- Glossary

- Incremental Tax

Incremental Tax

A tax rate that changes depending on the amount of income reported is called an incremental tax. This typically indicates that the tax rate rises in proportion to the degree of declared income. The purpose of this kind of tax is to lessen the tax burden on persons with lower incomes and enterprises.

Incremental taxes have the drawback of potentially rendering investments unprofitable if the subsequent income places a company in a higher tax category. At the higher incremental tax levels, investors may choose to switch to tax-free investments (like municipal bonds) rather than pay the higher tax rates. Extreme tax avoidance tends to be encouraged by very high additional tax rates.

How Incremental Tax Works

People are subject to various rates of taxation under incremental tax systems. Thus, incremental tax is also known as a progressive income tax or a tax with a marginal rate. Government agencies determine prices. Based on their incomes, taxpayers are assigned to tax brackets. Whether they submit their returns as single people or married couples, they are taxed according to their marital status.

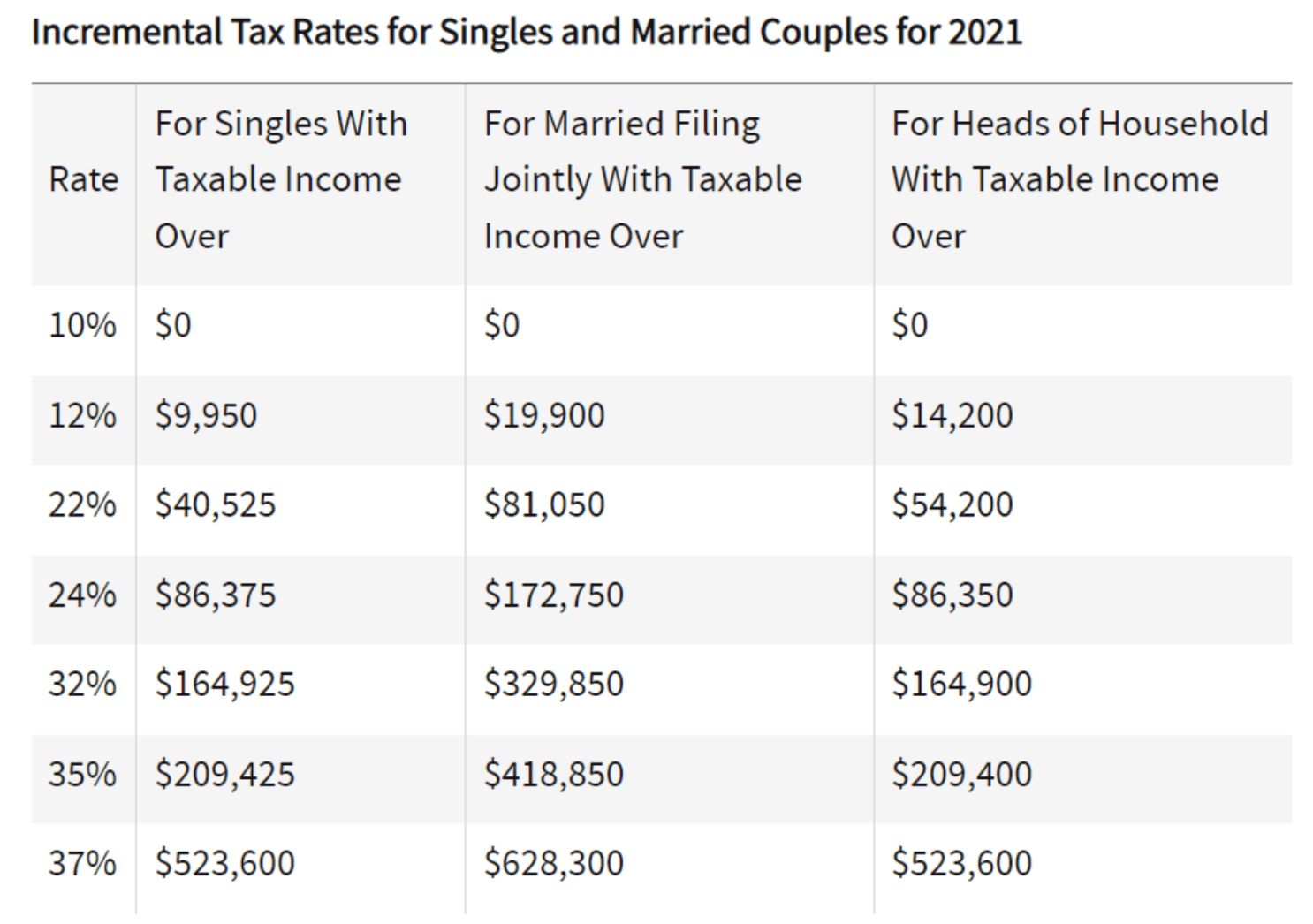

The rates and income ranges for single, married filing jointly, and heads of household filers in 2021 are shown in the table below.

Incremental Tax vs. Other Types of Taxes

One form of tax system that is levied on income is incremental taxes. Taxpayers must pay for other categories as well.

Flat or Proportional Tax

A flat or proportional tax system levies taxes on people depending on their incomes, similar to incremental taxes. Yet instead of brackets, everyone pays the same price regardless of their income or wealth. Because you pay the same amount whether you earn $30,000 or $150,000 a year, flat taxes empower people to earn more and keep more of their income in their own pockets.

There are flat tax laws in force in nine states. Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah are among them as of 2020.

Regressive Taxes

Regressive taxes are imposed evenly regardless of an individual's income, much like the flat tax. But regressive taxes have a bigger impact on low-income people than they do on high-income people. This is so that those in the latter category, who can afford to pay more, can. Sales taxes, property and school taxes, and so-called "sin taxes," which are collected on products like alcohol and tobacco, are examples of regressive taxes.

For instance, all people in New Jersey are subject to a 6.625% sales tax on the majority of goods.

This fee is applied to everyone who shops within the state. But those with modest incomes suffer from the tax. After tax, a $500 item costs $533.12 ($500 x 1.06625). A person making $1,000 a month might have trouble affording this item, whereas someone making $4,000 a month definitely won't have too much trouble.

Conclusion

- A taxpayer's percentage contribution to an incremental tax is based on their income level.

- These taxes are incremental because they raise the amount of tax you pay as your income increases.

- Redistributive taxes or progressive taxes are other names for incremental taxes.

- Additional tax types include regressive taxes and flat or proportional taxes.