How to manage your pay stub: A comprehensive guide

Getting your paycheck is always exciting, but it's not just about the money you've earned. You also need to know how much has been deducted for taxes, insurance, and other benefits. Your pay stub is like a receipt that breaks down your earnings and serves as proof of income and a legal document.

Getting your paycheck is always exciting, but it's not just about the money you've earned. You also need to know how much has been deducted for taxes, insurance, and other benefits. Your pay stub is like a receipt that breaks down your earnings and serves as proof of income and a legal document.

It's worth noting that not all employers are required to provide pay stubs by federal law, but many states have their own laws mandating itemized wage statements. For example, in California, pay stubs must show hours worked, hourly rates, and deductions made, while in Florida, employers are not mandated to provide an itemized wage statement.

Deciphering your pay stub

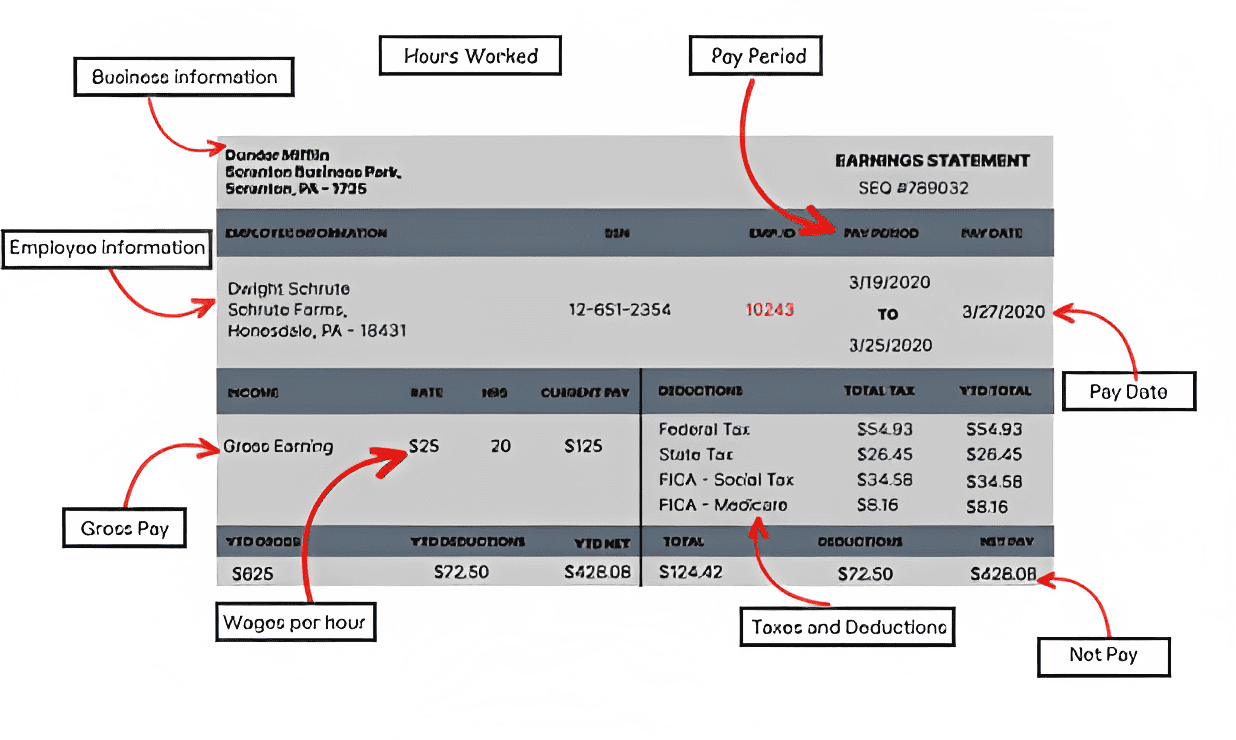

Pay stubs look intimidating, but here's a breakdown of common elements to help you better understand what they say.

- Business Information: Your pay stub includes business information such as the company's name, address, and contact details. This information is useful if you need to resolve any payment issues.

- Employee Information: This includes your name, address, and possibly your employee ID number. Update your employer for any changes to this information to prevent misdirected communications.

- Hours Worked: “Hours worked” reflects the hours you’ve worked based on your timesheet. Plus any overtime, which is typically paid at a higher rate. It’s a multiplier for your gross pay — the amount you're owed before any tax deductions, including nontaxable income.

