1099 Forms for Freelancers and Small Business Owners

If you are already part of this gig economy as a freelancer, consultant or small business owner, you must file 1099 forms. However, 1099 forms are still shrouded in mystery for many new gig workers and business owners.

In 2021, 47 million Americans decided to put an end to their W2 lives and part ways with their employers. With so much news of mass layoffs floating around, it’s not very surprising.

Interestingly this great resignation fuels the rise of new businesses. During the Jan 21-Nov 21 periods, the number of registered businesses [surged 55% ] higher than that of 2019. With more registered businesses, the number of 1099-K forms filings also spiked by 33%.

It implies one thing: The gig economy is on the rise. [41% of US adults ] are already dependent on side gig income, and most likely, more will follow.

If you are already part of this gig economy as a freelancer, consultant or small business owner, you must file 1099 forms. However, 1099 forms are still shrouded in mystery for many new gig workers and business owners.

This article is for fixing that knowledge gap. Read on to uncover what 1099 forms entail, how these are different from other forms and what best practices are.

What is a 1099 form:

Freelancers, consultants and some service-based business owners don’t have employee-employer relationships with their clients. So your clients can’t handle taxes against your service charges in the same way they handle taxes incurred on their employees' salaries.

That’s where 1099 forms come in. These are a collection of tax forms for documenting all the income you received from your clients or other non-employer entities. Interest from your bank, rent you received from tenants, earning from freelance work/ services– every cent you earn( over taxable income cutoff) from non-employer sources should be mentioned in 1099 forms.

Usually, 1099 issuers send two copies of 1099 forms: one to the freelancers/ service business owners and another one to the IRS.

Here is something important: As an independent contractor, you are not the one responsible for 1099 tax payments. 1099 forms are for providing information to the IRS. Once received, the IRS compares the information provided in your 1099 forms with your 1040 (the tax form for personal federal income tax returns) and other forms.

Types of 1099 forms

From non-employee compensation to the cancellation of any Debt, IRS has introduced 1099 forms for almost every possible income generated from non-employer entities.

Here are brief introductions of the most commonly used 1099 forms.

1099 NEC

1099-NEC was reintroduced in 2020 to report any non-employee compensation. This is the most common 1099 Form you would encounter as a freelancer or a small business owner.

According to 1099 NEC guidelines, if your clients have paid $600 or more to any independent contractors( freelancers, for example), they need to file for 1099 NEC. Automatically, you will receive a copy of that 1099 form too. If you have multiple clients, you will receive an equal number of 1099 NECs.

On the other hand, If you hire contractors and freelancers, first, you need to collect their names, addresses and TIN ( most like their social security number) using a W-9 form. During the 1099-NEC tax filing, put those details in the form and send them a copy.

Due date of mailing 1099 NEC to recipients: 31st Jan 2023

IRS due date for e-filing: 31st Jan 2023

1099 MISC

1099 NEC covers regular or one-time payments you receive for your services as a freelancer or business owner.

However, you might have other sources of income, such as royalties, prizes, awards and rents. 1099 MISC is for such categories of non-employee payment.

When it comes to receiving a 1099 MISC from a business, either of these conditions must meet:

- If they paid you more than $10 in royalties.

- If you sold $5,000 worth of consumer products not in a permanent retail location.

On the flip side, if you awarded cash prizes, hired legal consultants, purchased fish for resale and rented an apartment, a 1099-MISC form is a must. You also need to file in case of withholding any federal taxes.

Nonetheless, to complete your 1099-MISC, the following details are required:

- Payer’s information, including name, address, and taxpayer identification number (TIN).

- Recipient’s information, including name, address, and TIN.

- The amount of payment.

- Any federal or state income tax withheld.

Due date of mailing 1099 MISC to recipients: 31st Jan 2023

IRS due date for e-filing: 31st March 2023

1099 K

When you are on a freelance marketplace ( Fiverr, Upwork) looking for the next lucrative gig or selling your products on Amazon, you get paid through debit card/credit card payments. You receive money once the platform processes those card payments and sends them to you. IRS considers such freelance marketplaces, payment processing platforms ( Paypal, Stripe) and marketing sites ( Amazon) as payment settlement entities. And these entities are legally bound to file a 1099 K if a consultant or business owner receives gross card payments of $600 or more on the platform.

Therefore, you might receive a 1099 K Form from these payment settlement organizations.

On the other hand, if you have hired freelancers on those platforms, you have good news. Since it’s the platform’s responsibility to file 1000 Ks, you have one less form to fill out.

Note: Sometimes, payment services like Paypal mistakenly report cash gifts( which are tax-free) you receive in the 1099-K forms. Once submitted, even the IRS can’t reverse the mistakes.

So, compare reports received from Paypal with your own book records. If there is any inconsistency, reach out to their customer service.

1099 DIV

You might have stock, bonds and real estate investments for steady passive income. IRS made it clear that you must submit the details of that passive income through another informational gain form–1099 DIV.

Banks or other financial institutions send these 1099-Div forms to investors after paying dividends during a calendar year.

