Form 5329: A Guide to Additional Taxes on Qualified Plans and IRAs

Form 5329 is an essential IRS document used to report and calculate additional taxes on certain tax-favored accounts, such as IRAs, HSAs, and retirement plans. The form addresses penalties for early withdrawals, excess contributions, or missed required minimum distributions (RMDs). It consists of nine parts, each focusing on specific penalties related to tax-favored accounts. Understanding and filing Form 5329 accurately can help taxpayers avoid hefty penalties and ensure compliance with IRS regulations, safeguarding their financial health and retirement savings.

Every Form issued by the US government has a certain purpose and the Form 5329 is no different from that.

Form 5392 is a critical document for all those taxpayers who come across penalties for accounts that are at an advantage. These accounts often include Health Saving Accounts, IRA 401, and the Coverdell Education Savings Account. This Form is to be filled out when there are extra taxes that need to be paid when the guidelines are not followed.

What is IRS Form 5392?

The IRS Form 5392 is used to report and calculate extra taxes on certain types of accounts. These accounts are tax-favored accounts or retirement plan accounts. One needs to fill out this form when there are any errors or miscalculations at the time of contribution, distribution, or withdrawal from these accounts. This Form is to be ideally submitted along with Form 1040 while filing out the taxes.

What are the reasons why an individual needs to fill out Form 5329?

Any early withdrawal from an IRA account or other accounts that are qualified for a retirement plan. There can even be excess contribution to an IRA or an HSA account which can be a trigger to fill out this form or it can even be the failure to take out the minimum or required amount for distribution. Failing to fill out Form 5392 can lead to extra penalties and additional interest charges that can accumulate and have a financial impact.

Who is eligible to fill out Form 5329?

All those individuals who have a retirement plan are not required to fill out this form. Only those individuals are liable to fill out this form.

Early Distributions

Those individuals who have taken money from a retirement account such as IRA, 401(k), 403(b) and have removed some funds from their respective accounts before reaching the age. Before completing 60 years and hitting their retirement period they have removed the money from their account and such individuals ideally have to pay a 10% penalty fee for removing the money before time. This penalty needs to be reported on Form 5392 however there are certain criteria in which there are expectations for the Penalty such as medical expenses for purchasing a home for the first time or other expenses such as educational expenses.

Excess Contributions

This field mainly refers to the 6% penalty when an individual has contributed much more than what is required to their IRA, or HSA account than the criteria required by the IRA. Then a 6% penalty is levied on the individuals.

Missing Out on RMD

Missing out on required minimum distributions and individuals who qualify for these criteria are required to withdraw a certain amount from their retirement accounts such as the IRA, or 401(k) and if individuals fail to take the RMD then they are subjected to a hefty penalty of 25%. If the individual wants they can get this opportunity waived by giving a reasonable explanation for missing out on the RMD.

Other Situations

There are other situations as well where Form 5329 is required to be filled as in receiving taxable distribution from different educational institutes such as Coverdell ESA.

Let's breakdown the Form 5329 and go through each section

The Form 5329 consists of many parts and to be precise it consists of 9 parts. These 9 parts focus on different types of additional tax which are related to retirement plans and other accounts which are tax-favored.

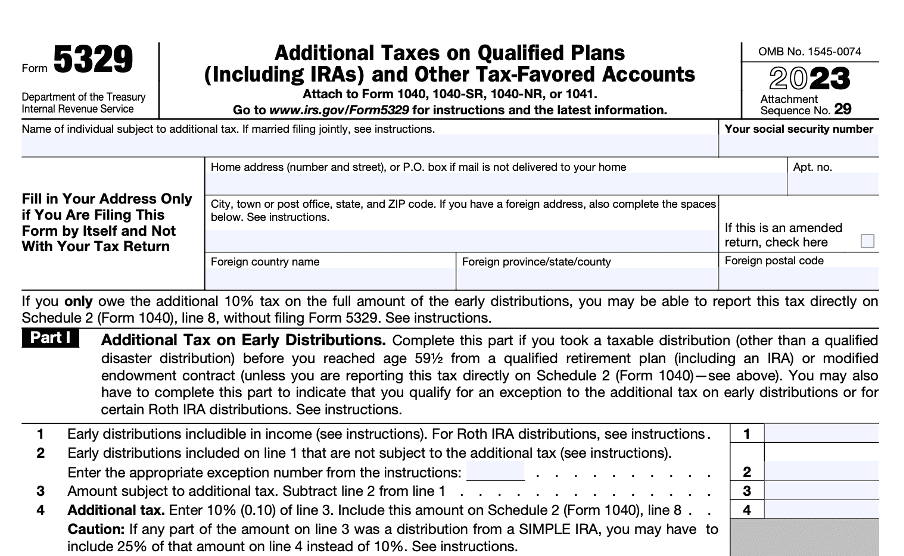

Part I: Taxes on Early Distributions

This section is for all those individuals who have withdrawn their money before the time is due. You will report the entire amount removed and compute any additional tax owed. If you qualify for a penalty exemption (for example, medical expenditures, a handicap, or a first-time home purchase), utilize this area to file your claim. The exclusions might help you avoid paying the whole 10% penalty.