- Wages Per Hour: The hourly wage agreed upon by you and your employer. It is the amount you are entitled to receive for every hour worked and is the basis for calculating your gross pay.

- Gross Pay: The total amount of money your employer owes you for the pay period, before any tax deductions. It includes your regular pay, any overtime pay, bonuses, or other earnings you may have received. If you fall under the 'nontaxable income' bracket, it will be indicated here.

- Taxes: The amount of federal income tax taken out of your paycheck is determined by your income level and tax bracket. However, the amount of state income tax taken out of your paycheck depends on where you live and work, as different states have different tax rates and rules.

- Deductions: Health or dental insurance payments, retirement account contributions, and loan repayments may be listed as deductions on your pay stub. Some of these deductions are taken out before taxes, while others are taken out after taxes.

- Net Pay: Also referred to as your "take-home pay" or "net income," net pay is the amount of money you are paid after all the taxes, deductions, and withholdings have been taken out of your gross pay.

- Pay Period: The pay period column lists the range of dates that your pay stub covers. It could be weekly, bi-weekly, or monthly, depending on your employer's pay schedule. Keep track of the pay period to know which earnings are included in your pay stub.

- Pay Date: The day you'll receive your paycheck for the pay period. Your pay date could be a few days after the pay period ends or several weeks later, depending on your employer's pay schedule.

How to access your pay stub

It’s crucial that you keep track of your pay stub information regularly to ensure that you're being paid correctly and stay on top of your finances. Consider using a spreadsheet or budgeting app to stay organized.

Depending on your employer, there are different methods to access your pay stubs.

1. Get digital access

Log into your company's HR portal and go to the payroll section. Choose the pay period you want to view, and review your gross pay, taxes, deductions, and net pay. Check for errors or discrepancies, and save a copy of your pay stub if you need it for your records.

2. Get a physical copy

Your employer may provide you with a physical copy of your pay stub, either handed out to you in person or mailed to your home address.

3. Receive email statements

You can opt to get your pay stub over email, too. Check your inbox for an email from your employer that either includes your pay stub as an attachment or has a link to an online portal where you can access it.

Five pay stub tips to protect your privacy

To prevent unauthorized access to your personal information, here are five pay stub tips to keep in mind:

1. Set a strong password for your pay stubs

When accessing your pay stub online, use a strong password to keep hackers out. Use a mix of uppercase and lowercase letters, numbers, and special characters to create a strong password that is difficult to guess. Avoid using easy targets such as your name, birth date, or "123456” and change your password periodically to prevent unauthorized access.

2. Always use a secure connection

Be sure to access your pay stubs on a secure internet connection such as your home wifi network or a trusted mobile hotspot. Avoid logging into your pay stub portal from public networks as they are often unsecured, putting your personal information at risk. Think of it like making sure your phone line is secure before sharing private information.

3. Keep physical copies under lock and key

If you prefer having hard copies of your pay stub, make sure to keep them safe and secure. Store them like valuable treasures in a locked cabinet to prevent unauthorized access to your personal information.

4. Shred unneeded documents

Disposing of your documents without caution makes you vulnerable to identity theft and other forms of fraud. Hence, it is advised to shred documents that you no longer need such as old pay stubs, bank statements, and credit card bills.

5. Be wary of phishing scams

Your personal information is the fish that phishers want to catch. Be cautious and verify the authenticity of any emails, phone calls, or text messages that request personal information such as your social security number, login credentials, or pay stubs. If you're unsure of their legitimacy, contact your employer directly to confirm authenticity.

How to check for errors in your pay stub

Checking the accuracy of your pay stub is crucial because even the smallest discrepancies add up really fast and result in you losing money in the long run. Ensure that your pay stub reflects your true income, taxes, and deductions.

Here are some tips to help you double-check your pay stub and catch any errors:

1. Check personal information

Your personal information is the foundation of your pay stub. Ensure that it's all accurate, from your name to your Social Security number. It may seem insignificant, but even a small error could result in bigger problems down the road.

2. Verify your pay rate

Your pay rate should be the same as what you agreed upon when you were hired. Check that it's correct, especially if you recently received a raise.

3. Confirm hours worked

Check that the number of hours worked and the corresponding pay are correct. Make sure to double-check any overtime or special pay rates you're entitled to.

