How to Prepare Your Annual Budget to Withstand a Recession

Long story short, small businesses can survive a recession, but only if finances are managed properly, and decisions are taken at the right moment. This article is about helping small businesses prepare for that recession. We will discuss the challenges you would experience and how you can deal with them.

If you are a small business owner, you are probably aware of the recession lurking in the shadows. People have been talking about it since Q1 of 2022.

However, the world bank finally made it clear: The global economy will be thrown into the chaos of the recession in 2023.

And during this recession, small businesses will get affected. Of course, many small business owners believe. And based on how US small businesses have [dealt with economic downtimes before], their confidence is well-founded.

However, the cushion is pretty thin. A 2020 JP Morgan study revealed that 50% of small businesses have fewer than 15 cash buffer days.

Long story short, small businesses can survive a recession, but only if finances are managed properly, and decisions are taken at the right moment.

This article is about helping small businesses prepare for that recession. We will discuss the challenges you would experience and how you can deal with them.

Effects of a recession on small businesses

To figure out the ways to make your business “recession-proof,” first, you have to understand the full extent of the recession’s effect on small businesses.

In simple words, a recession is a period when all economic activities take a nosedive. Gross domestic product (GDP), total income, employment, wholesale retail sales– you would find every component of the economy takes a massive hit during these periods. Chances are, you probably felt similar chaos during the Covid-19 pandemic as a business owner.

Here is what a recession looks like for a small business:

-

Reduced profit: During a recession, consumers get more conservative with their spending. As a result, the sales and, by extension, the profit plummet. Small businesses often feel the punch in the gut hardest, as most of them often don’t have massive cash reserves to fall back on.

A lower profit margin also makes it harder for business owners to reinvest in their marketing, production, and other areas of operations. This, in turn, makes small businesses even more vulnerable.

-

Decreased demand: As stated above, the downward trend of demand starts from consumers’ unwillingness to spend, but that’s not where it ends. When (link: https://fincent.com/glossary/cash-flow text: cash flow) dries up, business owners are often forced to cut back on their marketing. No wonder, without proper promotional efforts, the sales pipeline dries up, which adds fuel to the already raging inferno of economic crisis.

-

Cash flow issues: Having a net positive cash flow is a challenge for businesses. However, during the recession, it becomes almost insurmountable.

Firstly, regular customers stretch out payment terms because of their own cash flow issues. Many accounts receivable might even become uncollectable. On top of that, lenders impose stricter criteria when determining the eligibility of businesses for loans. Under these circumstances, many businesses empty their last cash reserves to fix things momentarily.

-

Price wars: Cash flow issues give birth to price wars. When sales dwindle, and customers no longer spend generously, many small business owners decide to lower prices to attract customers. It deals a crushing blow to already low profitability.

However, things get even more serious when competitors lock horns in price wars. In order to scrape the barrel, businesses try to lower the price than their competitors. And this price war often favors those who have bigger cash reserves. The race leads to the sudden demise of businesses with low financial endurance.

-

Operational changes: During recessions, small businesses are forced to do things for less. For this, they revamp processes, automate, and get rid of unnecessary processes and workflows. This can lead to radical changes in how business operations look like.

Interestingly, small businesses have one small advantage over established large businesses: flexibility. Small businesses can change their operation faster as they have to deal with fewer legal/ logistical hurdles.

-

Marketing Constraints: Marketing is an area of operation that suffers budget cuts often during recessions. During those hard economic times, many business owners redirect the funds to production, logistics, and other crucial areas. It temporarily solves some issues but ends up brewing bigger problems later.

If businesses are dependent on paid channel promotion, they can get hurt badly during a recession.

The solutions to this situation are self-sustaining marketing channels and a creative marketing approach.

-

Employee lay-offs: A high layoff rate is one of the telltale signs of a recession. Companies often cut down on their workforces to support declining cash flow during economic downtime. Sometimes companies freeze their hiring pipelines too. That means vacant positions remain open for months, and existing members of staff take on more responsibilities.

Overall, small businesses are the first to lay off employees. However, they are also the first to bring back the employees during a recovery period.

Long story short, you, as a small business owner, can expect your regular business challenges to amplify on an overwhelming scale during the recession. The fact that everyone is thrown into a chaotic situation at once makes the recession’s corrosive effects difficult to overcome.