As an Investor, you might receive multiple forms for every dividend of more than $10.

Please note, apart from these four forms, there are other variations of 1099 forms such as 1099-INT, 1099-R, 1099-S and so on.

1099-Forms: Mistakes to avoid

Not understanding your 1099 forms enough.

Most freelancers and small business owners don’t start with basic tax knowledge. To be honest, that’s not the smartest thing to do.

Why?

First of all, this lack of basic knowledge led to a lot of confusion:

“Do I need to do a 1099 K if I am just an occasional freelancer who gets paid via PayPal, not a full-time one?”

“ I use my personal phone for my business. Should I mention it as a business expense?”

“Freelancer I hired used the word “company” on his card. Do I need to file a 1099 NEC?”

Most of us do taxes when the deadlines are close. You don’t want that extra confusion at the eleventh hour.

Secondly, you might miss a certain form, report your income incorrectly and mix up your personal expenses with business ones, all of which might get you slapped with a hefty fine. For example, you didn’t file 1099 NEC because you haven’t received it from your client. And you thought you didn't have to mention it on your 1040, either. Suddenly, the IRS owes you a fine.

That’s why you must have the bare minimum of tax knowledge. You can always hire professionals. But if you lose records, for example, they might not be able to help that much. You have to accept that while the gig economy offers some flexibility, it also increases your responsibilities.

Not keeping track of your business expenses.

While calculating your payable tax amount, the IRS leaves out your business expenses. Luckily, As a freelancer or a small service-based business owner, you have some degree of flexibility in how you define your business expenses.

For example, you can record your fuel expenses as business expenses whenever you use your car to drive to your client’s office. A full-time employee, on the other hand, can’t request any tax deduction based on how much he/she paid for commuting to the workplace.

You can also depreciate your equipment, such as furniture, laptop, machinery etc. and slash your taxes by a few hundred dollars.

Long story short, learn what you can register as business expenses, keep records and save taxes on your 1099 Forms.

Not keeping records and proof of expenses.

You can’t do your taxes right or deduct all of your allowable business expenses unless you are keeping your books. How can you, for example, submit your fuel costs if you don’t have how much you spent during your tours from home to the client’s office? Or if you don’t have proof, there is no way you can’t stop Paypal that the cash you received from your friend is a gift (non-taxable).

Not to mention, the IRS wants taxpayers to save all the receipts. Apart from invoices and other obvious documents, as an independent contractor, you also want to keep your car expense receipts, meal expenses ( business lunches ), and home office expense proofs. Often, these are areas the IRS pays special attention to during audits.

Now, keeping records of every little thing on Excel sheets is daunting. However, a bookkeeping solution such as Fincent can make it much easier. This application directly connects to your business bank account and fetches your transactions on the dashboard.

Go to the “Timeline” tab to see the detailed list of every transaction, income, and expense. You can easily dig up your old records by setting your filters.

Here is what it looks like:

