- Glossary

- Marginal Tax Rate

Marginal Tax Rate

The marginal tax rate is the tax rate you pay on every dollar of increased income. Individuals' federal marginal tax rate in the United States grows as their income rises. As a result, your marginal tax rate is almost certainly lower than your tax bracket.

This system of taxation, known as progressive taxation, seeks to tax individuals based on their wages, with lower-income earners paying less tax than higher-income earners.

Understanding Marginal Tax Rate

A marginal tax rate divides taxpayers into tax brackets or ranges, which decide the rate applied to the tax filer's taxable income. As one's income rises, the last dollar earned is taxed at a greater rate than the first. In other words, the first dollar earned is taxed at the lowest tax bracket rate, the final dollar earned is taxed at the highest bracket rate for that total income, and everything in between is taxed at the rate for the range into which it falls.

New tax rules can alter marginal tax rates. With the passing of the Tax Cuts and Jobs Act (TCJA), the current marginal tax rates became effective in the United States on January 1, 2018. The previous law established seven brackets: 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.The revised plan, which was enacted into law in December 2017, maintains the seven bracket structure. However, changes were made to the tax rates and income levels.

Advantages and Disadvantages of Marginal Tax Rate

Advantages

- The tax burden is shifted to those with higher incomes.

- Protects the taxpayer by lowering the tax when income falls.

- Governments benefit more from marginal taxation.

Disadvantages

- Increased income attracts greater taxes, discouraging business expansion.

- It is unconstitutional since it does not treat all citizens equally.

- The country's highest-earning people may flee to avoid paying higher taxes.

How To Calculate Marginal Tax Rate

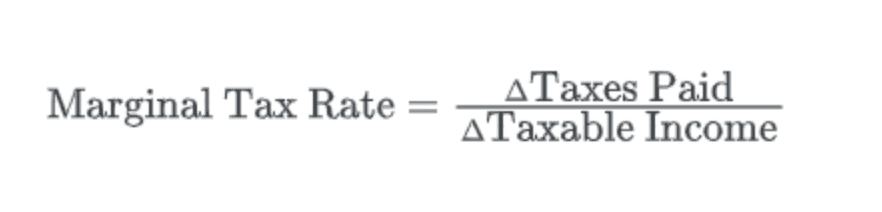

The marginal tax rate is calculated by taking the change in taxes paid and dividing it by the change in taxable income. This enables firms and people to understand how their charges fluctuate as their revenue varies.

Delta is the name given to the triangle symbol in the formula below. It means to change, therefore it means to only use the quantity that differs from the original.

Calculating the marginal tax rate is beneficial. However, in most circumstances, if you pay a marginal tax rate, it is public information. Understanding this is especially crucial for the United States, as it is one of the few developed countries that requires its citizens to manually submit their taxes. In many European countries, the government has a mechanism in place that allows residents to file them for free.

Key Takeaways

A marginal tax rate is a tax increase for earning an additional dollar. The income tax system in the United States has a progressive marginal tax rate based on set income brackets.

The average tax rate is the total of many marginal tax rates. It is derived by dividing total income by total taxes paid. The marginal tax is computed by dividing the change in taxes by the change in income.