However, there are certainly ways to secure your business.

Ways to recession-proof your annual budget:

Here are some ways to increase your chances of staying afloat ( or thriving) during the 2023 recession.

Manage your cash flow:

During recessions, the first crippling blow comes in the form of poor cash flow. Lower profitability, uncollectable (link: https://fincent.com/blog/what-is-accounts-receivable-definition-importance-and-examples text: accounts receivable), reduction in clients’ order volume- all of these dry out your cash flow in no time. Soon you find yourself struggling to manage the amount of cash required to keep your business running.

So what is the best course of action?

Garrett Yamasaki, founder of WeLoveDoodles has a piece of advice:

“Take care of your cash flow: you need to have money in your hands, and you need to know where it goes, where it comes from, and how often it comes and goes.”

Here are a few ways you can maximize your cash flow during the recession:

-

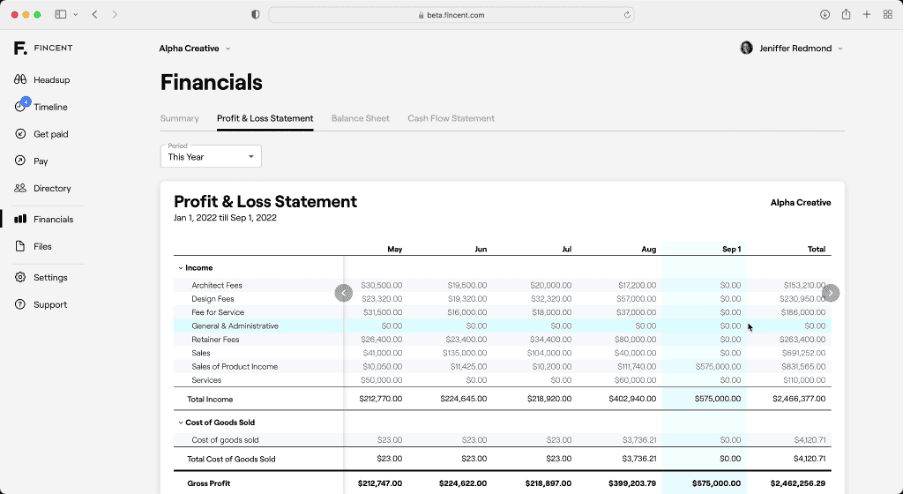

Review your (link: https://fincent.com/blog/everything-about-cash-flow-statements-definition-sections-examples text: cash-flow statements) monthly and get a future projection with the help of other financial statements like (link: https://fincent.com/glossary/profit-and-loss-statement text: profit and loss statements).

If you are a Fincent user, you can get your profit-loss statements and cash flow statements on the “Financials” tab.

-

During the recession, some delay in invoice payments is expected. And in some cases, delays can get even months long. You should be empathetic, but at the same time, you still want to keep a close tab on your accounts receivable collections and follow up on invoices.

Usually, a bookkeeper takes care of such responsibilities. However, you can cut your costs and get the same result by switching to a (link: https://fincent.com/online-bookkeeping-service text: bookkeeping solution) such as Fincent.

You, as a Fincent user, can list all of your vendors and customers on the Directory tab. Once you click on any entry, you will see lists of all the associated invoices and their status.

Want to follow up on any invoices? Click on the invoice, type your follow-up message, and hit “send”.

Here is what it looks like:

- Also, delay all those large expenses that have lower chances of generating cash flow immediately. For example, you have plans to invest in new training programs for your employees. Usually, this is a great idea as it can lead to more productivity. But you can put it on hold during a recession and invest the money elsewhere.

Be mindful of your inventory:

Based on a slightly dated report (2018) by WaspBarcode, 43% of small businesses don’t track their inventories. In 2023, hopefully, the numbers have improved, but it's unlikely everyone is tracking inventories now.

Why is this important, especially during a recession?

Because it has a huge impact on your available cash reserve( and survivability).

In SME expert Barry Moltz’s words, _“During a recession, companies that get stuck with large inventories that are not selling to customers risk not having enough cash because too much of it is invested here.” _

Therefore, you want to be mindful when it comes to managing inventories:

- Pay attention to how long a product stays in inventory before it gets sold. You want to invest in products that get sold faster.

- Consider slashing your fulfillment rates to a point that is still acceptable to your customers.

