You can contribute up to 25% of net earnings ( limit is $66000) in your solo 401(k) plan.

- You can put a maximum $15000 in your SIMPLE-IRA plan plus either a 2% fixed contribution or a 3% matching contribution. Use Form 1040 Schedule 1 line 15 to report your salary reduction contribution and employee contribution ( if self-employed, you are your own employee).

Startup cost deduction:

Starting a business can cost a serious amount of money. Thankfully, you can deduct certain startup costs as a sole proprietor. These startup costs may include:

- Permit and license costs

- Opening inventory costs

- Advertisement costs

- Office furnishing costs

- Customer survey associated costs

- Travel costs

There is one catch, though: you won't get a huge tax cut. IRS requires you to split your startup expenses and claim deductions over many years, not at once. In case your starting costs are under $50,000 in total, you can deduct $5000 in the first year.

If the starting expenses go beyond $50,000, your first-year deduction lowers by the amount you exceed $50,000. For example, if you spent $53,000, your first-year deduction will be ($5000-$3000)= $2000.

For the remaining amount, you have to amortize. According to IRS rule, you need to divide up your remaining amount and claim your deduction in equal installments over 15 years.

In the previous example, you split up the remaining $51,000 into 15 equal installments of $3400. The year after the starting year onwards, you can claim $3400 deductions every year.

Home office deduction:

Many sole proprietors run their businesses from their homes, especially freelancers and independent contractors. It opens up the perfect opportunity to claim tax off on your home office expenses.

To be able to qualify, your home office must check off two boxes:

- You regularly and exclusively use a part of your home as your office. You should have the proper work set up, and the place should have identifiable boundaries. In other words, if you use your kitchen table as your work desk, IRS would deny any home office deduction. You should even save a few pictures of your home office in case IRS auditors ever knock on your doors.

- Your home must be your primary place of business. You should be carrying out important business operations most of the time from your home office. So if you enjoy working from your favorite co-working space too much, you may miss out on home deductions.

So, what Form should you use when taking home office deductions? It’s Form 8829 along with Schedule C.

Business use of vehicle deductions:

For independent contractors and small business owners who registered themselves as sole proprietors, tax deductions on the basis of business use of personal vehicles can be another opportunity to lower your taxes.

The idea is very simple: If you are using your vehicle for business-related transportation, you can deduct the entire vehicle operational cost. If you use it for both personal trips and business trips, you get to deduct only business-related usage. And yes, IRS may want to verify the deductions you've taken on your tax return. Therefore, you want to keep records to support your claims.

There are two methods for deducting vehicle expenses—choose whichever one results in a lower tax bill:

- The standard mileage rate method: This is straightforward. You just multiply the miles driven for business-related travel in a year by IRS’s standard mileage rate. The standard mileage deduction in 2023 will be $0.655 per mile.

- The actual expense method: As the name suggests, in this method, you add up all the money you spent already to keep your vehicle running. Then you multiply that number by the percentage of your business use. If you use a vehicle only for business use, you can deduct the entire amount.

Some of the costs you can include are:

- Lease payments

- Auto insurance

- Gasoline

- Maintenance (such as oil changes, brake pad replacements, tire rotations)

- New tire purchases

- Title, licensing, and registration fees

- Vehicle depreciation

Now you have remembered, IRS counts a trip as business travel only when the taxpayer must travel away from their primary place of business. That means if you travel to your co-working space from your home, it doesn’t count. However, when you drive to meet your clients, you can register that as a business trip.

Sole proprietors should use Form 1040 Schedule C to report business travel deductions.

Apart from the above-mentioned tax write-offs, you can claim deductions on education, rent, business interests, bank fees, legal fees, etc., depending on your situation.

Nonetheless, you need to keep track of your transactions and records to get maximum tax benefits. Many use Excel sheets for this purpose. But anyone who tried Excel sheets before knows tracking every transaction on an Excel sheet is time-consuming and exhausting.