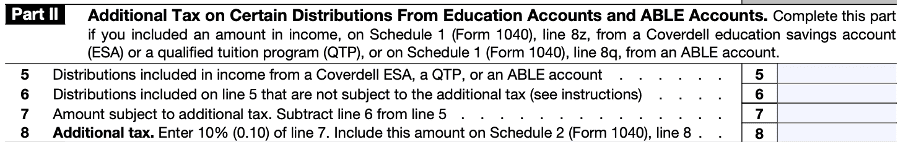

Part II: Additional Tax on Certain Tax-Favored Accounts

This section applies if you donated more than the IRS-allowable amount to a tax-favored account, such as an HSA or ESA. Excess contributions are subject to a 6% excise tax for each year that they stay in the account. In this part, you will determine the penalty depending on the excess amount.

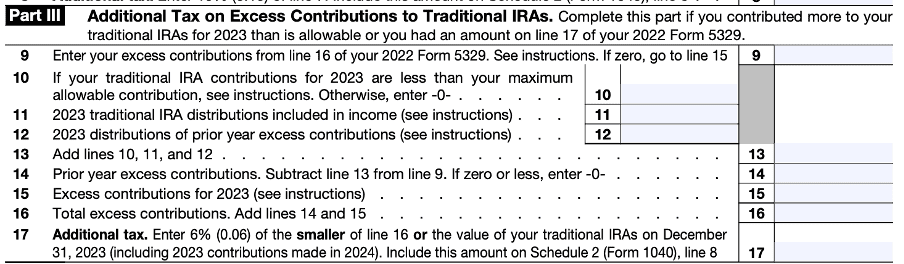

Part III: Additional Tax on Excess Contributions to Traditional IRAs

If you have contributed more than the limit to a conventional IRA, you have to disclose the remainder and pay the 6% penalty tax. This section is used to calculate the extra tax for the year. Excess contributions that are not addressed by the last filing date may result in an annual penalty until resolved.

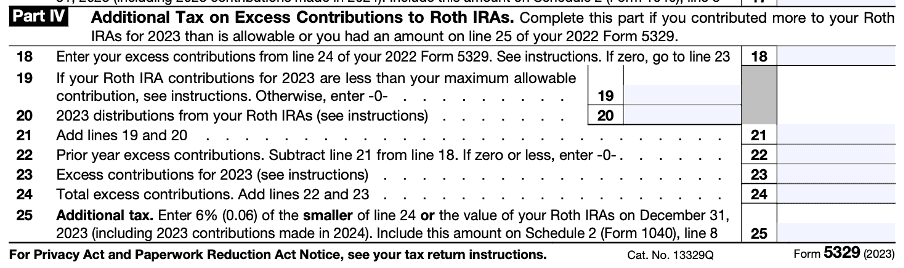

Part IV: Additional Tax on Excess Contributions to Roth IRAs

Excess contributions to Roth IRAs, like standard IRAs, must be disclosed and are subject to a 6% excise tax. In this section, you'll calculate the penalty for making excessive Roth IRA contributions.

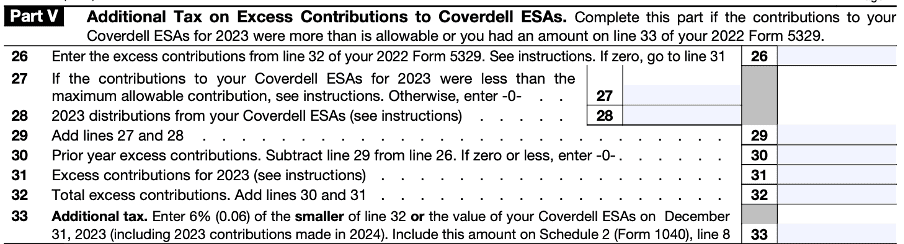

Part V: Additional Tax on Excess Contributions to Coverdell ESAs

Coverdell ESAs are educational savings accounts with contribution limitations. Contributions that exceed the maximum allowed are subject to the 6% penalty stated in this section.

