- Glossary

- Consumer Price Index

Consumer Price Index

The Consumer Price Index (CPI) tracks changes in consumer prices on a monthly basis in the US. The cost-of-living index (CPI) is determined by the Bureau of Labour Statistics (BLS) as a weighted average of prices for a sample of products and services that is indicative of total consumer spending in the United States.

The CPI is one of the most often used measures of inflation and deflation. The CPI report uses a different survey methodology, price samples, and index weights than the producer price index (PPI), which analyzes changes in the prices paid to American manufacturers of products and services.

Understanding Consumer Price Index

Each month, over 80,000 prices are provided to the BLS by about 23,000 retail and service businesses. Despite having the word "urban" in their names, the more thorough and often used of the two CPI indexes created from the data encompasses 93% of the U.S. population.

The basis for the shelter category prices, which account for a third of the total CPI, is a study of the rental rates for 50,000 dwelling units, which is used to establish the growth in rental prices as well as owners' equivalents.

To accurately depict the proportion of consumer spending that goes towards housing costs, the owners' equivalent category mimics the rent equivalent for owner-occupied homes.5 While income taxes and the costs of investments like stocks, bonds, or life insurance policies are excluded from the CPI, user fees and sales or excise taxes are included.

Advantages & disadvantages of Consumer Price Index

Advantages

Financial market participants frequently use the CPI to determine inflation levels, and the Federal Reserve uses it to determine the appropriate level of interest rates.

Informed economic decisions are also made by businesses and consumers using the CPI. CPI is frequently a major consideration in wage negotiations since it tracks changes in consumers' purchasing power.

Disadvantages

More recently, some have asserted that the CPI is overstated when adjustments are made for increases in product quality and features.

The BLS claims that the highly contentious hedonic adjustments, which utilize regression techniques to adjust pricing for new features on only a small share of CPI goods, have a net impact on the index that is very near to zero.

How to Calculate Consumer Price Index

By contacting stores, service providers, rental properties, and businesses around the nation, the BLS registers about 80,000 items each month.

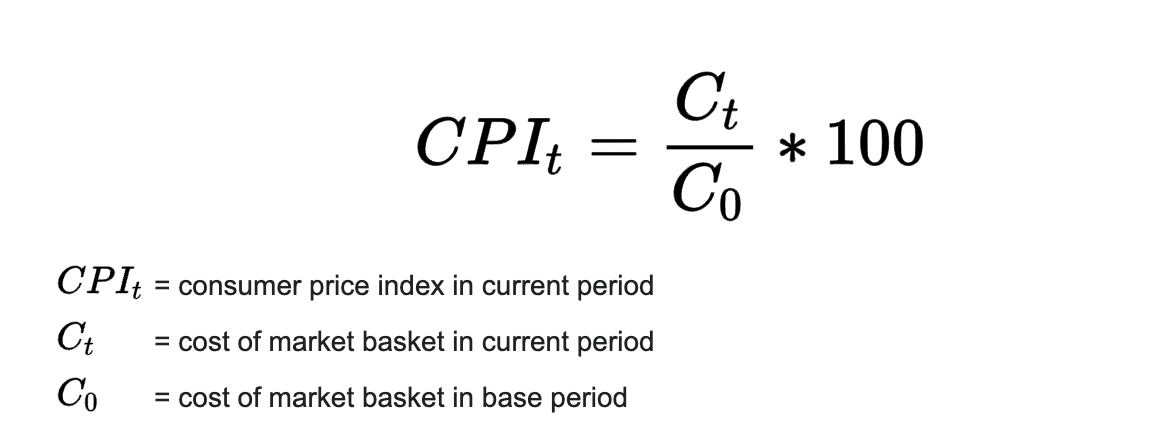

The formula below is used to determine the CPI based on the BLS survey:

Key takeaways

The Consumer Price Index, which measures the total change in consumer prices over time, is derived using a sample basket of goods and services.

CPI is the most often used (link: https://fincent.com/glossary/inflation text: inflation indicator), with other indicators used by policymakers, the financial industry, businesses, and consumers coming in close second.

While cost-of-living adjustments to government benefits are calculated using a comparable index that accounts for wage earners and clerical workers, the often referenced CPI is based on an index that accounts for 93% of the U.S. population.

About 80,000 price quotes from 23,000 retail and service businesses, as well as 50,000 rental housing units, are used to calculate the CPI each month.

Housing rents are used to estimate the change in shelter costs including owner-occupied housing that account for about a third of the CPI.