- Reduce your reorder points ( at which new stocks are ordered) and reorder quantities.

Essentially, your goal should be to walk the fine line between limiting investment in inventories and maintaining customer satisfaction.

Get multiple suppliers:

If you are dependent on suppliers, consider getting multiples. Firstly, during the recession, everyone takes a hit. Therefore, your main supplier might fail to deliver when you need your supplies the most. Secondly, having multiple vendors can trigger a mini-price competition. So, you might get your supplies at a lower cost.

You may not be able to raise the prices of your products/services during a recession. However, by securing constant flows of supplies and getting them at a lower price, you can certainly increase your profitability.

Analyze your pricing strategies:

Remember we discussed how competition on price is very common during a recession? One of the factors behind such competition is consumers’ tendency to go cheaper. By siding with businesses the offer more affordable options, consumers put pressure on businesses to lower their prices.

Essentially, what consumers look for is the best bang for their buck.

Therefore, instead of mindlessly lowering prices, you can focus on delivering better deals. For example, since many customers want to keep their purchases in use for longer, you can sweeten the deal by offering free maintenance with the purchase of your product.

If you are running a service-based business, you can bundle services together to create more value. For instance, if you are running a marketing agency, you can offer social media management and content as a bundle.

Decide what your priorities are and be decisive:

Going through a recession is hard emotionally, too. You will be dealing with a lot of anxiety, confusion, and uncertainty. However, this is also the time when you must be resilient and decisive.

Because by being decisive, you give yourself more options later on. Think for a moment; you come to the conclusion you are better off sizing down your inventory, laying off a few members of staff, or applying for credit. If you wait, after a few months, you might find yourself in the same or worse situation, just with less cash in your pocket. However, if you do it now, you can always order more and re-hire your laid-off staff.

Mark Selcow, who survived the 2008 recession, has the same opinion:

“ We felt it was better to be more decisive. We knew we couldn’t let hesitation affect our conviction to make big decisions. _In uncertain times, it’s easy to get caught up in emotions like fear or overreact to the latest piece of information, whether good or bad.” _

In short, prioritize your business’s survival, be transparent with your team, and act fast. If you survive, you can always restore things back to how they used to be.

Ask for help:

A recession puts some serious strain on the economy. But there is always some help available if you look for it.

For starters, the US Dept of the Treasury has multiple assistance programs for providing a cushion for distressed small businesses.

- (link: https://fincent.com/glossary/tax-credits text: Small business tax credit program): A number of critical tax benefits, particularly the Employee retention credit and Paid leave credit.

- Emergency capital investment program: This program supports the efforts of low and moderate-income community-led financial institutions to assist small businesses.

- Paycheck protection program: Small businesses receive funds to maintain their payroll and cover applicable overhead costs.

Apart from government aid, you should tap into your professional network. Ask your mentors and partners for advice or help getting a loan or a government grant. And by all means, do your part if someone else reaches out to you.

Caitlyn Parish, CEO of Cicinia, puts it this way:

_Knowing that you have people in your corner can give you the confidence and resources you need to move forward.” _

Wrapping up

During a recession, your main goal should be ensuring the survival of your business. You want to maximize your cash flow, cut down on unnecessary expenses, pause activities that don’t generate cash flow immediately, and keep your staff and community closer.

Proper bookkeeping makes financial management a lot easier. You can always hire a professional or do it yourself. However, professional bookkeepers aren’t cheap, and your attention should be on other important things. A simple solution to this problem is getting a bookkeeping application like Fincent. We have already showcased how it can help with managing cash flows and generating crucial statements. But it can offer a lot more.

Related articles

Building the Right Bookkeeping Model for Your Construction Business

Bookkeeping is the cornerstone of financial success for construction businesses. By recognizing the significance of bookkeeping, construction companies can overcome the unique challenges they face and build a strong financial infrastructure. From maintaining compliance and achieving financial visibility to optimizing project cost management and navigating cash flow fluctuations, effective bookkeeping empowers construction businesses to drive growth and profitability.

Read moreHow is Bookkeeping Different for Marketing and Advertising Agencies

By setting realistic marketing budgets, identifying tax-deductible expenses, and streamlining reconciliation and reporting processes, marketing agencies can optimize their financial management. These practices contribute to improved financial stability, better decision-making, and long-term success in the dynamic marketing industry.

Read more