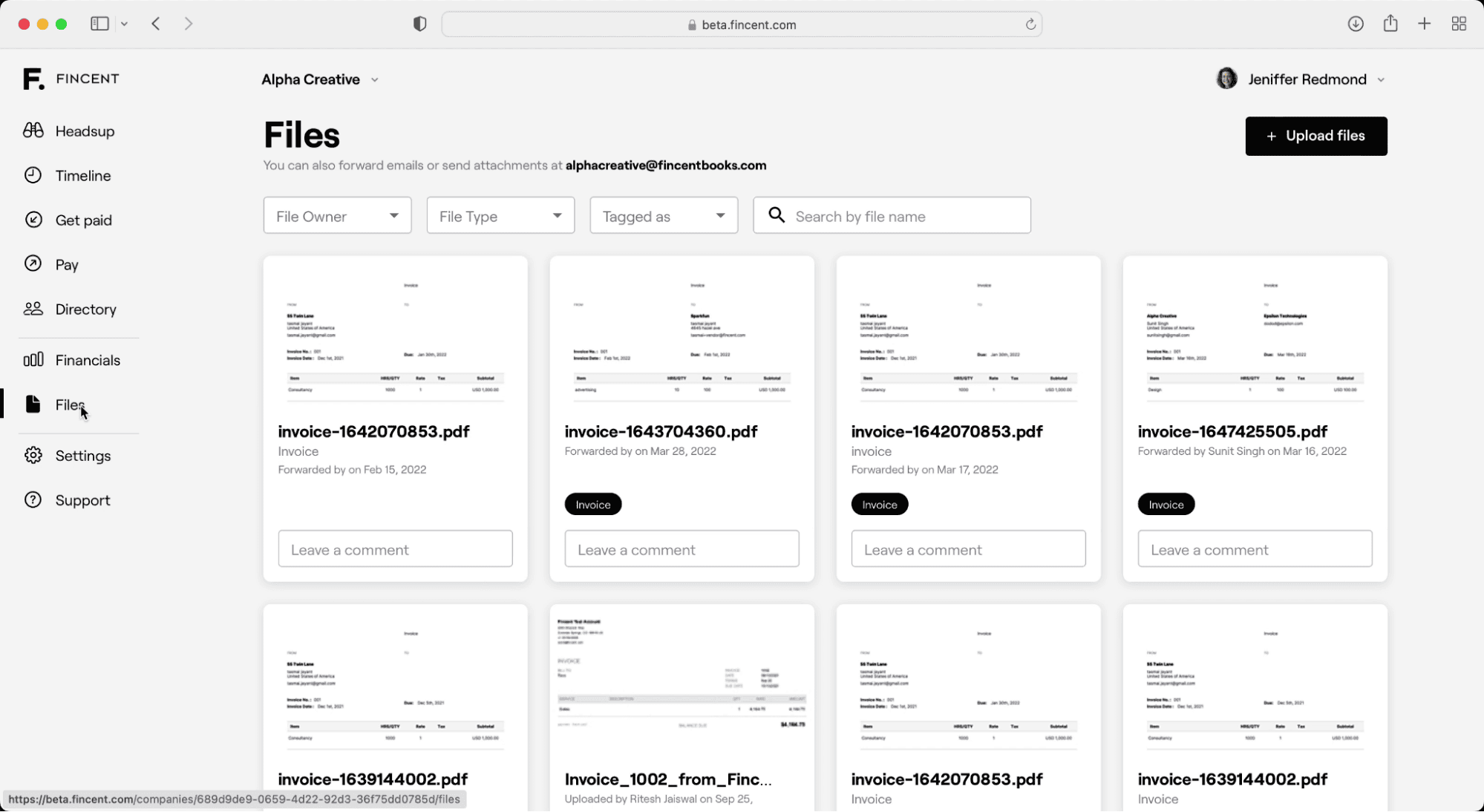

Moreover, Fincent allows you to save and keep your receipts organized.

Just go to the “File” tab to find your receipts. You can look up the right one using tags, file type or even direct search.

Not matching your reported income with your tax document

Independent contractors receive 1099-NEC and 1099-MISC from the businesses that hire them. Depending on your personal revenue sources, you might also receive another 1099 from other entities ( for example, 1099 K from payment settlement entities such as Amazon).

Nonetheless, the IRS is supposed to receive two copies of the same 1099 forms: 1.) 1099 copy from your client/customer/bank/ other entities 2.) Independent contractor copy from you.

It’s crucial that all the parties are on the same page before the final submission:

- Check with your client/customer/other issuing parties to make sure records on both sides match. If there is any discrepancy, immediately contact the issuing party.

- If you haven’t received your 1099 forms, reach out to your client for those.

- Some 1099 forms are required to be sent by mail. In some cases, the arrival of those forms can get delayed. In such situations, you must provide your income details using the 1040 form.

- Your non-employer income information should be congruent with your income tax file (1040 form).

Failing to report your income or submitting wrong info are the surefire ways to get fined or even audited. It’s your responsibility to confirm that your records are correct and the IRS receives the correct info.

Not understanding what the IRS considers as a hobby, not a business:

Most everyone has a side income or two. But that doesn’t mean the IRS considers your side income stream as a business.

Here are some factors the IRS takes into account before considering an activity as a business:

- Do time and effort you put into your side hustle show you have a serious intention of making a profit?

- Do you depend on the income that said activity generates for your living?

- Do you take steps to make your side income source more profitable?

- Does your activity make some [profit] (https://fincent.com/glossary/profit) in some years?

- Do you operate in a business-like manner and keep proper records?

Also, IRS usually considers an activity as a business if it has made a profit in the last three out of five years.

But what is the problem if your side income activity is not a business by IRS’s definition?

Well, in that case, you won't be able to get any tax benefits based on your business expenses. So indirectly, you have to pay more taxes.

So, if you want benefits, try to make your side hustle profitable and consistent. And in case you fail to generate profit, for now, you better have evidence of its future potential.

Conclusion

If you are a freelancer, consultant, or small business owner, having the basic knowledge of 1099 forms is a must. Each of these forms serves slightly different purposes.

Don’t forget to keep records and grab maximum tax benefits to do your taxes right. However, if you feel taxes are overwhelming, Fincent has a solution- personalized tax services for Fincent users. The idea is: do a flawless job with your bookkeeping using Fincent and then let Fincent tax experts do the heavy lifting for an added small fee.

Related articles

Form 8912: Credit to Holders of Tax Credit Bonds

Form 8912 is designed for taxpayers to claim credits for holding qualified tax credit bonds, such as clean energy, school construction, or other infrastructure-focused bonds. These bonds help fund essential public projects, promoting advancements in renewable energy, education, and community development. By filing Form 8912, taxpayers can reduce their tax liability while supporting government-backed initiatives aimed at building a sustainable and equitable future. This form not only provides a financial benefit but also encourages investment in projects that have a lasting positive impact on society.

Read moreHow To Prevent Penalties for 4th Quarter Estimated Tax Payments

Timely 4th quarter estimated tax payments are crucial to avoid penalties and maintain financial stability. Understanding criteria, accurate calculations, and prompt payments are key for individuals with irregular income.

Read more