4. Review your deductions

Go through all deductions listed, including taxes, retirement contributions, and health insurance. Ensure that they are accurate and match what you have authorized your employer to deduct.

5. Look for other payments

Expecting bonuses or other payments? Ensure that they have been included in your pay stub. These additions can affect your net pay, so it's essential to keep track of them.

6. Calculate your net pay

Finally, add up all of your pay and deductions to calculate your net pay. Ensure that this matches the amount deposited into your bank account. By doing this, you verify that you're receiving the correct amount of money for the work you've done.

Remember, checking your pay stub is not only about catching mistakes, but it's also about staying in control of your finances. By taking the time to double-check your pay stub, you're ensuring that you're getting paid what you deserve.

“I found an error! What now?”

- Start by collecting all the documentation that supports your claim, such as time sheets, pay rates, and identity proof. This evidence can be used to prove the error.

- Once you have gathered the evidence, inform your employer of the error in a way that complies with the company's guidelines. Provide them with the evidence you've collected to help expedite the process.

- If your employer refuses to correct the error, you have the right to escalate the matter.

At this point, you may want to consider seeking legal help from a wage-and-hour employment lawyer. They can help you determine the best course of action for your claim, whether it's filing for lost wages or seeking other remedies to prevent similar errors from happening again.

One significant advantage of working with an employment lawyer is their ability to negotiate a settlement early in the process. With their guidance and expertise, you can avoid a lengthy trial and resolve your claim more efficiently.

If your employer refuses to settle your claim, your employment lawyer will be there to fight for your rights and ensure that you receive the money you deserve.

How to use your pay stub effectively

Managing your finances involves setting realistic financial goals and tracking your progress over time. Your pay stub can help you achieve these goals by providing you with valuable information about your income and expenses. Armed with this information, you can plan for large expenses and make better decisions such as building an emergency fund, paying off debts, or saving for retirement.

Here’s how:

1. Determine the cost of your expense and list all associated costs Whether you're planning for a vacation, a new car, or a down payment on a house, it's important to determine the total cost of the expense and create a list of all associated costs. This helps you plan and budget accordingly.

2. Divide the total cost by the number of months you have to save

Once you have determined the total cost of the expense, divide it by the number of months you have to save before the expense is due. This helps you determine how much you need to save each month to reach your goal.

3. Determine how much money you have available each month

Review your pay stub to determine your net pay after expenses such as rent, utilities, and other bills. This is how much money you have available each month to save towards your goal.

4. Subtract what you need to save from your net pay

Subtract the amount you need to save each month from your net pay to determine how much you have left over for other expenses. This helps you identify areas where you may need to cut back on expenses to meet your savings goal.

5. Look for ways to save on expenses

If you find that you don't have enough money left over each month to meet your savings goal, consider cutting back on expenses. Consider saving on variable expenses like groceries, entertainment, and transportation. Or take on a part-time job or side hustle to increase your income.

6. Set up an automatic transfer from your checking to a savings account

To stay on track with your savings goal, set up an automatic transfer from your checking account to a savings account each month. This ensures that you are putting money towards your savings goal.

In conclusion, the humble pay stub plays a vital role in helping you manage your finances. By carefully reviewing your pay stubs, you can identify errors and take immediate action to rectify them. Whether it’s tracking your income, monitoring deductions and taxes, or planning for future expenses, using your pay stubs effectively is the key.

Modern financial management platforms like Fincent help you stay on top of your money by tracking your earnings, expenses, and bank balances. With the power of pay stubs and Fincent in your arsenal, you'll be a financial superhero in no time!

Related articles

Building the Right Bookkeeping Model for Your Construction Business

Bookkeeping is the cornerstone of financial success for construction businesses. By recognizing the significance of bookkeeping, construction companies can overcome the unique challenges they face and build a strong financial infrastructure. From maintaining compliance and achieving financial visibility to optimizing project cost management and navigating cash flow fluctuations, effective bookkeeping empowers construction businesses to drive growth and profitability.

Read moreHow is Bookkeeping Different for Marketing and Advertising Agencies

By setting realistic marketing budgets, identifying tax-deductible expenses, and streamlining reconciliation and reporting processes, marketing agencies can optimize their financial management. These practices contribute to improved financial stability, better decision-making, and long-term success in the dynamic marketing industry.

Read more