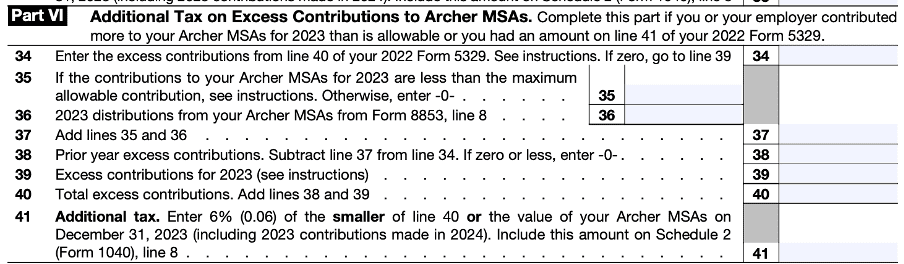

Part VI: Additional Tax on Excess Contributions to Archer MSAs

If you or your employer contributed too much to an Archer MSA, this part is used to calculate the excise tax owed on the excess contributions.

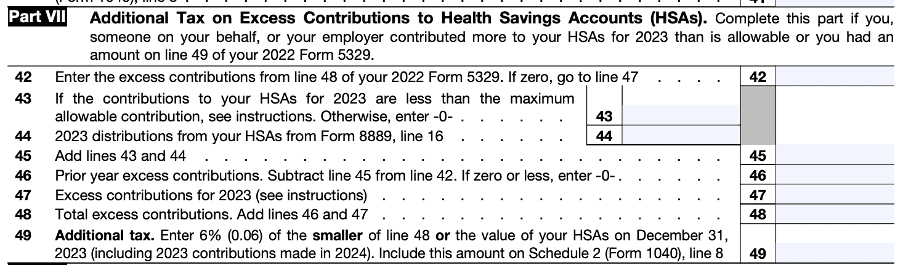

Part VII: Additional Tax on Excess Contributions to Health Savings Accounts (HSAs)

Contributions to an HSA above the annual limit set by the IRS are subject to a 6% excise tax. This part helps you calculate that tax.

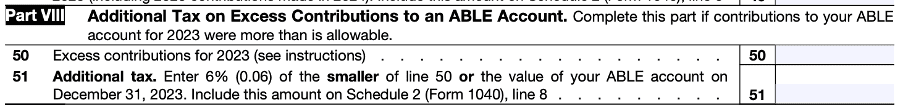

Part VIII: Additional Tax on Excess Accumulation in Qualified Retirement Plans (including IRAs)

If you didn’t take your RMD by the required deadline, the IRS imposes a 25% penalty on the amount you should have withdrawn. For those individuals as of 2023 who have filled out the form correctly, the penalty can be reduced if it is filled in a timely manner.

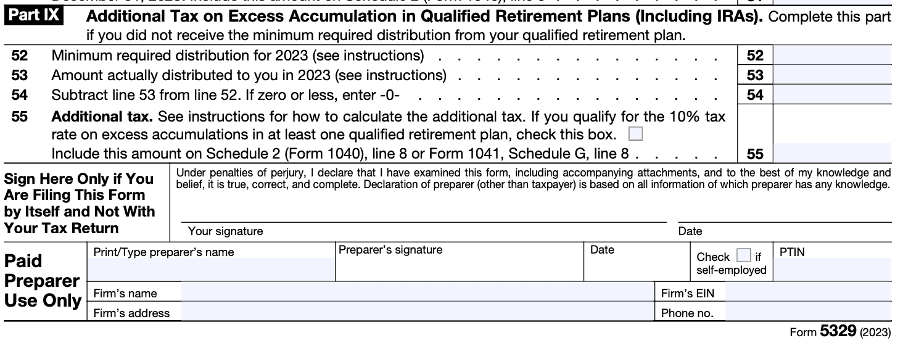

Part IX: Tax Waiver for Excess Accumulation in Qualified Retirement Plans

If you missed an RMD owing to an acceptable reason (such as sickness or an accounting error), you may apply for a penalty waiver under this section. Attach an explanation for why you missed the distribution and how you corrected it.

What are the reasons for Form 5329 and how can one avoid penalties in the future?

There are many reasons why one has to fill out Form 5329 can be early withdrawal. Withdrawing early from their retirement account 401(k) and other retirement accounts before the age of 60 without qualifying for it can result in a 10% penalty on it. One can fill out the form 5329 and ensure it is submitted before the deadline. To avoid penalties one can track distributions and contributions carefully and plan their withdrawal wisely.

Conclusion

Form 5329 is required to be filled by anybody facing penalties related to qualified retirement funds and other tax-favored accounts. Knowing when and how to file it will help anyone avoid penalties which can be expensive. Understanding the needs and requirements of Form 5329 will help one understand the depth of retirement account taxes and keep your finances and taxes in place.

Related articles

A Guide to W2 & W4 Forms For Your Small Business

Here is a simple breakdown of IRS forms W2 and W4. The article explains how to use them and why they are important for your small business.

Read more