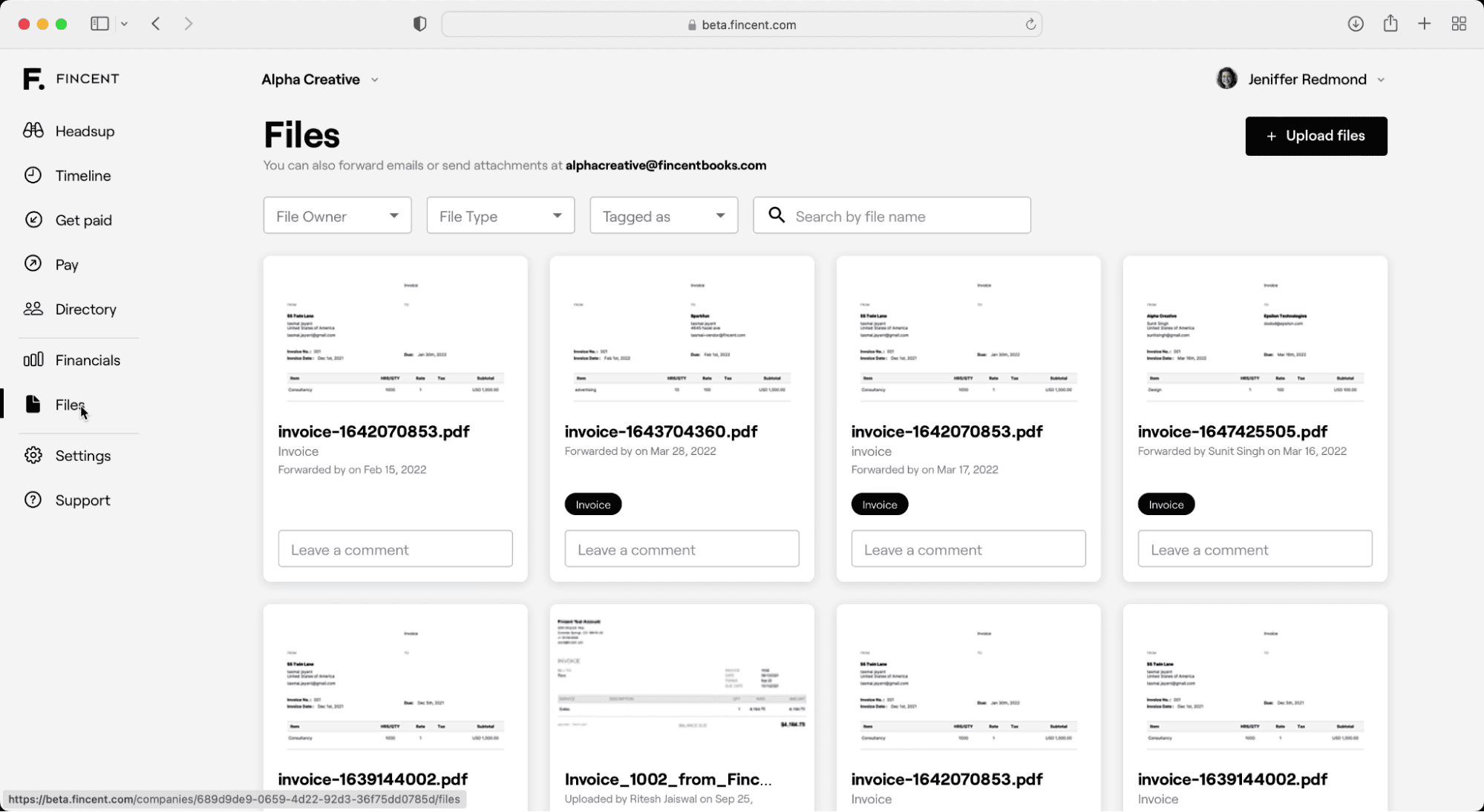

A bookkeeping solution such as Fincent can be a great alternative. Once you connect your business account, Fincent automatically keeps a record of each transaction.

Want to find any transactions or see how much you have spent on advertising in the last 6 months? Just type in the search bar on the Timeline tab, and voila! You have what you are looking for. No need for any mental gymnastics on your part.

Fincent also allows you to save and organize your invoices, receipts, and records.

However, being organized will solve only half of your bookkeeping related ( by extension, tax-related)worries.

