- Glossary

- Economic Injury Disaster Loan

Economic Injury Disaster Loan

The Economic Injury Disaster Loan Program (EIDL) is a scheme that can offer small businesses or private, non-profit organizations that sustain significant economic injury as a result of the declared disaster financial assistance up to $2 million (actual loan amounts are based on amount of economic injury), regardless of whether the applicant experienced physical damage.

The EIDL program offers emergency operating finance to help businesses and private, non-profit organizations meet their financial responsibilities that they would have been able to pay had the disaster not occurred.

Who Is Eligible For Economic Injury Disaster Loans?

Small enterprises or private non-profit organizations who have suffered economic harm and are situated in a county, parish, or jurisdiction that is next to one that has been declared a disaster are eligible for EIDL support.

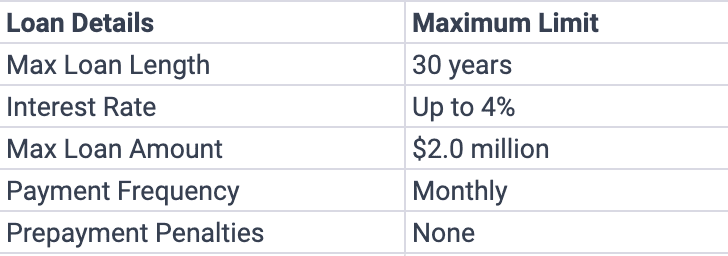

What Are The Loan Terms For Economic Injury Disaster Loans?

The EIDL programme offers emergency operating finance to help businesses and private, non-profit organizations meet their financial responsibilities that they would have been able to pay had the disaster not occurred.It provides protection against the immediate financial harm caused by the disaster and enables you to maintain a manageable operating capital position during the affected time. EIDLs cannot make up for lost income or profits.

Loan Approval Conditions

Traditional EIDL requirements have been loosened up to some extent in the following loan approval conditions:

- Without a personal guarantee, you can borrow up to $200,000.

- First-year tax returns are not necessary, and approval may be contingent on a person's credit rating.

- No proof that you could not obtain credit elsewhere is necessary.

- No collateral is required for loans under $25,000. A broad security interest in business assets may be used for loans more than $25,000. You must consent to the SBA reviewing your company's tax documents.

Key Takeaways

- The original EIDL Advance program is no longer in effect, however EIDLs will still be usable until December 31, 2021.

- You are not eligible to apply for the new EIDL Targeted Advance, which is only open to certain applicants in communities with low incomes.

- The SBA will let you know if you qualify for a new EIDL Targeted Advance.

- As of October 8, 2021, the maximum loan amount, based on the economic harm incurred, is $2 million.

- The SBA will get in touch with borrowers for some of the loans that were approved before April 6 and are eligible for an increase.

- The streamlined regular EIDL application process should take two hours.