IRS tax is a vast subject, and it’s not unusual to end up in situations where you don’t know which way to go. For example, how would you draw the line between “marketing expenses” and “costs of goods sold” if your marketing agency uses old works for promotional purposes?

Or maybe you are just not ready, deadlines are close and you are in panic mode.

In such situations, you need help from professionals. You can always hire a tax professional (and pay a hefty fee).

Alternatively, let Fincent help you here too. Apart from the Bookkeeping solution, we have an army of professional bookkeepers. Once you opt for the “catch up bookkeeping service” , Fincent experts will take 30 days to fix 1 year of books and take care of your tax filings.

Remember those hard-to-navigate situations we mentioned? It’s on us to help you get out of such situations. Do you need any help with filing any tax forms? Support is available all the time.

Sole proprietorship taxes: Forms you need to file

By now, you should have a good idea of what you can deduct from your payable taxes. But which Forms should a sole proprietor file?

Firstly, Form 1040 is a must. This is what you use to report your personal income. Apart from 1040, depending on your business type, operations, and streams of income, you may need to file other forms.

The IRS has prepared a list of tax forms for sole proprietors, which you can check for more info.

Nonetheless, here is a small discussion on the most common sole proprietorship tax forms:

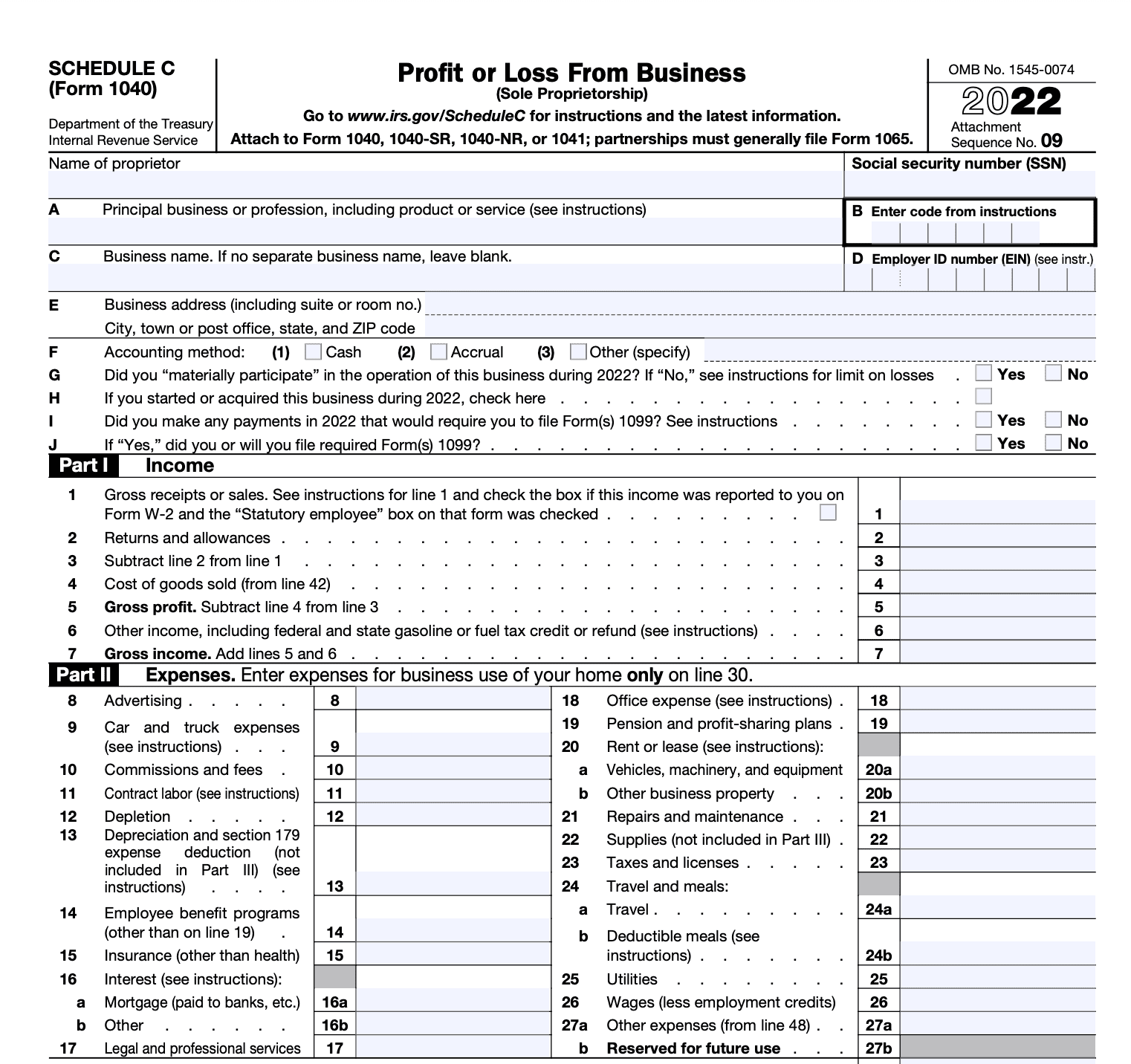

Schedule C:

Along with Form 1040, you need to file Schedule C ( “Profit or Loss from Business”) at the end of the year.

Source:[ IRS Form 1040](https://www.irs.gov/pub/irs-pdf/f1040sc.pdf)

As the name suggests, this form is for reporting your business’s profits and losses. It has five parts asking about your income, expenses, costs of goods sold, information on your vehicle, and other business expenses.

Use your financial statements, invoices, and mileage tracking app info to complete this form. And as we mentioned before, don’t forget to keep proofs.

_Note: If you don’t have a bookkeeper or don’t know how to create income statements, use Fincent. It auto-generates and updates your income statements based on your business account transactions. _

Schedule C also asks a few questions that you should be able to answer:

Accounting method( line F): In the first section, you need to answer which accounting method your business uses. Unless your account says otherwise, mention cash basis as your accounting method.

Material participation( line G): Most sole proprietors actively engage and manage their businesses. Therefore, you want to mark “yes.” However, if you are a consultant or investor, talk to a professional before marking anything.

1099 requirement( line I): Did you hire any freelancer/independent contractor or pay anyone more than $600 in prize? If yes, then you need to file 1099 forms.

You can read our Schedule C guide for an in-depth understanding.

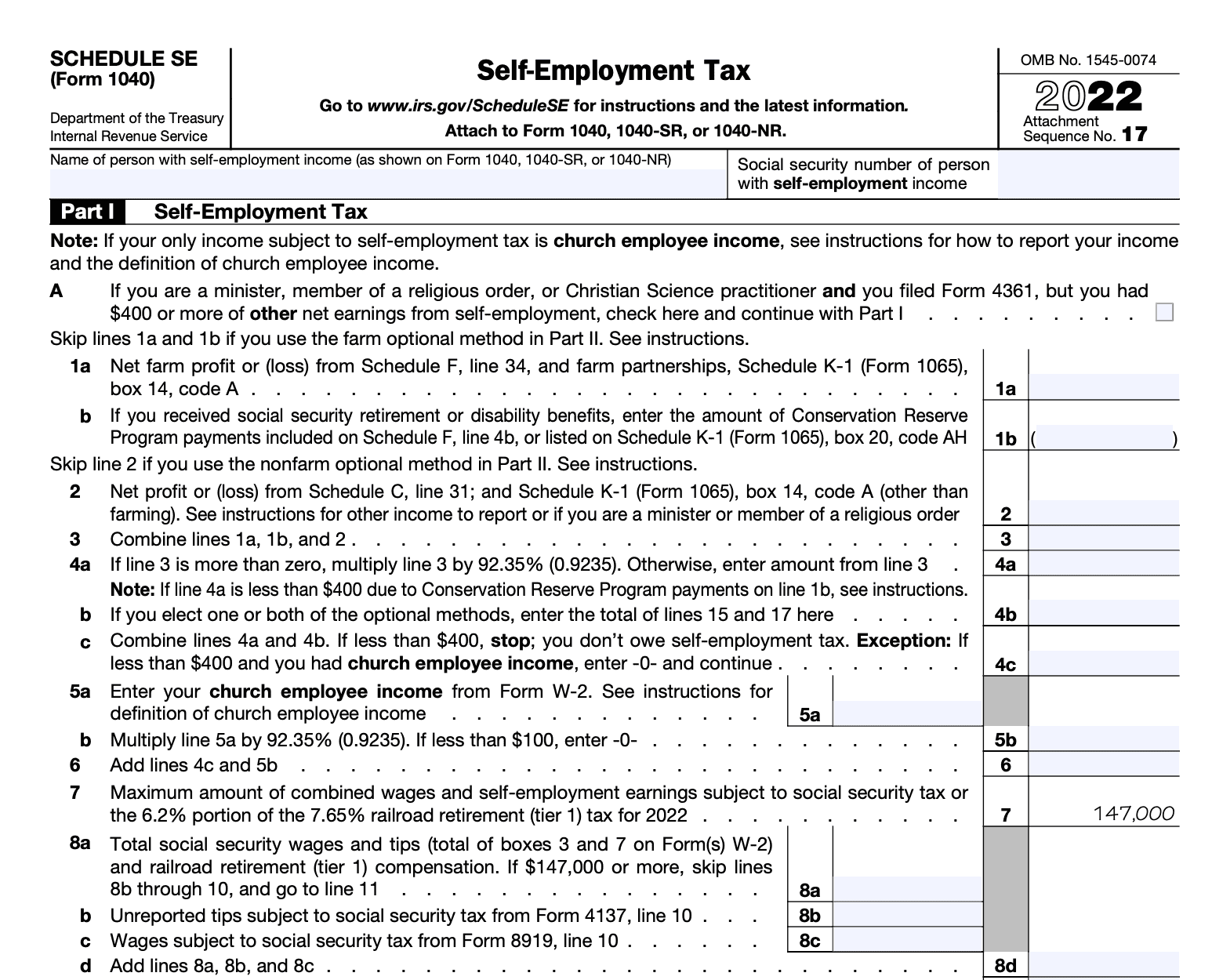

Schedule SE:

IRS requires every sole proprietor to pay his/her Self-employment tax and file a Form Schedule SE. This self-employment tax is the sum of two separate taxes: Social Security tax and Medicare tax.

The current self-employment tax rate is 15.3%. However, as we already discussed, you can get a tax deduction equal to half of the self-employment tax amount.

Source: [IRS Form Schedule SE](https://www.irs.gov/pub/irs-pdf/f1040sse.pdf)

Please note that your self-employment taxes must be paid quarterly based on IRS due dates. However, you are supposed to file your Schedule SE along with Schedule C and Form 1040 annually.

Form 940:

If you hired any employee (full-time, part-time, or temporary) in a financial year and paid $1500 or more in wages, you are liable to pay Federal Unemployment tax. You need to file Form 940 to report it.

Form 1099:

Different 1099 forms cover different aspects of non-employee compensation. For instance, you must file a 1099 NEC if you hire freelancers. 1099-MISC is for reporting any royalties, awards, or rent you paid. There are other forms, such as 1099-K, 1099-DIV, etc. If you match any 1099 form requirements, you need to file that specific 1099 form(s).

When should you file your sole proprietorship taxes?

Deadlines for your sole proprietorship taxes depend on the specific taxes. Some returns, like Form 1040 and Schedule C, must be filed annually. On the other hand, other forms, like Form 941 ( payroll taxes), must be filed quarterly.

Please note, since sole proprietorship businesses are not viewed as a separate entity, you must file all the business taxes before your income tax deadline. Usually, the income tax deadline is April 15. However, if you file for an extension and get it, then your new deadline will be October 15.

Also, some taxes are meant to be paid quarterly ( like self-employment tax). Keep in mind that if you don’t pay those taxes in time, penalties will wait for you.

Conclusion:

As a sole proprietor, you need to file several business and self-employment taxes along with the income tax. You can get significant deductions when filed correctly. We have already discussed how Fincent application and Fincent catchup bookkeeping services can help with your taxes and books.

Related articles

Manual vs Automated Expense Tracking: What’s Better for Your Small Business

Read about the difference between manual and automated business expense tracking and see what your business needs.

Read moreWhat is Transaction Auto-Categorization? How Does Fincent’s Auto-Categorization Feature Work?

Read how transaction auto-categorization helps you understand your finances better and how Fincent is using AI to improve the process.

Read more